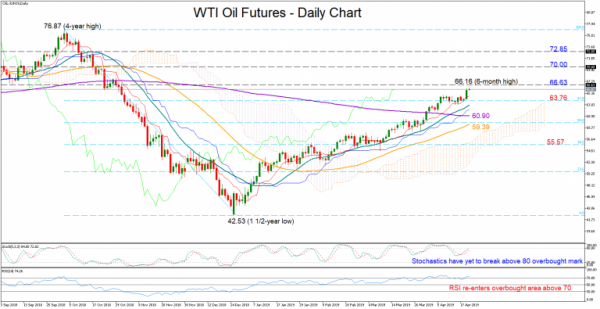

WTI oil futures extended their bullish momentum above the 66 level and towards fresh six-month highs on Tuesday. While the RSI has re-entered the overbought territory, the Stochastics have yet to post a bearish cross above 80, indicating that there is still some room for improvement in the short term. Trend signals are also positive as the market action is currently taking place above moving averages and the Ichimoku cloud.

The bulls are expected to find immediate resistance near 66.63, identified by the peak on January 2017. To take the rally to the next level however, they would have to overcome the 70 level, which is half-way up the aggressive sell-off in August 2013. Higher, another key resistance is located around 72.85.

A reversal to the downside could first retest the 61.8% Fibonacci of 63.76 of the downleg from 76.87 to 42.53. Moving lower, the area between the 200- and the 50-day moving averages (60.98-59.39) that encapsulates the 50% Fibonacci could be the trigger point of a steeper decline that would open the way towards the 38.2% Fibonacci of 55.57. Any close below the latter would shift the medium-term outlook from bullish to neutral.

In brief, the short-term bias is cautiously bullish as the market trades near overbought levels, while in the medium-term picture the market remains in positive mode as long as it holds above 55.57. It is also worth noting that a golden cross between the 50- and the 200-day MAs seems to be in progress as the lines approach each other.