Key Highlights

- The Euro struggled to break the 0.8680 resistance against the British Pound.

- EUR/GBP recently traded below a bullish trend line at 0.8660 on the 4-hours chart.

- The German IFO Business Climate Index declined to 99.2 in April 2019 from 99.6.

- The US Durable Goods Orders in March 2019 could increase 0.8%, whereas the last was -1.6%.

EURGBP Technical Analysis

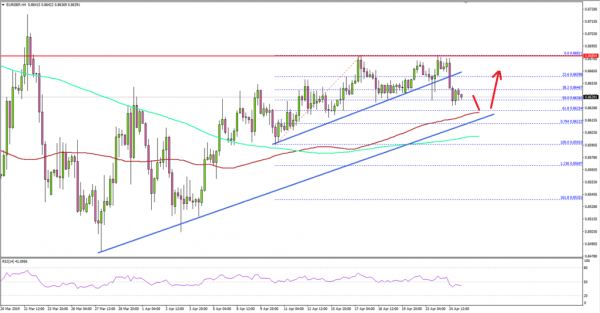

The Euro faced a strong resistance near the 0.8680 level and recently declined against the British Pound. However, the EUR/GBP pair remains well supported on the downside near 0.8620 and 0.8600.

Looking at the 4-hours chart, the pair traded higher steadily after it settled above the 0.8600 resistance and the 100 simple moving average (4-hours, red). The pair climbed towards the 0.8700 level, but it failed to clear the 0.8680 level on two occasions.

As a result, there was a bearish reaction recently below the 0.8670 level and a bullish trend line at 0.8660. The pair tested the 50% Fibonacci retracement level of the last major wave from the 0.8591 low to 0.8681 high.

However, there are many supports on the downside near the 0.8620 and 0.8600 levels. More importantly, the 100 simple moving average (4-hours, red) is positioned near 0.8620 and the 200 simple moving average (4-hours, green) is near 0.8600.

There is also a connecting bullish trend line in place with support near 0.8620 on the same chart. Therefore, as long as EUR/GBP is above 0.8600, it is likely to bounce back in the near term.

On the upside, the main resistance is near 0.8680, above which the pair is likely to climb above 0.8700 and 0.8720.

Fundamentally, the German IFO Business Climate Index for April 2019 was released by the CESifo Group. The market was looking for a minor rise in the index from the last reading of 99.6 to 99.9.

The actual result was below the forecast as there was a decline in the index to 99.2, instead of a rise to 99.9. The IFO Current Assessment index also declined from 103.8 to 103.3.

The report added that:

In manufacturing, the business climate has again worsened markedly. Once more, companies rated their current situation less favorably. Pessimism has also grown regarding the coming months. Capacity utilization fell by 0.8 percentage points to 85.4 percent. This is still higher than the long-run average of 83.7 percent.

Overall, there could be short-term bearish moves in EUR/GBP, but it is likely to gain traction as long as above 0.8600. On the other hand, EUR/USD and GBP/USD traded to new weekly lows recently, and both are currently consolidating losses.

Economic Releases to Watch Today

- US Durable Goods Orders for March 2019 – Forecast +0.8% versus -1.6% previous.

- US Initial Jobless Claims – Forecast 200K, versus 192K previous.

- Tokyo CPI for April 2019 (YoY) – Forecast +0.8%, versus +0.9% previous.