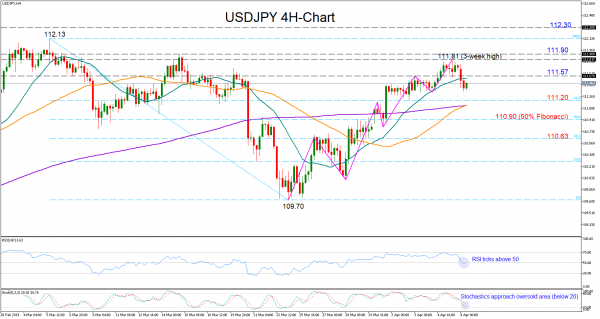

USDJPY failed to close above the 112 level on Friday once again, with the price retreating below the 20-period moving average in the four-hour chart.

The fast stochastics, however, provide optimism that the pair could recoup some losses as the red %K line and the blue %D line approach oversold territory (below 20). The RSI looks to be improving at the current time, though, as long as it holds close to its 50 neutral mark, any gains could appear limited in the short term.

Should the pair climb back above 111.57, the previous high of the recent uptrend, positive momentum could meaningfully extend towards the 111.80-111.90 area. Breaking significantly above this zone, the bulls would push card to clear the 112 mark and more importantly the 112.30 number which had acted as a strong support at the end of 2018.

Otherwise, a drop below 111.20, the 61.8% Fibonacci of the downleg from 112.13 to 109.70, may further weaken sentiment in the market, whilst a fall under the 50% Fibonacci of 110.90 would put the recent upward pattern into question. The 38.2% Fibonacci of 110.63 could be the next level to watch if the sell-off continues.