Sterling suffers another round of selloff today as the markets clearly disapprove of UK Prime Minister Theresa May’s next step on Brexit. In short, she’s just seeking a short delay until June 30. But any date beyond May 23, when EU elections take place, is already rejected back on March 11. May also intends to bring her old deal to a third meaningful vote and there is so signs on any chance to get through the Commons. More volatility would likely be seen in the Pound as the March 21-22 European Council meeting looms.

Staying in the currency markets, Canadian is also among the weakest ones as WTI crude oil dips sharply to 58.94 after failing to break through 60 key resistance zone. But the find direction, a breakthrough or rejection, could depend on oil inventory data to be release soon. Australian Dollar is currently the strongest one, followed by Swiss Franc. Dollar is mixed, awaiting FOMC rate decision, economy projections and press conference.

In Europe, currently, FTSE is down -0.08%. DAX is down -1.57%. CAC is down -0.43%. German 10-year yield is down -0.0073 at 0.092. Earlier in Asia, Nikkei rose 0.20%. Hong Kong HSI dropped -0.49%. China Shanghai SSE dropped -0.01%. Singapore Strait Times dropped -0.41%. Japan 10-year JGB yield rose 0.0092 to -0.036.

UK PM May seeks Article 50 extensions until June 30, But EU Juncker warns against it

UK Prime Minister Theresa May confirms at PMQs in parliament that has written to European Council President Donald Tusk to seek extension of Article 50 until June 30. She noted that MPs voted for only a short extension last Thursday. Also, holding European election would not be in anyone’s interest. May also said the government will hold another meaningful vote.

May said: “As prime minister, I am not prepared to delay Brexit any further than the 30th of June … I have therefore this morning written to President Tusk, the president of the European Council, informing him that the UK seeks an extension to the article 50 period until the 30th June… The government intends to bring forward proposals for a third meaningful vote. If that vote is passed, the extension will give the House time to consider the Withdrawal Agreement Bill. If not, the House will have to decide how to proceed.”

However, European Commission President Jean-Claude Juncker warned UK Prime Minister Theresa May in a phone call that short Brexit extension has to be complete before May 23. Or, UK will have to take part in EU elections. His spokesperson also said “the president has clearly warned the prime minister against including a date for the extension that will be after the European parliament elections. That’s why he repeated in this call his advice, which he set out in his letter on March 11, that the withdrawal has to be complete before May 23, otherwise we risk facing institutional difficulties and legal uncertainty, given the European elections date.”

UK CPI ticked up to 1.9%, house price growth slowest since 2013

In February, UK CPI accelerated to 1.9% yoy, up from 1.8% yoy and beat expectation of 1.8% yoy. It’s close to the two year low in January. Core CPI, on the other hand, slowed to 1.8% yoy, down from 1.9% yoy and missed expectation of 1.9% yoy. RPI was unchanged at 2.5% yoy, matched expectations.

PPI input rose to 3.7% yoy, up from 2.6% yoy. PPI output rose to 2.2% yoy, up from 2.1% yoy. PPI output core slowed to 2.2% yoy, down from 2.4% yoy.

Also from UK, house price index rose 1.7% yoy in January, down from December’s 2.5% yoy and missed expectation of 1.7% yoy. It’s also the slowest pace since June 2013.

From Germany, PPI dropped -0.1% mom, rose 2.6% yoy in February.

BoJ Jan minutes: Current policy stance appropriate as momentum towards 2% inflation target maintained

As revealed by minutes of January 22-23 BoJ meeting, “most members” believed it’s appropriate to ” persistently continue with the powerful monetary easing under the current guideline for market operations” as momentum towards 2% inflation target was maintained. Meanwhile, “many members” said it’s necessary to take account of developments of developments in economic activity, and financial conditions in a “balanced manner”.

The board also spent considerable amount of time discussing monetary policy stance in responses to downside risks. One member noted it was necessary to “devise ways to avoid a situation where an expectation that no policy change would occur for the time being would be fixed to an excessive degree in financial markets”

Another member noted that “it was not desirable to adopt a stance of not taking action until a serious crisis occurred”. This member also said “it was necessary to emphasize the Bank’s stance of taking swift, flexible, and decisive actions.”

Also released in Asian session, Australian Westpac leading indicator rose 0.0% mom in February. New Zealand current account deficit narrowed to NZD -3.26B in Q4.

China Xi to strengthen global strategic partnership with Italy

On the eve of his visit to Italy, Chinese President Xi Jinping wrote in Corriere della Sera newspaper saying that the country is ready to strengthen a “global strategic partnership”. Xi added that “with my visit I wish to set out together with Italian leaders the guidelines for bilateral relations and take them into a new era.” Additional, China like to coordinate more closely with Italy in multilateral organizations like UN, WTO and GD20. And both countries could develop joint projects in ports, shipping, telecoms and pharmaceuticals.

Separately, Vice Foreign Minister Wang Yi said “it is hard to avoid misunderstandings occurring during the process of advancing the construction of the Belt and Road. But he emphasized that “facts are the best proof”. Italy is set to send a high-level delegation to the second Belt and Road summit in Beijing next month. And they would be the first G7 nation to join the initiative, which could upset the US and alert EU.

