WTI crude is trading half a percentage point higher on Wednesday, continuing recent gains following a brief spell of consolidation.

The Chinese data may not have been the catalyst for the recent gains in oil prices – taking Brent to fresh five month highs and WTI just shy – but it may well be helping to sustain them. We haven’t seen much of a corrective move since the rally on Tuesday which suggests there may be more to come.

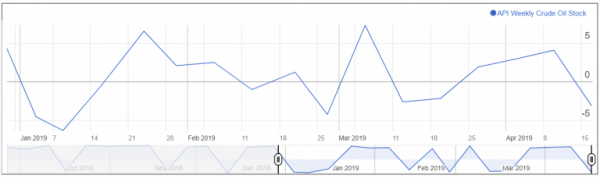

A surprise drawdown in inventories gave oil prices a nice boost just as people appeared to be starting to question the sustainability of the rally. This came after three consecutive weeks of gains as it appeared that demand was slipping just as OPEC+ cuts were starting to bite.

What may support this view is the fact that price has barely surpassed the previous peak in Brent and it’s already stalled, while the momentum indicators aren’t particularly supportive of the bullish case.

WTI Crude Daily Chart

Still, the market can continue to rally in the absence of momentum and if WTI breaks above $65, then $67-67.50 could offer further resistance.

Still, the market can continue to rally in the absence of momentum and if WTI breaks above $65, then $67-67.50 could offer further resistance.

EIA will release their inventory data on Wednesday, which is generally more widely followed than the API number so could trigger more of a market reaction if the number is confirmed or added to.