New Zealand Dollar is among the weakest today, together with Australian and Canadian. Selloff in Kiwi picked up momentum last week after Q1 CPI release disappointed by slowing to 1.50%. There are increasing expectation that RBNZ could cut interest rate at the upcoming meeting on May 8.

In the latest weekly commentary, Westpac noted that May’s meeting is a “close call”. A cut is supported by “continued low level of inflation and softness in business sector indicators”. However, “longer-term outlook for the economy is looking less worrying than it did a few months ago, especially given the recent news that there won’t be a capital gains tax.” On the other hand, ANZ “long-end yields have pre-empted a cut” in May. But they expected “another move lower once the first cut is delivered and markets open up to the possibility of a third. ”

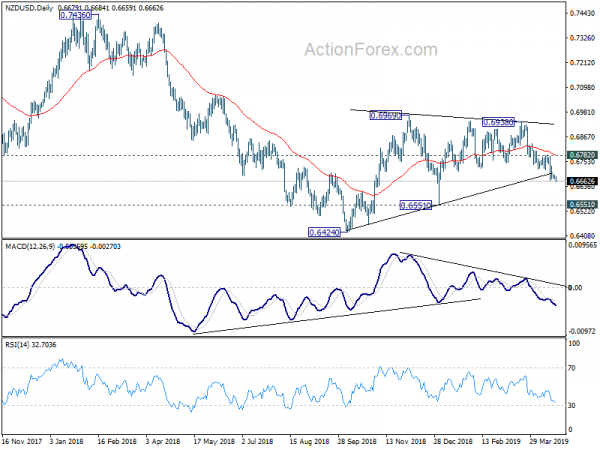

NZD/USD fall from 0.6938 resumes today by taking out 0.6666 temporary low and hits as low as 0.6659 so far. Further decline is expected as long as 0.6782 resistance holds, towards 0.6551 support. The corrective pattern from 0.6424 could have completed with three waves to 0.6938 already. Firm break of 0.6551 should add to the case of medium term down trend resumption through 0.6424 low. Nevertheless, rebound from 0.6551 will extend the corrective pattern with one more rising leg.