Tuesday March 5: Five things the markets are talking about

Global equities were mixed overnight as investors digested Chinese tax cuts and lower growth forecasts while awaiting for details on a possible China-U.S trade deal.

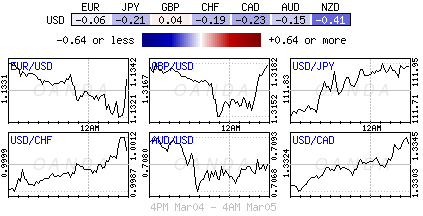

U.S Treasuries are steady while the ‘big’ dollar edges a tad higher for a fifth consecutive session.

At China’s National People’s Congress, authorities lowered its 2019 economic growth target to a range of +6.0-6.5% amid rising concerns over a downturn in the world’s second largest economy and will aim for consumer inflation of +3% this year and a fiscal deficit of +2.8%.

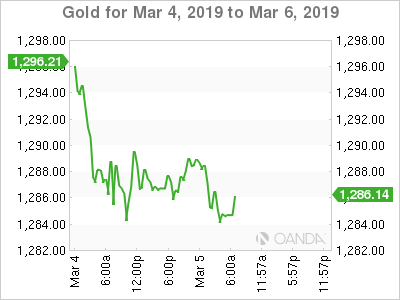

In commodities, gold has slid for a seventh consecutive session, its longest slump in two-years, while crude oil prices creeped a tad lower.

In FX, the AUD (A$0.7083) temporarily fell to a three-week low after the Reserve Bank of Australia (RBA) left its benchmark interest rate unchanged overnight as expected.

On tap: RBA Governor Lowe will give a speech on the Aussie housing market Wednesday, while BoC is expected to keep rates on hold due to uncertainty on housing and investment, while sticking to Governor Poloz message that borrowing costs eventually need to head higher. On Thursday, the ECB is expected to leave rates unchanged amid a deteriorating outlook.

1. Stocks mixed results

In Japan, the Nikkei eased from its three-month peak as chip, machinery firms slide and after China cut its economic growth target, hurting companies with large exposures to the world’s second largest economy. The index ended -0.4% lower, while the broader Topix dropped -0.5%.

Down-under, Aussie shares ended lower overnight, but trimmed deeper losses, after the RBA signalled a steady policy outlook and China said it would introduce further measures to aid its ‘cooling’ economy. The S&P/ASX 200 index finished down -0.3% after rallying +0.4% on Monday. In S. Korea, the Kospi stock index (-0.5%) fell for a third consecutive session as China cut in growth target. There is also investor uncertainty over the Sino-U.S trade deal.

In China, stocks rallied overnight after Beijing unveiled plans to cut taxes and increase public expenditure and lending to support a slowing economy. At the close, the Shanghai Composite index was up +0.9%, while the blue-chip CSI300 index rose +0.6%.

However, in Hong Kong, the equity market was little changed. At the close of trade, the Hang Seng index was flat, while the Hang Seng China Enterprises index rose less than +0.1%.

In Europe, regional bourses trade mostly higher across the board following a mixed session in Asia and higher U.S futures. More positive European Services PMI (Beats: Eurozone, Germany, France, Spain & Italy) has offset weaker China Caixin Services PMI which hit a four-month low.

U.S stocks are set to open higher (+0.23%).

Indices: Stoxx600 +0.16% at 375.68, FTSE +0.36% at 7,159.91, DAX +0.23% at 11,618.92, CAC-40 +0.17% at 5,295.79, IBEX-35 +0.25% at 9,283.00, FTSE MIB +0.28% at 20,775.50, SMI +0.14% at 9,402.50, S&P 500 Futures +0.23%

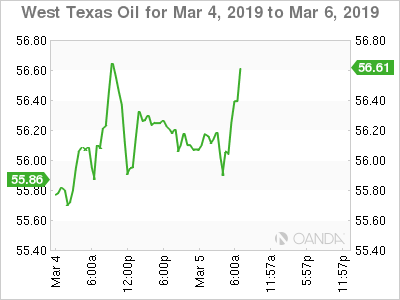

2. Oil falls as Libya’s largest field restarts, gold lower

Oil prices are lower, pressured by the restart of Libya’s biggest oilfield and on expectations for an increase in U.S crude stocks.

Brent crude has fallen -62c to +$65.05 a barrel, while U.S West Texas Intermediate crude has slipped -44c to +$56.15.

An increase in production will always worry crude oil ‘bulls.’ At Libya’s El Sharara oilfield, a number of wells have restarted, and the aim is to reach initial output of +80K bpd. The field had been closed since December.

