U.S. Highlights

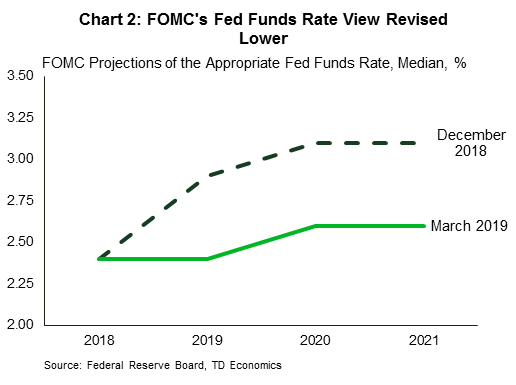

- The Fed’s dots showed that it only expects to hike rates once more by the end of 2020, sending Treasury yields lower mid-week.

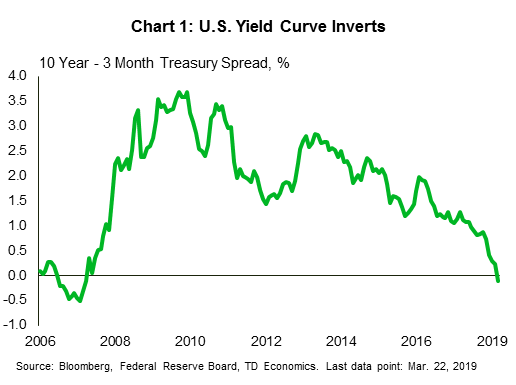

- On Friday, weakness in March manufacturing surveys in Europe, Japan, and the U.S. sent longer-term U.S. yields low enough to invert the yield curve. A yield curve inversion has historically preceded a recession by up to eight quarters.

- In a separate drama, the UK has earned a two-week extension on its Brexit deadline to April 12th. It remains to be seen if the UK’s parliament will pass the current deal reached with the EU, and so further cliffhangers are likely.

Canadian Highlights

- All eyes were on Ottawa this week as the Federal Government tabled its FY2019-20 budget. The budget contained some new policy initiatives, but there was little in the way of material implications on debt trajectory, near-term economic growth, or monetary policy.

- At the same time, three provincial governments showcased their FY 2019-20 budgets, laying out plans to remain in the black (Quebec, New Brunswick) or move back into it (Saskatchewan).

- The week wasn’t light on economic data. Wholesale trade kicked off the release schedule with a decent uptick. Capping the week, however, was a disappointing retail sales showing and an unsurprising CPI inflation print.

U.S. – When The Dots Are Down

The Fed’s revelation that it only expects to hike rates once by the end of 2020 fanned equity market flames through much of the week. However, a souring in March PMI surveys for Japan and Europe, dampening expectations of a modest rebound in these regions in 19Q2, snuffed out some of that optimism. Global treasury yields moved down sharply, causing the U.S. yield curve to invert slightly today (Chart 1). A yield curve inversion has historically preceded a recession by up to eight quarters.

The Fed meeting was the first opportunity for it to present updated economic projections since they pivoted to a patient stance in January. In the statement, FOMC officials downgraded their assessment of current economic conditions. Moreover, the committee reaffirmed that it “will be patient as it determines what future adjustments to the target range may be appropriate”, which is unchanged from the January statement.

Markets were waiting for the Fed’s dot plot downgrade, and it didn’t disappoint. The majority of FOMC members (11 of 17) do not expect to raise rates in 2019, down from a median expectation of two hikes in December (Chart 2). For 2020, the median expectation is one hike. The longer-run expected level of the fed funds rate is 2.8%, which is unchanged from December.

These lower rate expectations came alongside a modest downgrade to real GDP growth to 2.1% in 2019 (prev. 2.3%), and 1.9% in 2020 (prev. 2.0%). The unemployment rate forecast was raised two-tenths in 2019 and 2020, and one tenth in 2021. Inflation expectations, however, were unchanged, suggesting that the Fed’s expected monetary policy path should keep inflation on target.

Given a muted inflation backdrop, deteriorating economic outlook and uncertainty about the path of Brexit, an extended pause on hikes continues to be a prudent course of action and remains in line with our recent forecast.

Adding to Europe’s economic woes is the extended period of Brexit uncertainty. The EU agreed to extend the Brexit cliffhanger until April 12th if the UK’s parliament votes against the withdrawal agreement for the third time next week. That gives Theresa May three weeks to sell her negotiated Brexit deal to parliament. If the withdrawal agreement is eventually passed, it will have until May 22nd to sort out the logistics for withdrawal.

