U.S. Highlights

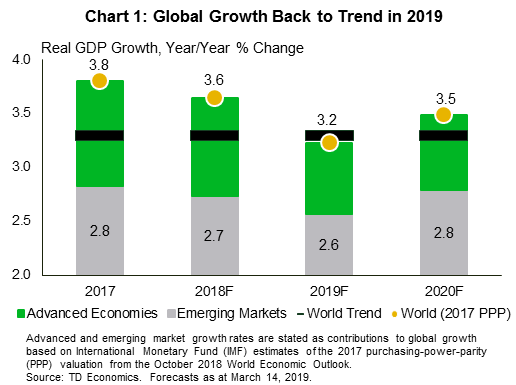

- Our updated economic forecast anticipates a slowdown in global growth to 3.2% in 2019, roughly at trend.

- A weak handoff from 2018 and start to 2019 motivates much of the downgrades in advanced economies, while growth in emerging markets is anticipated to perk up slightly later in the year.

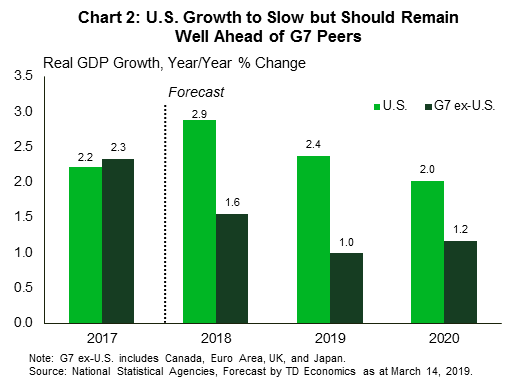

- Growth in the U.S. is expected to slow, but still remain at an above-trend pace this year. That said, lingering economic uncertainty could weigh further on the domestic and global outlook.

Canadian Highlights

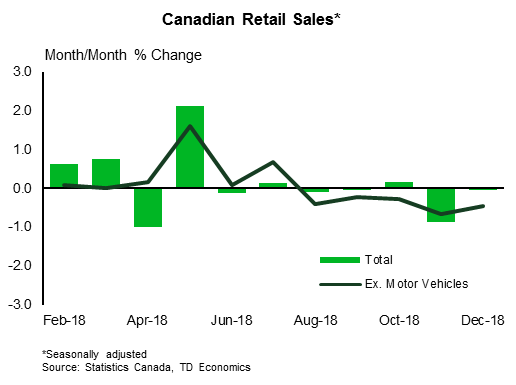

- Canadian data this week was somewhat discouraging. Households ended 2018 by setting a new record for relative indebtedness. Meanwhile, February home resale data showed a 9.1% drop in sales activity, but January manufacturing sales rebounded, up 1.4% in volume terms.

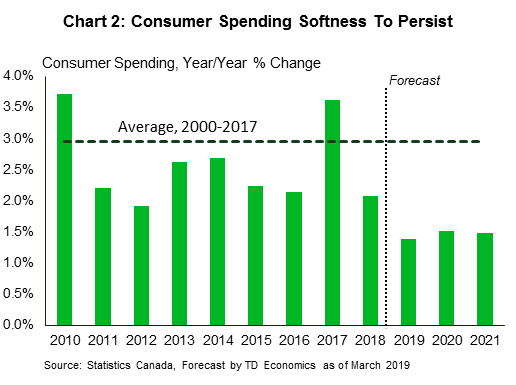

- Recent softness provides a weak starting point for our latest Quarterly Economic Forecast. We’ve downgraded our economic growth forecast for this year to 1.2%, with a modest acceleration to 1.8% in 2020.

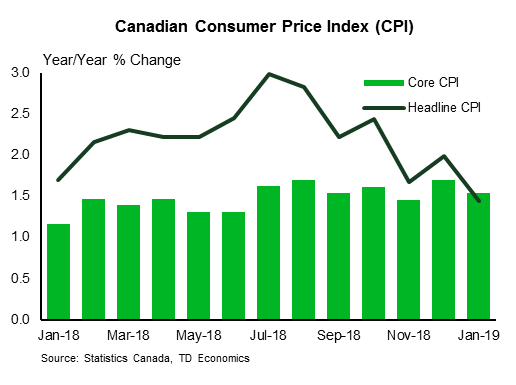

- Contained inflation and a forecast of just a trend pace of growth suggest that the Bank of Canada has already brought its monetary policy interest rate to a neutral stance. We expect no further rate hikes.

