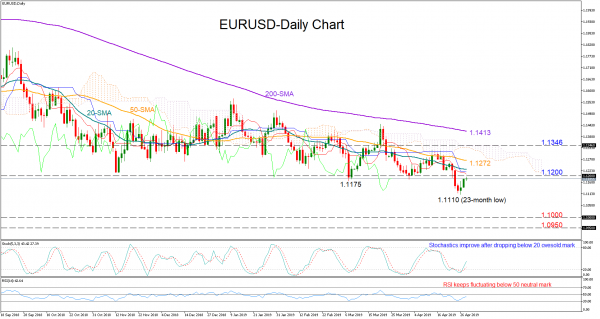

EURUSD tumbled into the 1.11 region on Friday for the first time after almost two years, stretching further its long-term downward pattern. While Monday’s bounce justified oversold signals by the Stochastic indicator, the weakness in the RSI, which continues to hover below 50, and the negative slope in the Ichimoku indicators (red Tenkan-sen and blue Kijun-sen) question how far any upside could go.

The 1.1200 mark is currently keeping the bulls under control and any climb above that border would likely improve sentiment, with resistance probably running next towards the 50-day simple moving average (SMA) at 1.1272. Should the bulls beat the wall around 1.1320 and more importantly climb above the top of the Ichimoku cloud seen near 1.1346, the rally may then extend up to the 200-day SMA (1.1413).

Otherwise, a reversal to the downside is expected to find immediate support around the 1.1110 bottom. In case the bears clear that barrier, the sell-off could pick up steam, pushing the price probably down to the 1.1000-1.0950 key restrictive area.

In the medium-term picture, the outlook has turned even more bearish after the close below the previous low of 1.1175. The falling 50- and 200-day SMAs are also a sign that a bull market is still far in the horizon.