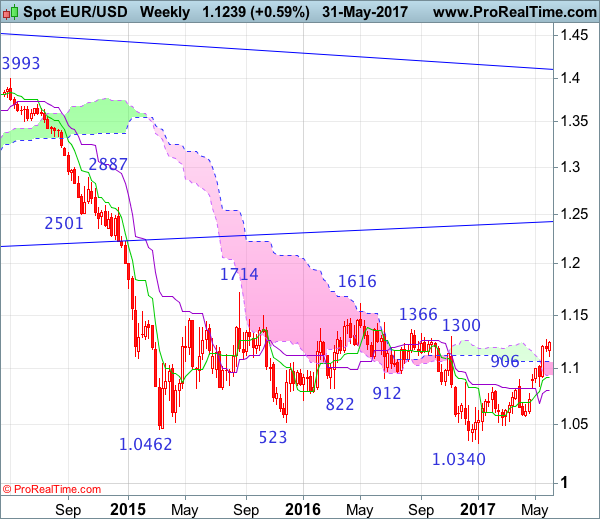

Weekly

• Last Candlesticks pattern: Shooting star

• Time of formation: 03 May 2016

• Trend bias: Down

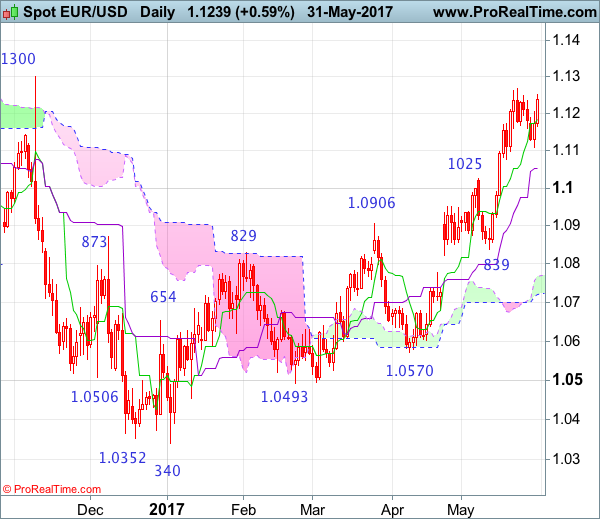

Daily

• Last Candlesticks pattern: Shooting star

• Time of formation: 3 May 2016

• Trend bias: Sideways

EUR/USD – 1.0946

Although the single currency retreated after rising to 1.1268, as euro did find renewed buying interest at 1.1109 earlier this week and has rebounded (we recommended in our previous update to buy at 1.1120 and a long position was entered), retaining our bullishness for recent upmove to resume after consolidation, above said resistance at 1.1268 would confirm the rise from 1.0340 low has resumed and extend further gain to previous resistance at 1.1300, then 1.1327, however, near term overbought condition should limit upside to previous chart resistance at 1.1366 but reckon 1.1440-50 would hold from here, risk from there is seen for a retreat later.

On the downside, whilst initial pullback to the Tenkan-Sen (now at 1.1184) cannot be ruled out, reckon downside would be limited sand said support at 1.1109 should remain intact, bring another rise later to aforesaid upside targets. A drop below said support at 1.1109 would defer and risk test of the Kijun-Sen (now at 1.1054) but only a daily close below there would defer and suggest a temporary top is possibly formed instead risk correction to 1.1025 (previous resistance now support), break there would add credence to this view, then correction to 1.0950-60 would follow, having said that, support at 1.0839 should remain intact.

Recommendation: Hold long entered at 1.1120 for 1.1320 with stop below 1.1105.

On the weekly chart, although euro slipped initially to 1.1109, renewed buying interest emerged there and the pair has rebounded since, retaining our bullishness for the erratic rise from 1.0340 low to bring a test of previous resistance at 1.1300, however, a break of another previous resistance at 1.1366 is needed to signal early downtrend has ended at 1.0340, bring further subsequent rise to 1.1428 but reckon 1.1500 would hold and price should falter well below another previous chart resistance at 1.1616.

On the downside, expect pullback to be limited to 1.1200-05 and bring another rise later to aforesaid upside targets. Below said support at 1.1109 would defer and risk weakness to the upper Kumo (now at 1.1067), then test of 1.1025 (previous resistance now support) but break there is needed to signal top is formed instead, bring further fall to 1.0965-70 but 1.0919-22 (current level of the Tenkan-Sen and previous support) should remain intact, price should stay well above another previous support at 1.0839, bring another rise later.