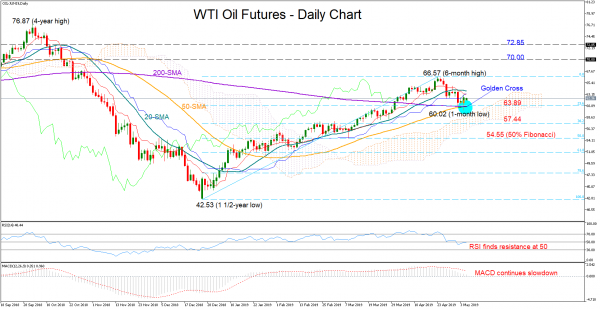

WTI oil futures managed to close with marginal gains on Monday after falling below the longer-term 50 and 200-day simple moving averages (SMA) to touch a one-month low of 60.02. The short-term bias, though, remains neutral-to-negative as the MACD is losing steam below its red signal line and moving towards zero, while the RSI seems to be unable to return above its 50 neutral mark.

In the medium-term picture, the news is more positive thanks to the golden cross formation by the 50- and the 200-day SMAs which indicates that a bull run may be on the horizon. Yet investors would like to see a larger distance between the lines to consider the signal more seriously.

Should the price overcome barrier between the red Tenkan-sen (63.29) and the 20-day SMA (63.80), positive momentum could probably last until the 6-month high of 66.57. Beating significantly that top, the way could open towards the 70 mark, while higher, a break above the 72.85 resistance level could provide more comfort to the bulls to keep going.

On the downside, the 23.6% Fibonacci retracement line drawn from the 1 ½-year low of 42.53 to the recent peak of 66.57 could act as support (66.89). A failure to hold above this level and therefore above the 50- and the 200-day SMAs could strengthen the sell-off towards the 38.2% Fibonacci of 57.44, while a decline under the 50% Fibonacci of 54.55 may have a bigger negative impact on the sentiment.

In brief, WTI oil futures are currently facing a neutral-to-bearish risk in the short-term, while in the medium-term picture, the outlook could improve further if the golden cross proves sustainable.