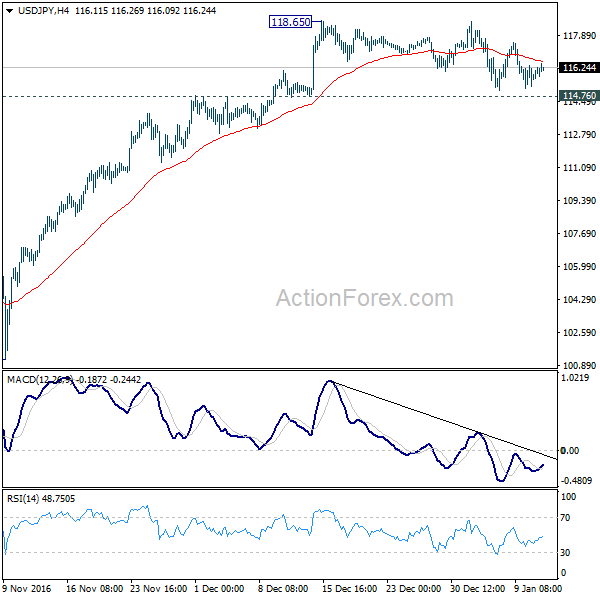

Daily Pivots: (S1) 115.18; (P) 115.76; (R1) 116.33; More…

USD/JPY is still bounded in consolidation pattern from 118.65 and intraday bias remains neutral. With 114.76 support intact, outlook stays bullish with further rally expected. Above 118.65 will extend the whole rise from 98.97 to 125.85 key resistance next. However, sustained break of 114.76 will confirm short term topping and bring deeper pull back to 55 day EMA (now at 113.12) and below.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.05 and below will extend the consolidation with another falling leg before up trend resumption.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box