Oil loses momentum just after breaking resistance

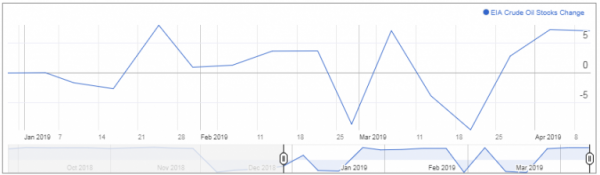

A second large inventory build in two weeks, reported by EIA on Wednesday, has seen the oil rally stutter just as it was getting going.

A break through an important resistance zone last week looked to have been the catalyst for another pop higher in WTI, with the price having jumped from around $63 to $65 in just a couple of days but already we’re seeing consolidation around these levels and momentum appears to have waned.

WTI Crude Daily Chart

The rise in inventories accompanied new economic projections by the IMF which highlighted slowing growth around the world and numerous risks to the economy. Reports that Russia may be contemplating raising production and refusing to partake in OPEC+ cuts beyond the current June deadline may also have contributed to oil quickly losing its appeal.

EIA Crude Oil Inventories

There remains numerous supportive factors for oil prices though, with clashes in Libya drawing much attention despite current production being uninterrupted. Above $65, the $67-68 has previously been a major area of support and resistance so we may not have to wait long for the rally to once again run into difficulty, if of course it finds its mojo again.