It appears that the global economy is now running at two different speed. US is maintaining firm momentum despite all the uncertainties and slowdown elsewhere. Strong corporate earnings provide evidence on underlying resilience. While global central banks are turning cautious or even dovish, there is little pressure for Fed to reverse course yet.

Dollar and Yen are the two strongest one for the week. US assets are given a strong boost on flight-to-quality flows. US stocks digested some of recent gains overnight, but S&P 500 and NASDAQ remained closed to record highs. US 10-year yield dived notably by -0.048 to 2.522 after being rejected by 2.6 handle just days again. This indicates strong demand for US treasuries. Dollar also surge through key resistance level against Euro.

On the other hand, Yen is some what boosted by flight-to-safety flows. In particular, German 10-year yield turned negative again for the first time since April 12. US yields also tumbled. Even though Asian stocks remain resilient, fall in global yields is enough to give Yen a race with Dollar as the strongest.

Technically, EUR/USD’s break of 1.1176 key support finally indicates resumption of medium term down trend from 1.2555. USD/CAD’s break of 1.3467 resistance now puts 1.3664 high into focus. Break will resume medium term up trend from 1.2061. AUD/USD is pressing 0.7003 key support and break will resume fall from 0.7295 towards 0.6722 flash crash low. No clear direction is seen in USD/JPY yet as it spiked through 112.13 briefly but pulled back almost immediately.

In Asia, Nikkei closed up 0.48%. Hong Kong HSI is down -0.54%. China Shanghai SSE is down -2.23%. Singapore Strait Times is down -0.17%. Japan 10-year JGB yield is up 0.0041 at -0.032. Overnight, DOW dropped -0.22%. S&P 500 dropped -0.22%. NASDAQ dropped -0.23%. 10-year yield dropped -0.0048 to 2.522.

BoJ pledges to keep interest rates low at least through Spring 2020

BoJ left monetary policy unchanged today as widely expected. More importantly, the central bank now provides much clearer forward guidance. It’s noted that “the Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time, at least through around spring 2020”. That’s based on “uncertainties regarding economic activity and prices including developments in overseas economies and the effects of the scheduled consumption tax hike.”

Under the yield curve control framework, short term interest rate is kept at -0.1%. BoJ will continue to purchase JGBs to keep 10-year yield at around 0%, with some flexibility. Annual pace of monetary base expansion is kept at JPY 80T. Y Harada dissented again, proposing to tie forward guidance to price stability target. G Kataoka also dissented too, urging BOJ to commit to take additional easing measures if there is downward revision in medium- to long-term inflation expectations. The vote was by 7-2.

On the economy, BoJ said it’s likely to “continue on a moderate expanding trend” despite the impact from overseas slowdown. CPI continued to show “relatively weak developments”, comparing to labor market tightening. But it expects CPI to “gradually” increase towards 2% target. Though, there are “high uncertainties regarding the outlook for economic activity and prices including developments in overseas economies”.

BoC dropped tightening bias, slashed GDP forecasts

Yesterday, BoC kept overnight rate unchanged at 1.75% and drops tightening bias. The accompanying statement concluded by saying that “an accommodative policy interest rate continues to be warranted”. The “appropriate degree” of accommodation will be evaluated as new data come in . In particular, BoC will monitor “developments in household spending, oil markets, and global trade policy”. The sentence regarding ” future rate increases” was omitted.

Growth forecasts for 2019 was sharply revised lower to 1.2%, down from January projection of 1.7%. 2020 growth forecast was revised slightly lower from 2.1% to 2.0%. Inflation is expected to remain around 2% through 2020 and 2021.

Suggested readings:

- BoC Poloz press conference live stream

- (BOC) Bank of Canada maintains overnight rate target at 1 ¾ per cent

- BOC Erases Rate Hike Possibility in Near- to Medium- Term

- BOC Drops its Hawkish Bias, USD/CAD Breaks Above 1.3500

- Bank of Canada Rate Hold Comes with a Growth Downgrade

- Bank of Canada shifts to neutral bias; takes an axe to 2019 growth forecast

NIESR expects no BoE hike until August 2020

UK National Institute of Economic and Social Research (NIESR) pushed back their BoE rate expectation by a year in the new forecasts. NIESR economist Garry Young said “now we expect the first increase in Bank Rate to be next August rather than this August.”

