Dollar and Yen are overwhelmingly the strongest ones for the week. The steep declines in bond yields indicate clear “safe haven” flows. In particular, German 10-year bund yield turned negative again. US 10-year yield (TNX) also dived notably by -0.048 to 2.522. TNX was on a verge of reclaiming 2.6 handle just days ago.

However, risk aversion is not apparent in the stock markets yet. DOW, S&P 500 and NASDAQ just closed slightly lower overnight, with the latter two being close to record highs. Major Asian markets are just mixed and showed no response. The greenback was shot higher against after strong US corporate earnings, including Facebook, Microsoft and Visa. But Asian stocks shrugged.

In Asia, currently:

- Nikkei is up 0.52%.

- Hong Kong HSI is down -0.01%.

- China Shanghai SSE is down -0.93%.

- Singapore Strait Times is down -0.18%.

- Japan 10-year JGB yield is up 0.0076 at -0.028.

Overnight:

- DOW dropped -0.22%.

- S&P 500 dropped -0.22%.

- NASDAQ dropped -0.23%.

- 10-year yield dropped -0.0048 to 2.522.

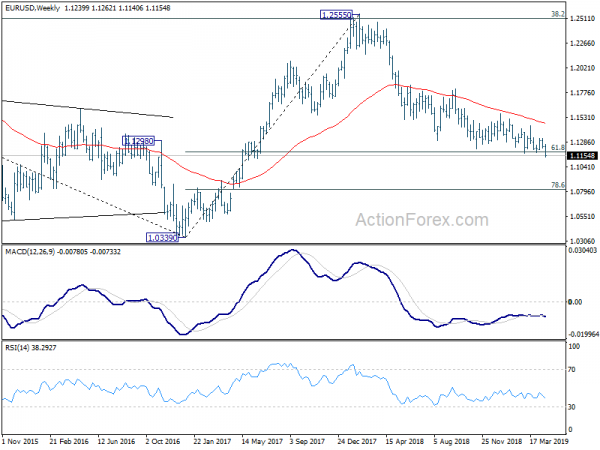

Technically, EUR/USD’s break of 1.1176 support yesterday is worth a mention. The down trend from 1.2555 (2018 high) should be resuming. Medium term bearish is also maintained with EUR/USD staying well below 55 week EMA. Next medium term target will be 78.6% retracement of 1.0339 to 1.2555 at 1.0813.