U.S. – Ahead of the (Slowing) Pack

In a year marked by high expectations for deals, 2019 is shaping up to be a rough year for the global economy, and advanced economies in particular. Our new quarterly economic forecast expects global growth to slow to 3.2% in 2019 from 3.6% last year (Chart 1). That’s down about 0.2 ppts from our December outlook.

This outlook is consistent with global demand growing roughly at the same pace as capacity, and, correspondingly, subdued inflation pressures. However, the headline print itself masks the disparate regional challenges. For example, a soft end to 2018 and a disappointing start to 2019 results in a much weaker growth outlook for G7 economies this year. Add a global manufacturing slump, and you have the impetus for a relatively weak economic expansion relative to past years. Downgrades like this justify the pivot to patience by G7 central banks. Interest rate hikes are effectively cancelled through the end of 2019.

In contrast, economic activity in the developing world is expected to heat up later this year. An anticipated improvement in global manufacturing activity, weaker inflation and lower global interest rates all support a firmer outlook in emerging market economies. That said, a slowing Chinese economy and elevated trade policy uncertainty vis à vis the U.S. could weigh further on major trading partners, stifling any sort of rebound in global economic activity.

The U.S. economy is expected to prove more resilient than its G7 peers (Chart 2). Although it too will see growth slow in 2019, the decline is largely due to the waning impulse from fiscal stimulus. Growth for 2019 is still expected to average an above-trend pace of 2.4%, half a point shy of last year’s strong performance. The government shutdown and continued phenomenon of residual seasonality weigh heavily on the first quarter, bringing down the annual average. However, both consumer and business spending fail to rebound to the heady quarterly growth rates observed in 2018 through the remainder of this year.

Spending on consumer durables, such as automobiles, is expected to decelerate. Moreover, although a rebound in housing activity is expected later this year, very weak momentum acts to ensure that residential investment contracts for a second consecutive year. Net trade is also expected to weigh on growth again this year, with import demand outpacing exports.

The data this week acted to support this outlook. January retails sales staged a solid rebound from December lows. Combined with solid wage gains in February’s employment report, this sets the table for an uptick in economic activity later this quarter. That said, geopolitical events this week proved less constructive. Trade talks between Presidents Trump and Xi have been punted to at least April, and Brexit will likely be delayed at least through June. This suggests that elevated political and trade policy uncertainty will continue to weigh on global economic activity for at least a couple more months.

Canada – Sitting at Neutral, Slogging Towards Normal

The economic data this week painted a generally downbeat picture. The one exception was manufacturing sales, which rose 1.4% in volume terms in January (see commentary), a strong report that was still not enough to offset the weakness seen in late 2018. Beneath the strong headline, forward looking components (new and unfilled orders) were soft.

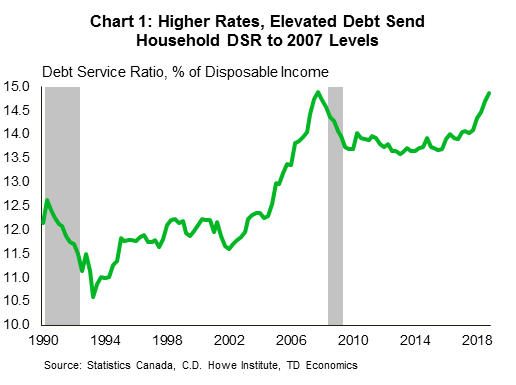

Striking a less positive note was Statistics Canada’s snapshot of Canadian finances at the close of 2018, showing that the stresses on households continue to mount (see our commentary). Past interest rate increases are continuing to manifest. The debt service ratio rose to 14.9%, just shy of its prior peak in 2007 (Chart 1). Household borrowing ran ahead of incomes again in 2018Q4, sending the debt-to-income ratio to 178.5%. The asset side of the equation was similarly discouraging. Household wealth fell 2.8% quarter-on-quarter. The value of natural resources dropped due to soft oil prices, while late-2018 market volatility took down the value of financial assets. The good news is that recent developments in these categories have been positive. Oil prices are up markedly from their late-2018 doldrums, and the S&P/TSX index has had a roaring start to the year, up more than 12% year-to-date.

The other major driver of falling household wealth was real estate, and here the story is one of ongoing weakness. Canadian real estate markets are struggling to gain traction, with February’s resale report disappointing expectations. Sales fell 9.1% month-on-month, and both the average sale price and the quality-adjusted home price index were down. Some of this may be due to bad weather, but it still paints a less than encouraging picture to start the year.

