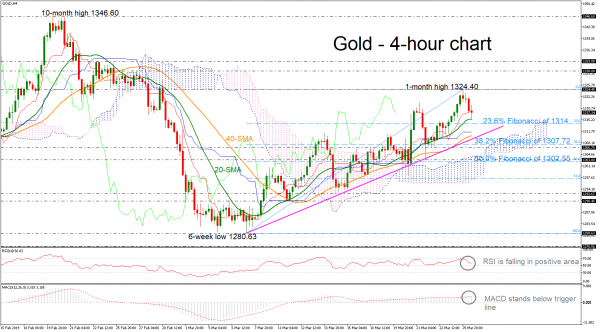

Gold has declined considerably since hitting the one-month high of 1324.40 on Monday’s trading session, returning back below the red Tenkan-sen line. The technical indicators are suggesting a potential downside risk as both are weakening. The RSI is falling towards the 50 level, while the MACD is ready for a bearish crossover with its trigger line.

Despite the technical indicators view, the current structure remains bullish in short-term, as the price is holding above the ascending trend line over the last three weeks.

Should the price continue the bearish movement, immediate support could come from the 23.6% Fibonacci retracement level of the upleg from 1280.63 to 1324.40, near 1314. Slightly below, the uptrend line and the 40-SMA could act as major support levels around 1310. A drop beneath these lines could send the price until the 38.2% Fibonacci of 1307.72 and the 1306.75 support. More downside movement could touch the 50.0% Fibonacci of 1303, which stands inside the Ichimoku cloud.

On the other side, resistance would likely come from the one-month high of 1324.40 ahead of the 1330 – 1333 resistance levels. Breaking these obstacles too, the investors could look next at the ten-month high of 1346.60.

To sum up, gold could follow a positive path in the short term, while in the medium term, the bullish outlook could come back into play if the precious metal overcome the ten-month high.