Canadian inflation climbs

Canadian inflation rose last month at a slightly faster-than-expected pace, pushed higher by increased costs associated with mortgage payments and fresh vegetables.

According to Stats Canada, Canada’s CPI climbed +1.5% y/y in February, up from a +1.4% rise in January. Market expectations were for a +1.4% increase.

Meanwhile, the Bank of Canada (BoC) preferred measures for underlying inflation was unchanged m/m, with the average core-CPI rate for February at +1.83%.

Canada Retail Sales Decline

Canadian retail sales fell for a third consecutive month in January on decreased demand for new and used cars.

Stats Canada said retail sales decreased -0.3% in January m/m to a seasonally adjusted C$50B. Market expectations were for a +0.4% increase.

In volume terms, January sales were unchanged from the previous month.

On a y/y basis, January retail receipts rose +1.1% vs. December’s +1.5% annual advance.

The level of retail sales now sits at a nine-month low and mostly weighed down by the auto component. Sales at motor vehicles and parts dealers fell -1.5% to C$13.47B. Ex-auto’s, Canadian retail sales advanced +0.1%.

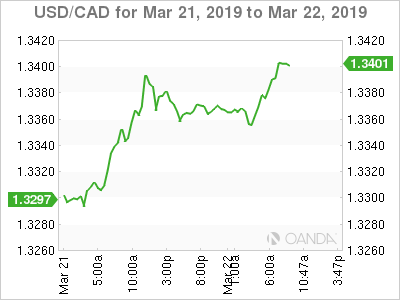

Loonie

The CAD is now trading at the low of the day, down -0.37% at C$1.3416