- US earnings season commences with JPMorgan & Wells Fargo

- Dollar advances alongside US yields, but pares gains

- Yen retreats ahead of US-Japan trade talks, gold follows

Earnings season kicks off with major US banks

US equity markets closed practically flat yesterday, though the Nasdaq Composite (-0.22%) did post some losses, with traders appearing reluctant to take on new positions ahead of what promises to be a stormy earnings season. US banking behemoths JPMorgan Chase and Wells Fargo will report their Q1 results today and markets will keep a watchful eye for evidence of whether the global slowdown has started to hit bank earnings, which are sensitive to business cycle changes.

In other words, the quality of earnings from these banks will not only affect their own stock price, but perhaps the market in general, as they may be a litmus test for the broader financial sector. To be clear, the earnings season likely presents the biggest near-term risk for US markets, considering the prospect for disappointing results or downbeat guidance in an environment where the major equity indices are trading just below all-time highs.

Dollar advances after solid US data, but can’t hold onto gains

Data on Thursday showed that US applications for unemployment benefits dropped spectacularly to 49 ½-year lows in the week ending April 6th and below expectations for a slight increase, indicating a resilient labor market and underpinning confidence in the US economy. Some upbeat remarks by Fed Vice Chair Clarida may have helped as well. However, gains were limited, keeping the greenback below the key 112 level against the Japanese yen as investors still need to see a sustainable improvement in economic indicators and reliable progress in global issues such as trade and Brexit before abandoning thoughts of a more dovish Fed.

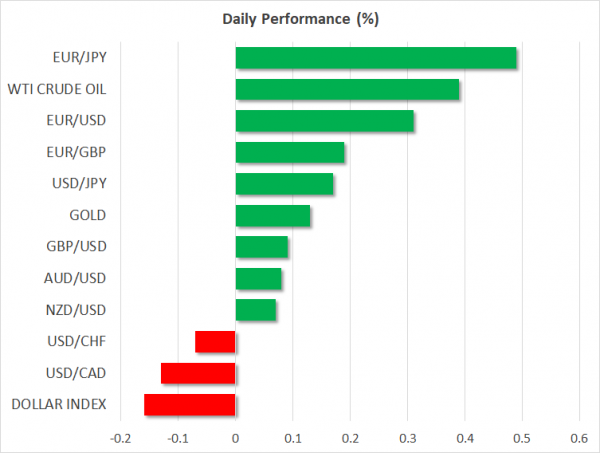

Yet, the greenback is giving back some of its gains early on Friday against a basket of six major currencies, mainly thanks to a stronger euro, which holds the biggest weight by far in that basket. A monthly preliminary survey by the University of Michigan will provide some clues on US consumer sentiment later in the day, with investors looking for any inflationary signs.

Yen retreats alongside gold

In the broader market, there were some sizeable moves, but with little in the way of fresh news behind them. Among the main under-performers was the Japanese yen, which fell nearly across the board, without a clear trigger. Perhaps traders trimmed some of their long exposure ahead of the US-Japan trade talks that will commence next week, and that could cloud the outlook for the currency via the threat of tariffs, despite its safe-haven status.

Gold retreated as well, though that seems owed mainly to the rebound in the dollar and long-term US interest rates. Since gold contracts are generally denominated in dollars, a strengthening US currency diminishes the appeal of the yellow metal for investors using foreign currencies.