The upside of a shorter extension than May had requested is it should reduce the duration of Brexit-related uncertainty, which is exacting a toll largely on UK economic activity, but also weighing on European sentiment. Our UK economic forecast was downgraded last week to a 1.2% pace in 2019, versus 1.6% in our December outlook. In its decision to leave rates on hold this week, the Bank of England continued to fret about Brexit developments. With Brexit developments in flux and weak foreign demand, we expect the BoE may remain on the sidelines through 2019.

Canada – Federal Budget Takes Centre Stage

It was a busy week for Canadian data and financial markets. The S&P/TSX lost ground this week as oil prices gave up earlier gains in light of Friday’s manufacturing data that signalled a deteriorating global economic outlook. Meanwhile, the budget-heavy week was joined by data that did little to change the downbeat domestic economic story.

The big-ticket event was the Federal Government’s release of its FY2019-20 budget on Tuesday. The government’s projected deficits for last year were lower than initial estimates, with the windfall used to finance new initiatives. Some of the measures include a focus on incentivizing education and job training, with new refundable tax credits and EI support, and reduced interest costs on Canada Student Loans. Other areas of focus included environmental initiatives, where the government is introducing a credit for electric vehicles and transferring $1 billion to municipalities for greening initiatives.

Arguably, the most attention-grabbing parts were its housing demand measures. Specifically, its First Time Home Buyer’s Initiative includes a shared equity mortgage program and an increase in RRSP withdrawal limits. This may help increase home ownership rates, but the impact on sales and prices is likely to be minor. Indeed, we anticipate both to be only around 3% higher by the end of 2020 if implemented. Still, not all markets are expected to benefit, with some like Toronto and Vancouver likely not benefitting as much due to the price cap, and with tight markets potentially experiencing higher price impacts.

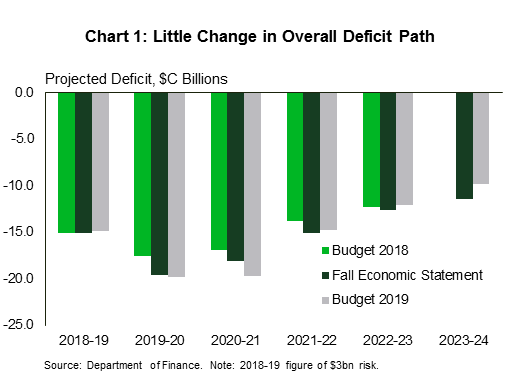

On the revenue side, the budget contained little change, with the most notable being a cap on the value of stock options subject to tax-preferred treatment. All told, the new budget’s measures are unlikely to have material implications on growth or monetary policy projections. Importantly, the deficit trajectory (Chart 1) is mostly unchanged.

Meanwhile, three provincial governments showcased a commitment to balanced budgets this week. New Brunswick’s decent starting point and planned spending restraint should help keep its books in the black within the projection horizon. Saskatchewan’s government also signaled a commitment to surpluses going forward, an encouraging feat given its outsized deficits following the 2014 oil price shock. Last but not least, Quebec’s new government tabled its first budget, introducing an array of new measures, with an intention to maintain surpluses of $2.5-$4 billion.

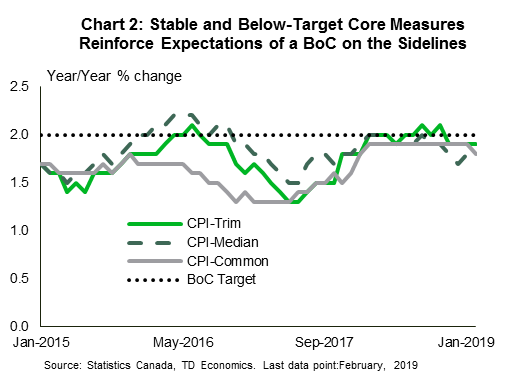

Budgets aside, two top-tier data releases capped the week. The CPI inflation print was unsurprising; with the headline coming in at 1.5% and the Bank of Canada’s core measures hovering slightly below its target, at an average of 1.8% (Chart 2). Retail sales disappointed for the third straight month, declining 0.3% and with volumes almost flat, consistent with expectations of a slowdown in consumer spending in Q1. Wholesale trade was decent, with a 0.6% uptick. Altogether, the data reinforce the expectation that the Bank of Canada will likely remain on the sidelines for a long period to come.

