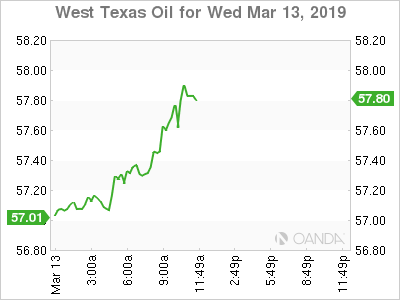

The EIA inventory report delivered its second decline in three weeks helping oil prices rise to the highest level in almost four months. The data confirms that the cutting of oil exports by the Saudis is making the US use up their inventories. The weekly EIA release showed a decline of 3.9 million barrels from the prior week, well below the median estimate of a build of 3.0 million barrels and exceeding the lowest estimate which called for a decline of 2.7 million barrels.

Oil prices may have cleared a key hurdle and while the risks to the downside remain, we could see bullish momentum accelerate here. Rising US production concerns remain but oil may not focus on that in the short-term as we may continue to see draws with inventories.

West Texas Intermediate crude tentatively broke above the $58.00 level and if the bullish breakout continues, price could target the psychological $60 handle. Major resistance will come from the 200-day SMA which currently trades at the $62.08 level.