Oil is also trading under pressure on market expectations that the latest round of U.S inventory reports this week will show rising crude stockpiles. A number of analysts expect crude stocks rose +400K barrels in the week to March 1.

Note: API data is due out today at 04:30 pm ET, while the U.S government’s official figures (EIA) is due on Wednesday (10:30 am ET).

Stateside, there are signs that the oil production boom, which has seen crude output rise by more than +2M bpd since early 2018 to more than +12M bpd, may slow down. U.S energy firms last week cut the number of oil rigs looking for new reserves to the lowest in almost nine months. Some producers are looking to cut back on spending.

Ahead of the U.S open, gold prices are steady, trading atop of a five-week low touched Monday, as a firmer U.S dollar and optimism over a likely U.S-China trade deal dented safe-haven appeal of the ‘yellow’ metal. Spot gold is down -0.1% to +$1,285.51 per ounce, after slipping to +$1,282.50 in the previous session. U.S gold futures are flat at +$1,287.50 per ounce.

3. RBA did what was expected

The Reserve Bank of Australia (RBA) left its Cash Rate Target unchanged at +1.50% (as expected). There were no notable changes in language from Governor Lowe and maintained its GDP and inflation outlooks. He reiterated the view that “low level of interest rates was continuing to support the domestic economy” and that that “inflation remained low and stable.”

Governor Lowe will speak tomorrow, just prior to the Q4 GDP release, on the biggest economic issue in the country–the impact of a weak housing market on Australia as a whole. Lowe is likely to point to the danger of “falling confidence” and “the probability of interest-rate cuts if ongoing home-price declines become disorderly.

Elsewhere, the yield on U.S 10-year Treasuries have backed up +1 bp to +2.73%. In Germany, the 10-year Bund yield has increased +1 bps to +0.17%, while in the U.K, the 10-year Gilt yield has gained +1 bps to +1.283%.

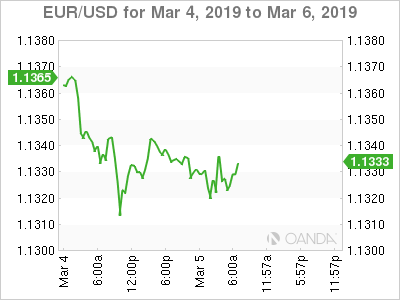

4. Dollar in demand

A rise in eurozone retail sales is failing to lift a falling EUR (€1.1326). Data this morning shows January retail sales rose +1.3% compared with a fall of -1.4% in December, in line with consensus.

This morning’s data is unlikely to change the tone of this week’s ECB meeting on Thursday. The ECB is expected to sound “cautious” and moreover, the USD remains strong and Friday’s NFP release is expected to confirm investors’ reasons to stay ‘long’ U.S dollar.

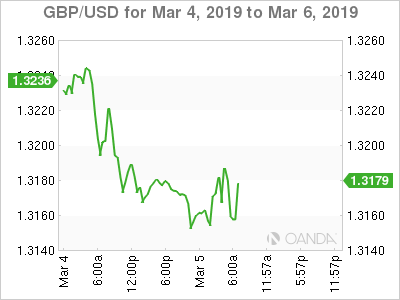

GBP/USD is steady atop of £1.3150-60 area. Brexit Secretary Barclay and Attorney General Cox are meeting with EU officials today in efforts to secure a legally binding change to the Irish backstop – however, no one is expecting anything to be accomplished today. Market expectations are leaning towards the Brexit deadline (Mar 29) to be “extended” or that PM May’s deal would be passed by parliament.

Note: An extension to Article 50 would lower the possibility of a “no-deal” Brexit but it would also prolong Brexit-related uncertainties.

USD/CHF ($1.0005) is a tad higher, up +0.2% and back above parity as inflation was still largely absent in Switzerland with Feb y/y reading at +0.6%. Swiss National Bank (SNB) is in “no hurry” to exit its negative rate policy.

5. Rise in U.K Services PMI lifts the pound

The pound (£1.3193) has rallied briefly after this morning’s purchasing managers’ survey on U.K. services sector activity unexpectedly rose to 51.3 in February from 50.1 in January. Market expectations were expecting a fall to 49.

According to HIS Markit, last month there was a “modest” upturn in output, however, new work fell slightly and staffing levels dropped to “greatest extent for over seven years.”

Brexit-related uncertainty “remained by far the most prominent factor acting as a brake on business activity growth in February,” it said, “even in the case of Prime Minister Theresa May’s deal going through.”

Other data showed consumers reined in their spending in February and shoppers focused on buying food, including for stockpiling, rather than non-essential items.