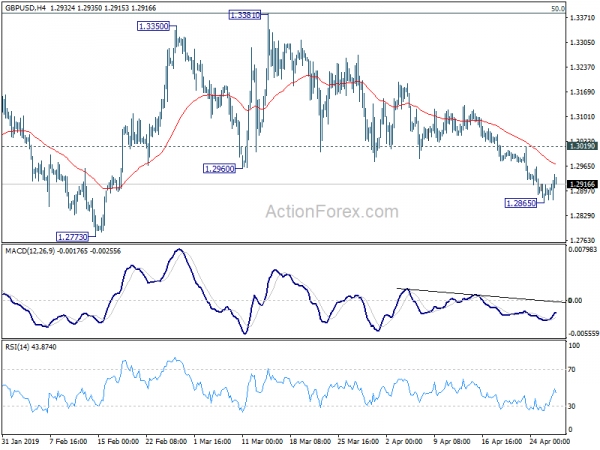

GBP/USD dropped to as low as 1.2865 last week but formed a temporary low there and recovered. Initial bias is neutral this week for some consolidations first. But upside should be limited by 1.3019 minor resistance to bring another decline. Current development suggests that rebound from 1.2391 has completed at 1.3381. On the downside, below 1.2865 will target 1.2773 support to confirm this bearish case. On the upside, however, break of 1.3019 resistance will dampen this bearish case and turn bias back to the upside for recovery first.

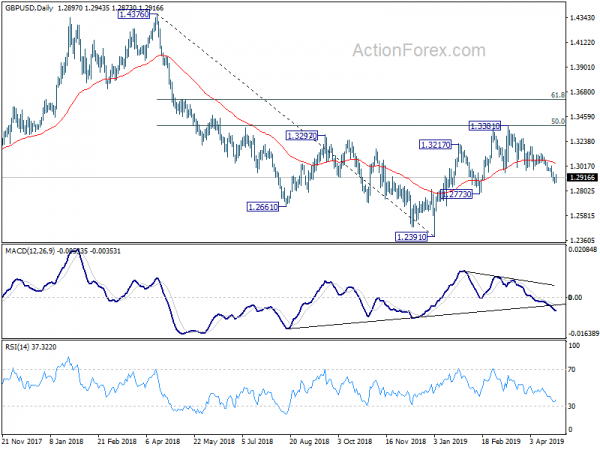

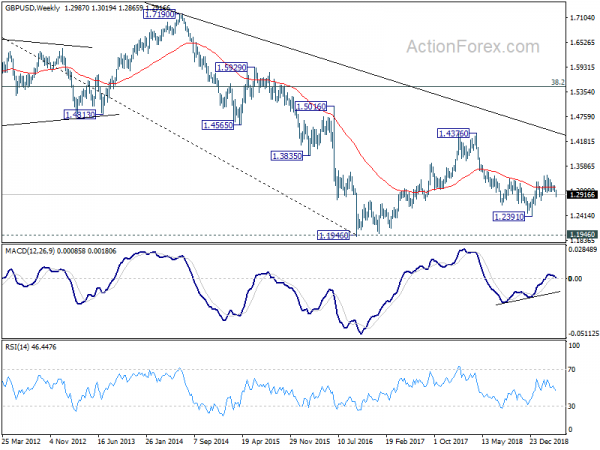

In the bigger picture, medium term decline from 1.4376 (2018 high) halted after hitting 1.2391. Rise from 1.2391 could have completed after just missing 50% retracement of 1.4376 to 1.2391 at 1.338. Such rebound could be a correction to fall from 1.4376 only. Break of 1.2773 support will affirm this bearish case and target 1.2391. Break of 1.2391 will resume the fall from 1.4376 to 1.1946 (2016 low).

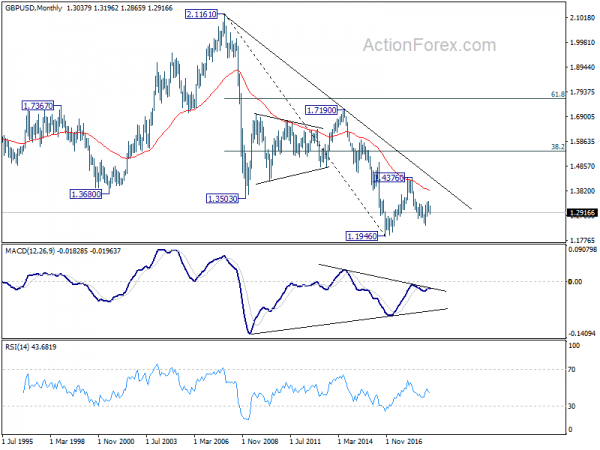

In the longer term picture, consolidative pattern from 1.1946 (2016 low) is still in progress. For now, we’d expect any downside attempt to be contained by 1.1946 low first. But decisive break of 38.2% retracement of 2.1161 (2007 high) to 1.1946 at 1.5466 is needed to indicate long term reversal. Otherwise, an eventual downside breakout will remain in favor.