These trends, and their knock-on effects on economic growth, are likely to continue and remain a key driver of TD Economics’ outlook. In our just-released Quarterly Economic Forecast, we see only a modest pace of consumer spending (Chart 2). The reasons are just what the recent data has shown: servicing debt is eating up a sizeable share of household incomes, weighing on consumer spending, notably in housing-related and durable goods.

The biggest change in our latest forecast is our Bank of Canada outlook, which sees no further interest rate increases. The rhetoric from Governor Poloz and company has shifted to reflect the reality of the recent soft patch, but still communicates a desire to move rates higher with time. This is not feasible over the foreseeable future. The key is the consumer: slower spending growth will constrain the pace of overall economic activity. This means little in the way of inflationary pressures and little reason to tighten monetary policy. Our forecast of growth at trend, near-target inflation and a low unemployment rate suggests the policy rate may already be at ‘neutral’. Thus, no further hikes are needed absent a significant upside surprise on growth. Given the economic headwinds at present, we aren’t holding our breath.

U.S.: Upcoming Key Economic Releases

U.S. FOMC Rate Decision

Date: March 20, 2019

Previous: 2.50%

TD Forecast: 2.50%

Consensus: 2.50%

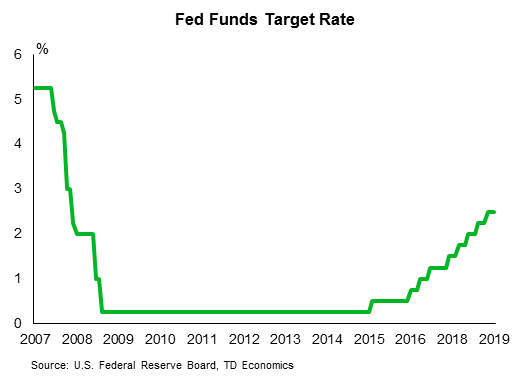

The March dot plot should suggest one more hike (to neutral) this year, and potentially no additional hikes in 2020 based on recent comments from several Fed officials. We also expect the median dots for 2020 and 2021 to no longer suggest hiking beyond a neutral range. We see this not as a consequence of a shift in the reaction function, but of the lower projected path for core inflation. More clarity about when runoff ends, and the size of the balance sheet at that time, should be forthcoming, if not in a separate statement then as part of Powell’s press conference. Look for a neutral market reaction, as outright rate cuts are priced for 2019.

Canada: Upcoming Key Economic Releases

Canadian CPI – February*

Release Date: March 22, 2019

Previous: 0.2% m/m, 1.4% y/y, Index: 133.6

TD Forecast: 0.7% m/m, 1.5% y/y, Index: 134.5

Consensus: N/A

We expect inflation to firm to 1.5% in February, reflecting a 0.7% increase in prices on the month. Gasoline prices lend a strong m/m boost, with solid gains in food prices as well. Elsewhere we expect most of the m/m gains to result from travel services and MIC. Airfares, the other source of oneoffs, look benign this month taking in account February seasonals and the near full correction last month. The previous jump in the rent index (+0.9% m/m) is unlikely to be repeated and is one source of downside risk. It is likely to be volatile going forward thanks to the methodology changes. Finally, core inflation is likely to be stable at 1.9% on average but risks remain skewed to the downside on the back of poor growth dynamics and weak wage growth. Looking ahead, the recent pickup in fuel prices along with the new CPI basket weights suggest a slightly higher trajectory for our forecast at 1.6% in Q1 vs 1.5%, though still below the BoC’s forecast of 1.7%.

Canadian Retail Sales – January*

Release Date: March 22, 2019

Previous: -0.1%, ex-auto: -0.5%

TD Forecast: 0.4%, ex-auto: 0.2%

Consensus: N/A

Stronger motor vehicle sales will help to drive a 0.4% rebound in January retail sales after broad weakness weighed on the sector into year-end. Motor vehicle sales will benefit from warm weather across most of the country alongside a pickup in consumer confidence; this should leave ex-auto sales to post a more modest 0.2% increase. Looking past motor vehicles the picture is mixed; robust labour market gains should help support consumer spending, but one month of positive home sales is unlikely to drive a rebound in demand for home furnishings given the broader trend, and a recent slowdown in residential construction will weigh on building material sales. Lower gasoline prices also present a headwind to nominal sales, although the positive impact on real incomes provides a silver lining from the cumulative 25% decline since October. Overall we expect real retail sales to come in at or slightly above the nominal print owing to a decline in seasonally adjusted goods prices during the month.