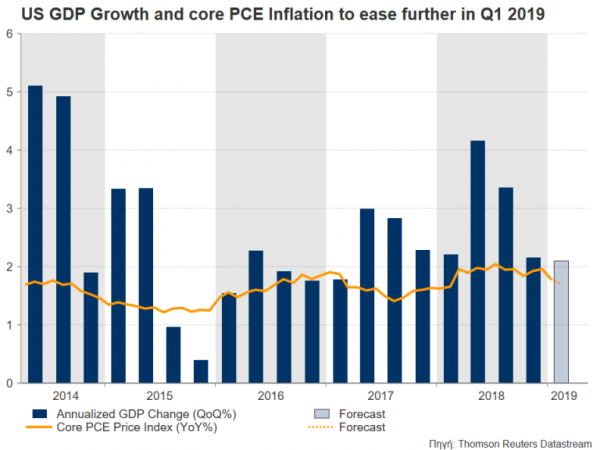

The US reports preliminary GDP growth figures for the first quarter of 2019 on Friday at 1230 GMT, while at the same time on Monday, the March core Personal Consumption Expenditures (PCE) index, will move front and center to add further clues on whether an accommodative monetary policy is indeed necessary in the year ahead. While analysts predict a slower economic expansion and a softer inflation, improving data out of the country have given a good feeling for the US economy lately. Personal income and personal consumption accompanying the inflation reading may turn views rosier as well.

After a surprising downward revision to GDP growth in the final quarter of 2018 that squeezed the annualized measure from 2.6% q/q to 2.2%, forecasts are now for a slimmer expansion of 2.1% in the first three months of 2019 – the lowest growth logged in since Q2 2017. Indeed, the new year found the government shut down until late January as Democrats and Republicans were fighting over the funding of the Mexican border wall. Investors had also a much darker vision about the future of the US-Sino trade relations than they currently have, while the impact of the massive Trump tax cuts that filled businesses’ and consumers’ pockets with more money from 2017 onwards had started to fade out. Besides, with Wall Street having suffered its worst annual performance in a decade, the sentiment coming into this year apparently could not be pleasing.

The core PCE index for the month of March that excludes volatile items such as food and energy is expected to be another weak spot on Monday, and an extra weight for the dollar, as projections stand for further inflationary easing. Particularly, the inflation gauge which the Fed uses to adjust monetary policy is said to have slipped to 1.7% y/y in March from 1.8% in February and down from the Fed’s 2.0% ideal level achieved in December.

The thinking that follows is that if the core PCE index extends slowdown below the 2.0% target, the Fed is likely to keep its word over stable interest rates in 2019 or even chose a rate cut if GDP growth continues to melt as well. However, with retail sales surging by the most in more than a year in March after a weak end to 2018, the trade deficit narrowing in the first quarter, and wage growth still fluctuating at decade highs, the outcome may appear more promising than previously thought, putting the Fed’s dovish stance into question. Personal consumption and personal income data are likely to embrace the idea if the figures pick up steam in line with forecasts, towards 0.4% m/m and 0.6% respectively.

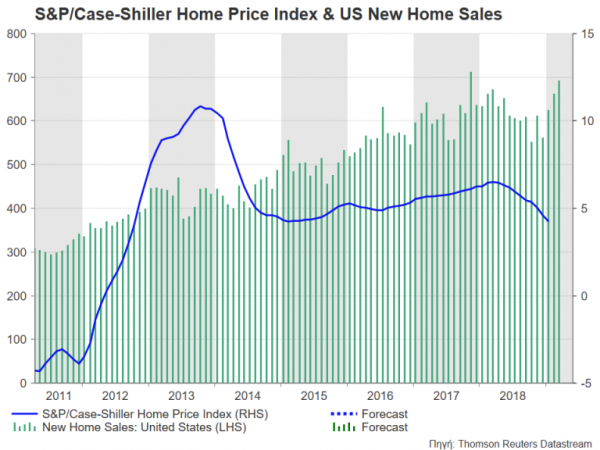

Yet, the US property market remains a puzzle and should be closely watched as house prices extended their almost one-year downtrend to fresh lows in February although lower mortgage rates raised demand for home sales. US-Sino trade relations and economic developments in China and Europe are additional key issues the central bank should consider before deciding on monetary policy in the coming months.

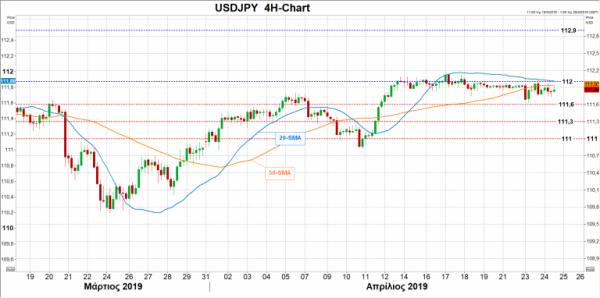

In FX markets, the dollar is outperforming against a basket of six currencies due to the slack in the euro and the pound. However, against the safe-haven yen, the greenback is facing a strong barrier between 112-112.30 that could potentially collapse if preliminary GDP growth or/and inflation figures manage to significantly surprise analysts to the upside, hinting a less dovish Fed policy meeting next week. The pair could rise as high as 112.90.

Otherwise, should the data disappoint, policymakers may retain a cautious tone until further notice. In such a case, USDJPY could move immediately towards 111.60 and then down to the 111.30-111 area.