The impact of dovish ECB quickly spread to the whole world. Following weakness in the US and Europe, Asian stocks tumble broadly today. Adding to the misery, China’s February trade data were shockingly terrible, recording -20.7% yoy contraction in exports. Weak export outlook adds to the case of “tough struggle” as described by Chinese Premier Li Keqiang earlier this week. Difficult export environment is a primary reason for lowering growth target to 6.0-6.5%, which lower bound is the slowest in three decades.

Stocks are additionally weighed down after Citic Securities surprisingly advised clients to sell shares of People’s Insurance Company of China saying it’s “significantly overvalued”. Some speculate that such a sell rating must be have greenlight from regulators. That is, the Chinese government could be seeing recent surge in stocks as overheating and prefer to cool it down into a slow bull market. China Shanghai SSE is currently down -4.19% as selloff as selloff accelerates. 3000 handle is lost.

In the currency markets, Yen is naturally the strongest one for today and the week. It boosted by both selloff in stocks as well as treasury yield. Acceleration is seen today entering into European session. Germany 10-year yield at 0.067 is now just 1/3 of this week’s high at 0.21. US 10-year yield also lost 2.7 handle. Swiss Franc follows as second strongest. Australian and Dollar are weakest ones.

For the week, after ECB’s all-round dovish turn, Euro is undoubtedly the weakest one. Canadian Dollar follows as second worst after BoC dropped tightening bias. Yen and Dollar are the strongest.

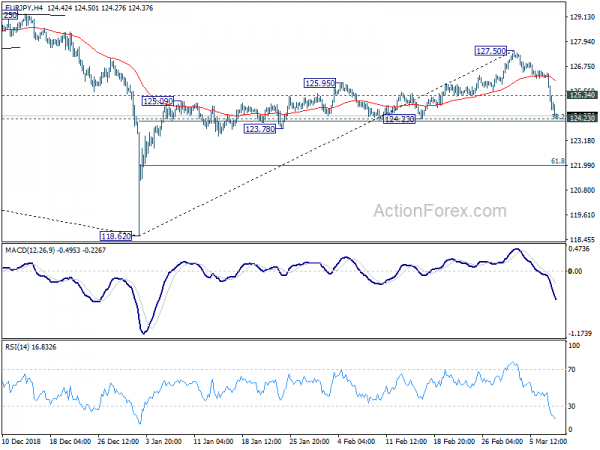

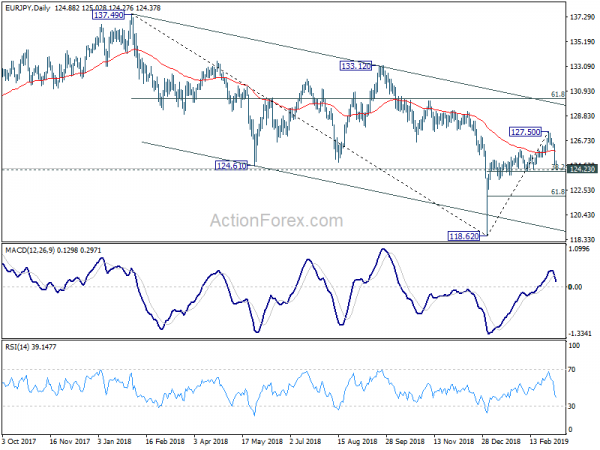

Technically, EUR/USD took out 1.1215 to resume down trend from 1.2555. Focus is now on 1.1186 fibonacci level. USD/JPY broke 1.0098 resistance and is set to test 1.0128 key resistance. The most important developments to watch are in Yen crosses. EUR/JPY is now close to 124.23 support and break will confirm completion of whole rebound from 118.62 and turn outlook bearish. Both USD/JPY and GBP/JPY break near term trend line support already. Focus will be on 110.35 in USD/JPY and 144.84 in GBP/JPY.

In Asia, Nikkei closed down 02.01%. Hong Kong HSI is down -1.61%. China Shanghai SSE is down -4.40%. Singapore Strait Times is down -0.86%. Japan 10-year JGB yield is down -0.0266 at 0.036. Overnight, DOW dropped -0.78%. S&P 500 dropped -0.81%. NASDAQ dropped 01.13%. 10-year yield dropped -0.056 to 2.636. 30-year yield dropped -0.046 to 3.025, still above 3.0 handle

Here are some suggested readings on ECB in case you missed what happened:

- ECB Announces new TLTROs, Markedly Downgrades Growth and Inflation Forecasts

- ECB: Sizeable moderation in growth, substantial downgrade in growth forecasts, risks still tilted to the downside.

- ECB: When Doves Fly

- ECB Review: A Postcard from Japan

- ECB Draghi’s Press Conference Comments

China trade surplus shrank to $4.1B in Feb, US imports tumbled -35% yoy ytd

China’s February trade balance data is rather terrible. Trade surplus shrank sharply to USD 4.1B, well below expectation of USD 27.2B. That’s primarily due to steep contraction in exports by -20.7% yoy, largest decline since February 2016. The data could be distorted by the timing of the New Year. But January and February combined, exports still dropped -4.6% yoy while imports dropped -3.1% yoy.

Looking at some January and February combined details, trade with the US continued to deteriorate drastically . Total trade with US dropped -19.9% yoy, exports dropped -14.1% yoy but imports dropped -35.1% yoy. Trade with EU wasn’t too bad, still recorded 3.7% yoy growth in total trade, 2.4% yoy rise in exports and 5.7% rise in imports. One interesting point to note is that imports from Brazil jumped 33.5% yoy while imports from Canada rose 34.9% yoy.

