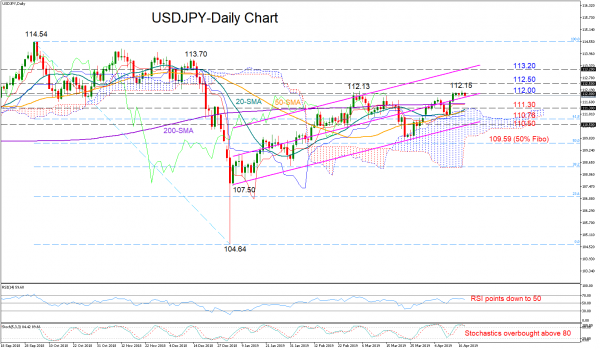

USDJPY has been on the sidelines for the most part of the week as the 112 level seems to be a real struggle for the bulls. Technically, the price could lose some ground in the short-term as the RSI is changing direction to the downside and towards its 50 neutral mark, while the Stochastics are warning over an overbought market, having already created a bearish cross within the %K and %D lines.

A rebound on the 20-day simple moving average (SMA) and near the upper surface of the Ichimoku cloud (111.30), however, could keep the pair on the uptrend started from the 107.50 low in early January. Should the price overcome the 112 mark, resistance could run up to the 112.50 former support area. Higher the top line of the ascending channel seen around 113.20 may also prove a challenge.

Alternatively, a decline under 111.30, could meet a strong barrier between 110.76 and 110.50, where the 61.8% Fibonacci of the downleg from 114.54 to 104.64 and the lower line of the channel are located. Exiting the channel, the 50% Fibonacci of 109.59 could take control.

In the medium-term picture, USDJPY is gently pointing up over the past three months, framing a positive profile. A strong rally above 112.50 would extend the upward pattern off 107.50, making the outlook even more bullish, while a decisive close below 109.59 would confirm the start of a downtrend.

In brief, USDJPY could lose further steam in the short term, while in the medium-term the pair continues to hold a positive outlook.