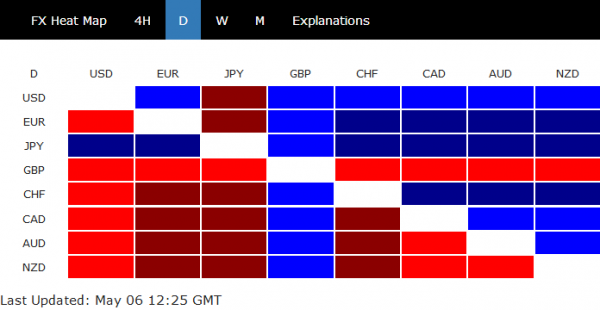

Entering into US session, Yen remains the the strongest on today, followed by Dollar. Risk aversion dominate the global financial markets as Trump decided to re-escalate US-China to full blown level and announced to raise tariffs on Chinese imports this Friday. Trump then double down with another tweet today, blaming Chines for US loss in trade and pledged not to take that anymore. China’s response has been refrained so far, indicating that the delegation is still in preparation to travel to the US. That helps halting free fall in the risk markets.

For now, Euro is third strongest, partly helped by better than expected investor sentiment data. Sterling is the weakest one as it pares back some of last week’s gain, additional pressured by rebound in EUR/GBP. Australian Dollar and New Zealand Dollar follow as next weakest. Both currencies are facing risks of central rate cuts this week, starting with RBA tomorrow.

In other markets, currently:

- DOW future is down -455 pts

- Gold is down -0.05%.

- WTI crude oil is down -0.88%.

In Europe:

- FTSE is on holiday.

- DAX is down -1.81%.

- CAC is down -1.87%.

- German 10-year yield is down -0.0106 at 0.018, staying positive.

Earlier in Asia:

- Hong Kong HSI dropped -2.90%.

- China Shanghai SSE dropped -5.58%.

- Singapore Strait Times dropped -3.00%.

- Japan remains in 10-day holiday.