Trade negotiating tactics are clearly being used by both the U.S. and China. Give-and-take was to be expected by both sides as we near an ultimate conclusion to a trade deal. Recent obstacles have seen the risk of a total collapse grow, which means, we could be finally nearing a deal in this over year long trade war.

High-level talks will occur today ahead of the Friday deadline for increased tariffs on Chinese goods imposed by President Trump. At a rally in Florida, Trump noted he is ready to raise tariffs on Chinese imports Friday, adding there’s nothing wrong taking in $100 billion a year in duties.

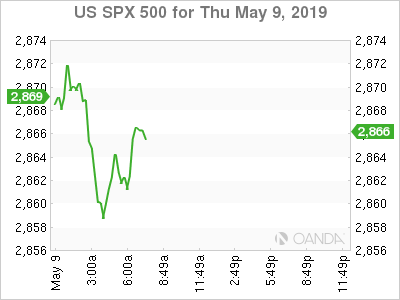

Markets have been busy repricing both will we see an increase in tariffs from both sides and the risk to either stalled negotiations or a complete collapse of trade talks. The outlook on the tariff increase is growing, though we may see a promise for the increases to start at a later date, if China offers meaningful concessions.

While the base case remains for a deal to be reached, the timing is uncertain, but likely to occur by early June at the latest. If we see a disastrous outcome this week, we could see a 10% correction with US equities. A framework agreement is likely to see stocks attempt another run at making fresh record highs.

- Oil – Geo risks to keep crude supported

- Korea – North launches as need for sanction relief grows

- Norges – Finally a cb that will raise rates

- Gold – Firm ahead of trade negotiations

Oil

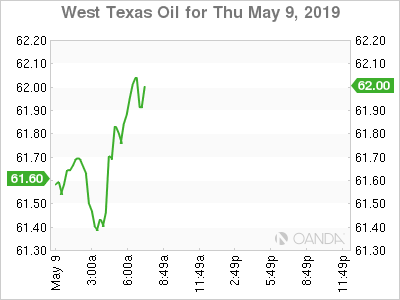

Geopolitical risks are likely to keep oil supported despite growth worries from a potential trade tariff increase. The increased tariffs would further put a dent in global growth and add to fears that the new norm will be a never-ending trade battle with President Trump at the helm. A total collapse in trade talks could deliver a strong blow to commodities, though that scenario is least likely.

Crude prices should see some support from supply risks from Libya and Venezuela, who both could lose half their production in a moments notice, which would translate to almost 1 million barrels a day lost in production.

Korea

North Korea launched its second test launch of weapons in less than a week, and after a two year pause. North Korean leader Kim Jong Un is in need of some US sanction relief and since talks fell apart in February, this act of defiance is aimed at setting up another meeting between Kim and Trump.

Norges

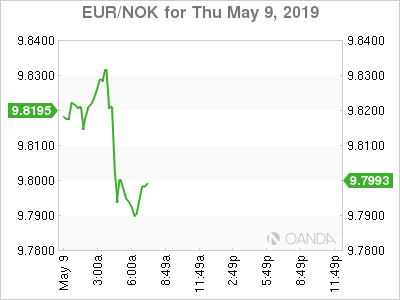

Norway’s central bank (Norges) kept policy unchanged at today’s meeting but they signaled the bank was likely to raise rates at the June meeting. The current monetary policy environment globally is one of accommodation, so it is refreshing to see a thriving economy with some inflation. Western Europe’s biggest oil exporter has a strong economy that has a 2.3% unemployment rate and inflation almost a full percentage point above target.

The Norges already raised rates at the March meeting and now a June hike is expected, but a third hike could be on the horizon, if global risk sentiment improves.

Gold

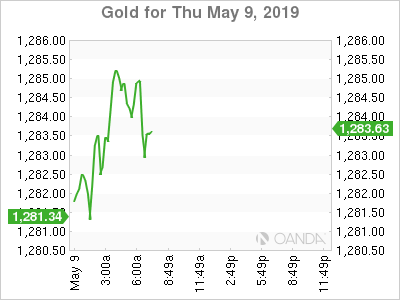

Despite all the uncertainties with next round high-level trade talks, gold has been able to deliver a meaningful rally. The yellow metal’s loss of safe-haven appeal will likely return if talks see a complete collapse, but that remains the lease likely scenario.