Japan Q4 GDP finalized at 0.5%, modest recovery with external risks

Japan Q4 GDP growth was finalized at 0.5% qoq, revised up from 0.3% qoq and beat expectation of 0.4%. GDP deflator was finalized at -0.3% yoy, unrevised. In January, overall household spending rose 2.0% yoy, beat expectation of -0.6% fall. Current account surplus widened to JPY 1.8T.

Japan Economy Minister Toshimitsu said Q4’s data showed modest recovery but weak external demand warranted attention. He sounded confident that steady recovery has been confirmed. However, the government is watching overseas risks including slowdown in China.

Vice Finance Minister for International Affairs Masatsugu Asakawa also sounded cautious regarding China. He noted that it’s “inevitable for Chinese economy to slow, with its potential growth lowering as a trend:. Though, he also noted that “it is unlikely to falter greatly as there’s room for authorities’ stimulus measures.”

EU Malmstrom urges US to do an industrial trade agreement to rebuild trust first

EU Trade Commissioner Cecilia Malmstrom said she had productive meetings with US Trade Representative Robert Lighthizer in Washington this week. She noted that both sides have agreed on a problem as “China is dumping the market, China is subsidizing their industry, this creates global distortions”.

However, there was obvious disagreement in the solution. Malmstrom complained that “the solution to these problems is not imposing tariffs on the European Union. Why is that so hard to understand?” And, she added “if you want an ally and partner, this is not the way to go about it.”

She emphasized that “we should work on common threats and common challenges and not impose tariffs on each other.” If US imposes auto tariffs to EU cars, Malmstrom pledged to, “with a very heavy heart”, retaliate against EUR 20b US imports.

On EU-US trade agreement, Malmstrom noted there is “no support” for a full comprehensive trade agreement in the EU right now. She reiterated EU’s stance that “if we start with industrial goods, which is much less complicated, and which will be beneficial from both sides, we maybe can rebuild that trust and then maybe we’ll see later” about agriculture”.

UK PM May to EU: It’s your interest that we leave with a deal

According to the pre-released extracts, UK Prime Minister Theresa May is expected to tell EU in a speech today that “it is in the European interest for the UK to leave with a deal”. And, “just as MPs will face a big choice next week, the EU has to make a choice, too.”

May is still seeking legally binding assurances from EU that the Irish backstop, if triggered, will be temporary. May will say “we are working with them but the decisions that the European Union makes over the next few days will have a big impact on the outcome of the vote.”

Without any fundamental change regarding Irish backstop, there is practically no chance for May to get her Brexit deal through the Parliament on March 12, next Tuesday. A vote on no-deal Brexit will then be held on March 13 to see if there is explicit consent on this path. If not, there will be another vote on Article 50 extension on March 14.

Looking ahead

Employment data from US and Canada will be the main focuses today. US will release non-farm payrolls, housing starts and building permits. Canada will release job data, housing starts and capacity utilization.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 126.15; (P) 126.41; (R1) 126.63; More….

EUR/JPY’s fall from 127.50 extends to as low as 124.27 so far today. Focus is now immediately on 124.23 cluster support 38.2% retracement of 118.62 to 127.50 at 124.10). Decisive break there should confirm completion of whole rebound from 118.61. Deeper fall should at least be seen to 61.8% retracement at 122.01. In this case, the chance of resuming larger down trend will also increase. On the upside, though, break of 125.34 minor resistance after defending 124.10/23 will retain near term bullishness. Intraday bias will be turned back to the upside for retesting 127.50 first.

In the bigger picture, current development argues that medium term decline from 137.49 (2018 high) has completed with three waves down to 118.62 already. Decisive break of 133.12 resistance will confirm this bullish case. And whole up trend from 109.03 (2016 low) might resume through 137.49 in that case. On the downside, break of 124.23 support will invalidate this case. And in such case, the down trend from 137.49 could possibly resume through 118.62.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q/Q Q4 | -0.50% | 2.00% | 1.80% | |

| 23:30 | JPY | Overall Household Spending Y/Y Jan | 2.00% | -0.60% | 0.10% | |

| 23:50 | JPY | GDP Q/Q Q4 F | 0.50% | 0.40% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | -0.30% | -0.30% | -0.30% | |

| 23:50 | JPY | Current Account Total (JPY) Jan P | 1.8.T | 1.38T | 1.56T | 1.63T |

| 0:00 | CNY | Trade Balance (USD) Feb | 4.12B | 27.15B | 39.16B | |

| 0:00 | CNY | Trade Balance (CNY) Feb | 34.4B | 122.0B | 271.2B | |

| 7:00 | EUR | German Factory Orders M/M Jan | 0.50% | -1.60% | ||

| 13:15 | CAD | Housing Starts Feb | 203K | 208K | ||

| 13:30 | CAD | Net Change in Employment Feb | -2.5K | 66.8K | ||

| 13:30 | CAD | Unemployment Rate Feb | 5.80% | 5.80% | ||

| 13:30 | CAD | Capacity Utilization Rate Q4 | 82.10% | 82.60% | ||

| 13:30 | USD | Change in Non-farm Payrolls Feb | 185K | 304K | ||

| 13:30 | USD | Unemployment Rate Feb | 3.90% | 4.00% | ||

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.30% | 0.10% | ||

| 13:30 | USD | Building Permits Jan | 1.29M | 1.33M | ||

| 13:30 | USD | Housing Starts Jan | 1.18M | 1.08M |