NIESR also noted that Brexit related uncertainty “has led to investment plans being deferred and increased stockbuilding.” Under the main scenario of “soft Brexit”, GDP growth will continue at around 1.5% in both 2019 and 2020. Unemployment rate will stay at around 4%. CPI will remain at around 2%.

Regarding different Brexit scenarios, growth will be similar between staying in EU and “soft Brexit”. However, growth will be weaker is UK is to stay in the customs union, and even worse in a no-deal Brexit.

On the data front

US durable goods orders and jobless claims will be the major focuses of the day. UK will release CBI trends total orders.

EUR/USD Daily Outlook

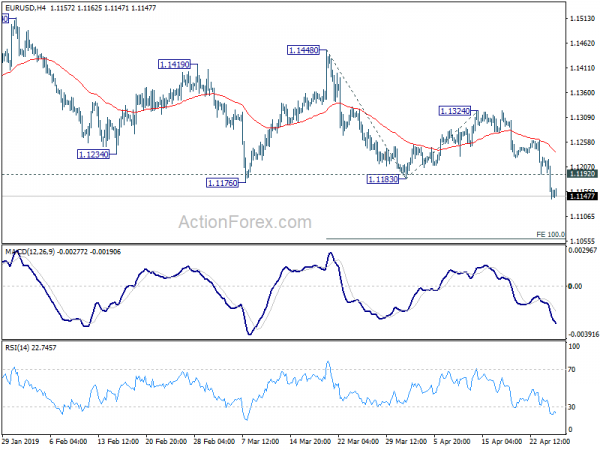

Daily Pivots: (S1) 1.1119; (P) 1.1174; (R1) 1.1206; More…..

EUR/USD’s decline continues and reaches as low as 1.1140 so far. The break of 1.1176 key support now suggests resumption of whole down trend from 1.2555. Intraday bias stays on the downside for 100% projection of 1.1448 to 1.1183 from 1.1324 at 1.1059. Break will target 161.8% projection at 1.0895. On the upside, above 1.1192 minor resistance will turn bias neutral and bring consolidations first. But recovery should be limited well below 1.1324 resistance to bring fall resumption.

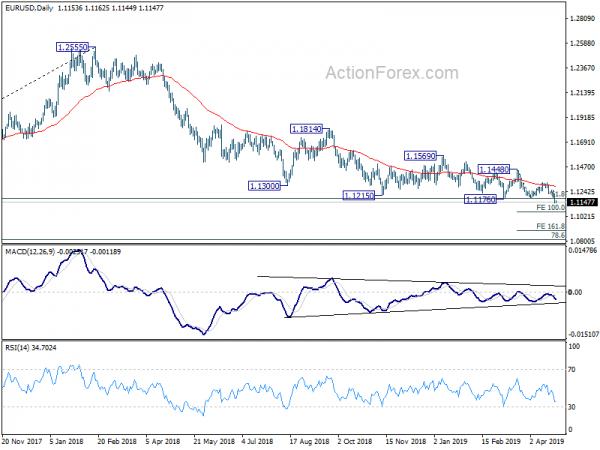

In the bigger picture, down trend from 1.2555 is now resuming with break of 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186. Medium term also remains with EUR/USD staying well below falling 55 week EMA. Next downside target will be 78.6% retracement at 1.0813. Sustained break there will pave the way to retest 1.0339. On the downside, break of 1.1448 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:30 | JPY | BOJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 10:00 | GBP | CBI Trends Total Orders Apr | 3 | 1 | ||

| 12:30 | USD | Durable Goods Orders Mar P | 0.70% | -1.60% | ||

| 12:30 | USD | Durables Ex Transportation Mar P | 0.20% | -0.10% | ||

| 12:30 | USD | Initial Jobless Claims (APR 20) | 199K | 192K | ||

| 14:30 | USD | Natural Gas Storage | 92B |