Oil prices dipped on Wednesday after a report showed a rise in available U.S. crude inventories, but the market remained tense amid an intensifying political crisis in Venezuela, tightening U.S. sanctions on Iran and continuing OPEC supply cuts.

Spot Brent crude futures, the international benchmark for oil prices, were at $71.65 per barrel at 0143 GMT, down 41 cents, or 0.6 percent, from their last close.

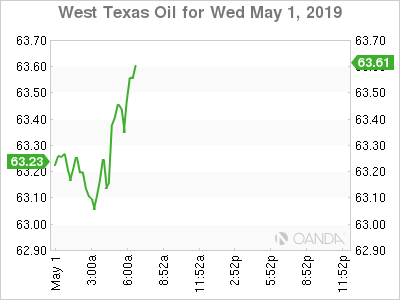

U.S. West Texas Intermediate (WTI) crude futures were down 51 cents, or 0.8 percent, at $63.49 per barrel.

U.S. crude stocks rose by 6.8 million barrels to 466.4 million barrels in the week to April 26, industry group the American Petroleum Institute (API) said on Tuesday, implying a rise in U.S. crude supply.

However, focus was shifting to the crisis in major oil producer Venezuela, where there appears to be a standoff between incumbent President Nicolas Maduro and opposition leader Juan Guaido. Many observers fear this could lead to large-scale violence, as well as disruptions to crude supply.

Crude markets have tightened this year due to supply cuts led by the Organization of the Petroleum Exporting Countries (OPEC) and beefed up U.S. sanctions on Iran’s oil exports.

Washington re-imposed sanctions on Tehran in November last year, but initially allowed its major buyers to import limited crude volumes for another six months.

That period expires on Wednesday, and Washington has said it will not extend any sanction exemptions as it aims to drive down Iranian crude exports to zero.

Despite this, some analysts say global oil markets are amply supplied.