Fed to stand pat, release new projections, may announce end to balance sheet runoff

Fed is widely expected to keep interest rate unchanged at 2.25-2.50% today. Also the central bank is expected to reiterated that it’s in no hurry to make another move. The language that “the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes” should be maintained .

There will be two major focuses for the announcement as well as press conference. Firstly, Fed’s is known to be preparing for ending the balance sheet roll-off this year. The balance sheet surged from less than USD 1T in 2008 to hit a peak of USD 4.5T as a result of the quantitative easing program. It then started to be reduced by USD 50B per month since early last year. The detailed plan might be revealed today with specifics on when and how the runoff would end.

Fed will also publish first set of new economic projections after it shifted to a “patient” stance. Forecasts on GDP, unemployment rate and inflation are important as usual. But a crucial part is projection on federal funds rate. Back in December, the median forecast was for interest rate to rise to 2.9% in 2019, with central tendency at 2.6-3.1%. For 2020, media rate was at 3.1%. The longer run neutral rate was projected to be at 2.8%, with central tendency at 2.5-3.0%. Today’s projections will hopefully answer questions like: Is there one or two expected rate hikes this year? Are some members expecting a rate cut? Where the neutral rate is? Will rate hike continue down the road to surpass neutral.

Below are some suggested readings on FOMC:

- FOMC Preview: Fed to Maintain Dovish Tone and Announce Plan to End Balance Sheet Reduction

- FOMC Preview: Is The Market Too Dovish On The Prospects For A 2019 Rate Hike?

- Fed to Clarify How Patient it Could Get With Rate Hikes

- FOMC Preview – Fed To Signal One More Rate Hike

- Two Thine Own Inflation Target Be True? Fed Policy Review Part 1

- Could the Fed Go Negative? Fed Policy Review Part 2

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3226; (P) 1.3269; (R1) 1.3306; More….

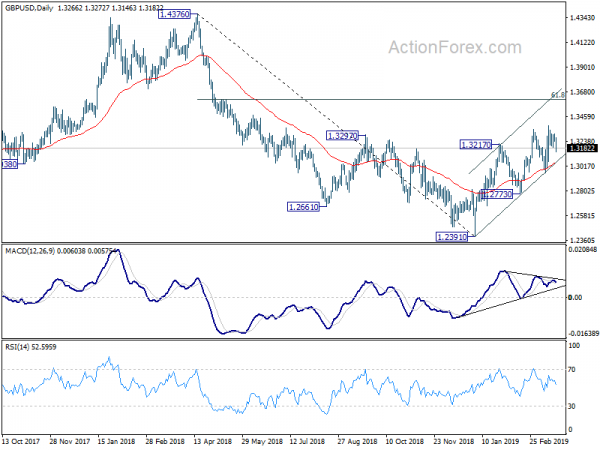

GBP/USD drops sharply today but it’s, after all, staying well above 1.2960 support. Intraday bias remains neutral and more consolidative could be seen. With 1.2960 support intact, further rise is expected. On the upside, firm break of 1.3381 will target 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. However, on the downside, firm break of 1.2960 will indicate that rebound from 1.2391 has completed earlier than expected. Deeper fall would then be seen to 1.2773 support for confirmation.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q4 | -3.26B | -3.55B | -6.15B | |

| 23:30 | AUD | Westpac Leading Index M/M Feb | 0.00% | 0.00% | 0.10% | |

| 23:50 | JPY | BOJ Minutes Jan | ||||

| 7:00 | EUR | German PPI M/M Feb | -0.10% | 0.20% | 0.40% | |

| 7:00 | EUR | German PPI Y/Y Feb | 2.60% | 2.90% | 2.60% | |

| 9:30 | GBP | CPI M/M Feb | 0.50% | 0.40% | -0.80% | |

| 9:30 | GBP | CPI Y/Y Feb | 1.90% | 1.80% | 1.80% | |

| 9:30 | GBP | Core CPI Y/Y Feb | 1.80% | 1.90% | 1.90% | |

| 9:30 | GBP | RPI M/M Feb | 0.70% | 0.70% | -0.90% | |

| 9:30 | GBP | RPI Y/Y Feb | 2.50% | 2.50% | 2.50% | |

| 9:30 | GBP | PPI Input M/M Feb | 0.60% | 0.60% | -0.10% | -0.30% |

| 9:30 | GBP | PPI Input Y/Y Feb | 3.70% | 4.10% | 2.90% | 2.60% |

| 9:30 | GBP | PPI Output M/M Feb | 0.10% | 0.10% | 0.00% | |

| 9:30 | GBP | PPI Output Y/Y Feb | 2.20% | 2.20% | 2.10% | |

| 9:30 | GBP | PPI Output Core M/M Feb | 0.10% | 0.20% | 0.40% | |

| 9:30 | GBP | PPI Output Core Y/Y Feb | 2.20% | 2.30% | 2.40% | |

| 9:30 | GBP | House Price Index Y/Y Jan | 1.70% | 2.40% | 2.50% | |

| 11:00 | GBP | CBI Trends Total Orders Mar | 1 | 5 | 6 | |

| 14:30 | USD | Crude Oil Inventories | -3.9M | |||

| 18:00 | USD | FOMC Rate Decision (Upper Bound) | 2.50% | 2.50% | ||

| 18:00 | USD | FOMC Rate Decision (Lower Bound) | 2.25% | 2.25% | ||

| 18:30 | USD | FOMC Press Conference |