U.S.: Upcoming Key Economic Releases

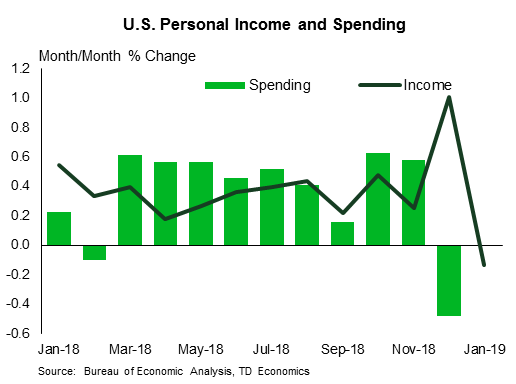

U.S. Personal Income & Spending – January/February

Release Date: March 29, 2019

Previous: Spending: -0.5% m/m; income: -0.1%

TD Forecast: Spending: 0.4% m/m; income (Feb): 0.3%

Consensus: Spending: 0.3% m/m; income (Feb): 0.3%

In line with the CPI print and maintaining its recent pace, we expect core PCE inflation to have advanced 0.2% m/m in January. This should keep the annual rate slightly below 2% for a fourth straight month. Conversely, spending should have bounced back from December’s large 0.5% contraction. We pencil in a 0.4% jump but see scope for a smaller increase. In the details, we expect a 0.5% m/m increase in services spending to be the main driver of the rebound, with a rise in spending on nondurables also helping on the headline. On the contrary, we see spending on durables acting as a headwind in January. All in, our headline forecast would suggest spending is tracking a soft 0.5% q/q increase for Q1. For personal incomes, we look for a 0.3% increase in February on the heels of strong average hourly earnings.

Canada: Upcoming Key Economic Releases

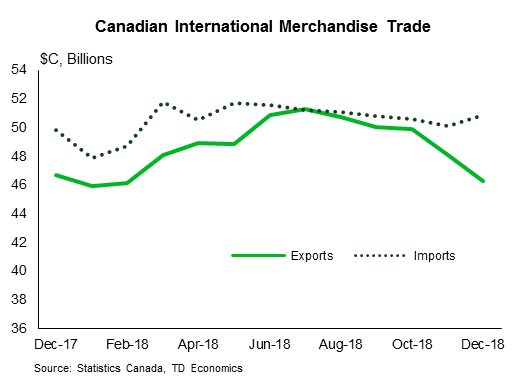

Canadian International Trade – January

Release Date: March 27, 2019

Previous: -$4.6bn

TD Forecast: -$3.6bn

Consensus: N/A

TD looks for the international merchandise trade deficit to narrow to $3.6bn in January on a combination of stronger exports alongside a moderation in import activity. Exports will benefit from a broad rebound in manufacturing activity while Alberta’s energy curtailment policy will have minimal impact; pipelines continued to operate at full capacity despite weaker production, although an unintended consequence was a sharp narrowing in the heavy crude discount which will weigh on the volume of rail shipments. However, higher oil prices will more than offset a pullback in crude exports by rail. On the other side of the ledger, imports should see a modest decline on weaker manufacturing activity south of the border and softer domestic demand after a 1.6% increase in December.

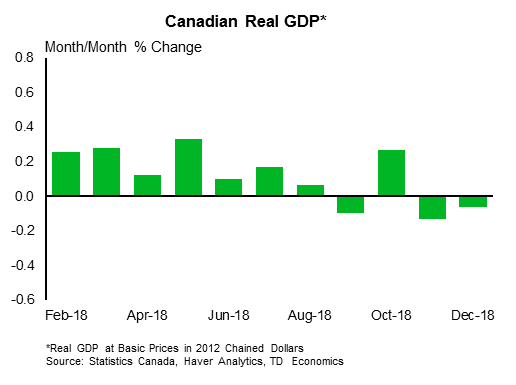

Canadian Real GDP – January*

Release Date: March 29, 2019

Previous: -0.1%

TD Forecast: 0.0%

Consensus: N/A

Industry-level GDP is forecast to remain unchanged in January, as distortions from Alberta’s oil curtailment program cast a shadow over what would otherwise be a decent report. Oil sands production fell by 7.3% (nsa) in January, but will recover gradually over the coming months as inventories normalize from elevated levels. Outside of the energy sector things look relatively intact, underscored stronger activity data while a rebound in existing home sales should provide fleeting support to real estate output ahead of an outsized pullback in February. Construction also ought to make a positive contribution on a reported increase in building investment although further deterioration in housing starts, which in February slowed to the weakest pace since 2014, bodes poorly for residential investment going forward. Unchanged GDP in January would present an upside risk to our current tracking for Q1 although consecutive monthly declines into year-end will present a high-hurdle to realize the Bank of Canada’s forecast for 0.8%.