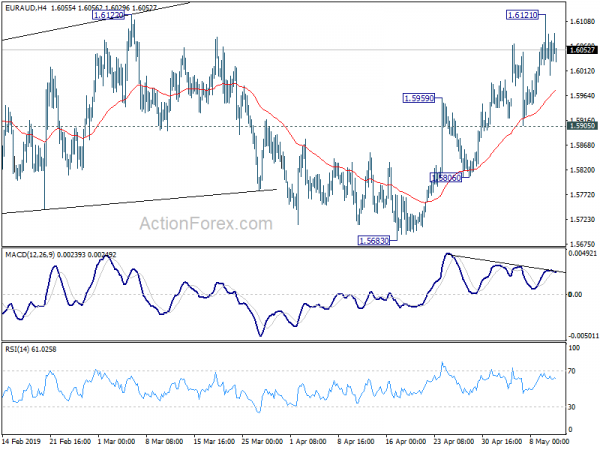

EUR/AUD rose to as high as 1.6121 last week but failed to take out 1.6122 key resistance yet. With a temporary top in place, initial bias is turned neutral this week first. On the upside, decisive break of 1.6122 will confirm the bullish view that correction from 1.6765 has completed with three waves down to 1.5683. In this case, further rise should be seen back to retest 1.6765 high. On the downside, break of 1.5905 support will indicate rejection by 1.6122 and turn bias to the downside for 1.5806 support and below.

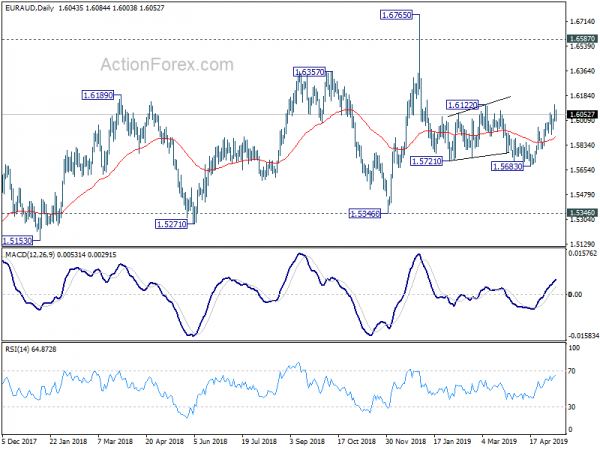

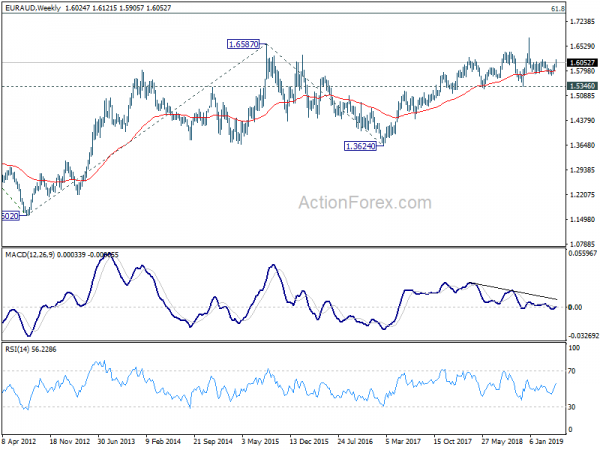

In the bigger picture, as long as 1.5346 support holds, outlook will still remain bullish. Up trend from 1.1602 (2012 low) is expected to resume sooner or later. Break of 1.6765 will target 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488 next. However, firm break of 1.5346 key support will indicate trend reversal, with bearish divergence condition in weekly MACD, and turn outlook bearish.

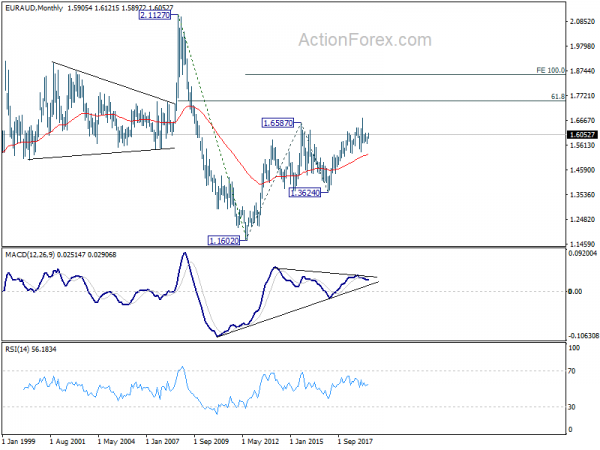

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) is still in progress for 61.8% retracement of 2.1127 to 1.1602 at 1.7488. Firm break there will pave the way to 100% projection of 1.1602 to 1.6587 from 1.3624 at 1.8069. This will remain the favored case as long as 1.5346 remains intact.