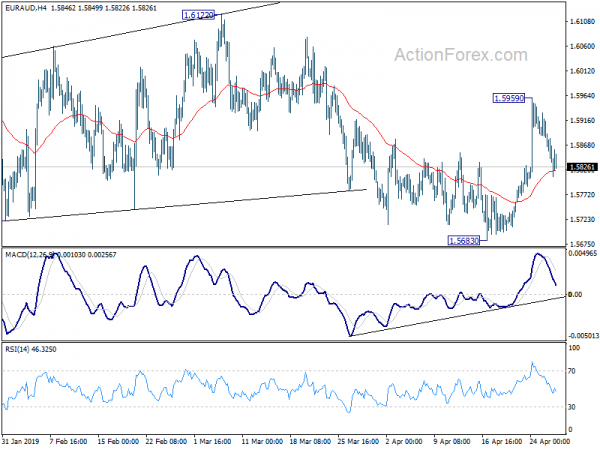

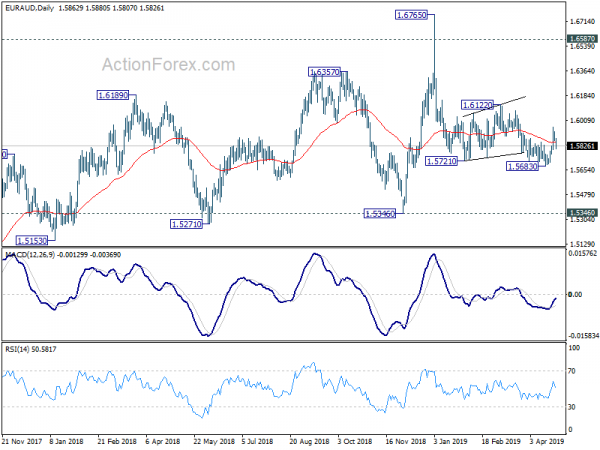

EUR/AUD’s strong rebound was limited by 1.5959 last week but was limited there. Near term outlook is mixed up by the deep retreat from there. Initial bias is mildly on the downside this week for retesting 1.5683 low. At this point we’re still slightly favoring the bullish case that correction from 1.6765 has completed with three waves down to 1.5683. Thus, downside of current retreat should be contained above 1.5683 to bring rise resumption. On the upside, above 1.5959 will target 1.6122 resistance to confirm our bullish view.

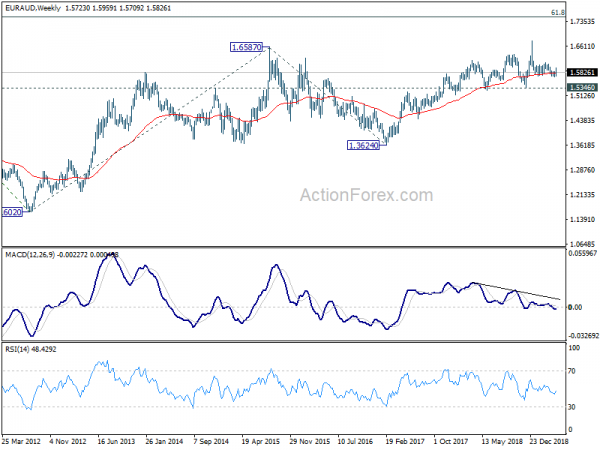

In the bigger picture, as long as 1.5346 support holds, outlook will still remain bullish. Uptrend from 1.1602 (2012 low) is expected to resume sooner or later. Break of 1.6765 will target 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488 next. However, firm break of 1.5346 key support will indicate trend reversal, with bearish divergence condition in weekly MACD, and turn outlook bearish.

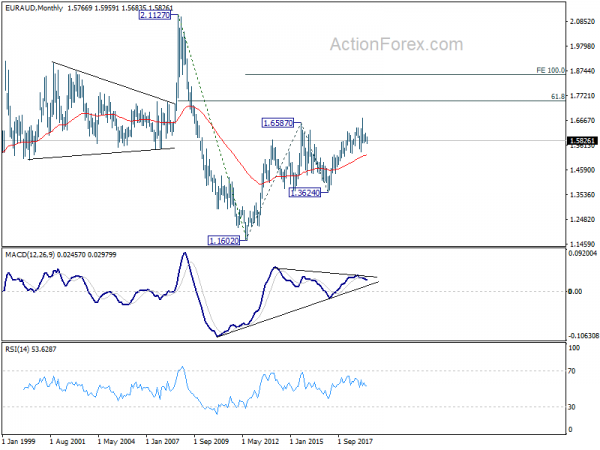

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) is still in progress for 61.8% retracement of 2.1127 to 1.1602 at 1.7488. Firm break there will pave the way to 100% projection of 1.1602 to 1.6587 from 1.3624 at 1.8069. This will remain the favored case as long as 1.5346 remains intact.