The financial markets are back in full risk on mode today. China Shanghai SSE jumped 1.8% to 2994.01, just missed 3000 handle. Optimism of bottoming in the slowdown is a factor as Caixin PMI manufacturing rebounded to 49.9, just missed 50. More importantly, MSCI said that it will quadruple the weighting of China-listed shares in its benchmark indexes. Billions of dollars are expected to flow into the market this year. Additionally, German retail sales jumped more than expected while subdued Eurozone inflation could keep ECB on hold for longer.

Yen is trading as the weakest one for today naturally. Additionally, the Japanese currency is pressured by surging global treasury yield. German 10 year yield is now at 0.203 comparing to 0.096 a week ago. US 10-year yield broke 2.7 handle yesterday and is set to extend the rally. Mixed US personal income and spending data is not derailing the upward trajectory. At the time of writing, Kiwi and Aussie are the strongest one. Canadian is the second weakest as oil price retreat and Canadian GDP contracted unexpectedly.

In European markets, FTSE is up 0.49%. DAX is up 1.17%. CAC is up 0.56%. German 10-year yield is up 0.173 at 0.203. Earlier in Asia, Nikkei rose 1.02%. Hong Kong HSI rose 0.63%. China Shanghai SSE rose 1.80% to 2994.01, just missed 3000. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield rose 0.0164 to -0.009, still negative.

US PCE inflation remains muted, income surged while spending dived

US personal income rose 1.0% in December, beat expectation of 0.3%. That’s the biggest rise since 2012. Personal spending dropped -0.5%, missed expectation of 0.1%. The decline in spending was the steepest since 2009. Inflation data are muted. Headline PCE slowed to 1.7% yoy, down from 1.8% yoy. PCE core was unchanged at 1.9% yoy.

From Canada, GDP dropped -0.1% mom in December, below expectation of 0.0% mom.

Eurozone PMI manufacturing: Deepest downturn for almost six years

Eurozone PMI manufacturing is finalized at 49.3 in February, up from initial estimate of 49.2, but down from January’s 50.5. That’s also the first contraction reading since June 2013. Markit noted there were concurrent declines in output and new orders. Also, price pressures continued to soften. Among the countries, Germany PMI manufacturing was finalized at 74-month low at 47.6, Italy at 69-month low at 57.5, Spain at 63-month low at 49.9. Though, France recovered to 3-month high at 51.5.

Chris Williamson, Chief Business Economist at IHS Markit said “Euro area manufacturing is in its deepest downturn for almost six years, with forward-looking indicators suggesting risks are tilted further to the downside as we move into spring.” And, “the downturn is being led by Germany and Italy, but Spain has also now fallen into contraction and only modest expansions are being seen in France, Austria and the Netherlands.” Also, “in addition to widespread trade war worries, often linked to US tariffs, and concerns regarding the outlook for the global economy, companies report that heightened political uncertainty, including Brexit, is hitting demand and driving increased risk aversion.”

Eurozone core CPI slowed to 1.0%, unemployment rate dropped to 7.8%

Eurozone CPI accelerated back to 1.5% in February, up from 1.4% yoy, matched expectations. CPI core, however, slowed to 1.0% yoy, missed expectation of 1.1% yoy. Unemployment rate was unchanged at 7.8%, beat expectation of 7.9%. That’s the lowest level since October 2008. For EU 28, unemployment also dropped to 6.5%, down from 6.6%, lowest since record started in January 2000.

Also released, Germany retail sales rose 3.3% mom in January, above expectation of 1.9% yoy. Unemployment dropped -21k in February while unemployment rate was unchanged at 5.0%. From Swiss, retail sales dropped -0.4% yoy in January versus expectation of 0.4% yoy. Swiss PMI manufacturing rose to 55.4, up from 54.3 and beat expectation of 55.4.

UK PMI manufacturing dropped to 52, UK economy faces a difficult 2019

UK PMI manufacturing dropped to 52.0 in February, down from 52.6 and matched expectation. Markit noted that stocks on inputs and finished goods rose sharpy. However, rate of job losses was at six-year high as optimism hits series low.

Rob Dobson, Director at IHS Markit said that “the current elevated degree of uncertainty is also having knock-on effects for business confidence and employment, with optimism at its lowest ebb in the survey’s history and the rate of job losses accelerating to a six-year high.” And, “apart from the uncertain outlook, manufacturers also face a darkening backdrop of a domestic market slowdown and weakening inflows of new export business, as global growth decelerates and trade tensions bite. Manufacturing and the broader UK economy therefore face a difficult 2019, with the slowdown being exacerbated later in the year as inventory positions are unwound and Brexit-related headwinds likely to linger.”

Also from UK, mortgage approvals rose to 67k in January. M4 money supply rose 0.2% mom in January.

Japan PMI manufacturing finalized at 48.9, sharper reductions in output and demand

Japan PMI manufacturing was finalized at 48.9 in February, revised up from 48.5. It’s the first contractionary reading since August 2016. Demand conditions in Japan deteriorated at stronger rate while business outlook was broadly neutral having fallen for the ninth straight month.

Joe Hayes, Economist at IHS Markit noted that “Sharper reductions in output and demand drove the Japanese manufacturing economy into contraction during the midway point of Q1, compounding reductions already recorded in January. Global trade frictions and weak domestic manufacturing demand pose considerable risks to Japan’s goods producers. As such, firms pared back expectations to near-neutrality. The rebound seen in the official Q4 GDP estimate does not appear to be reflective of underlying economic conditions in Japan.

“With the consumption tax hike set to come into play later this year, weak domestic demand will only heighten fears that the economy could be poised for a downturn. Focus turns towards service sector data, which will need to show signs of resilience in order to offset the manufacturing drag.”

Also from Japan, unemployment rate rose 0.1% to 2.5% in January, versus expectation of 2.4%. Tokyo CPI core was unchanged at 1.1% yoy in February, versus expectation of 1.0% yoy. Capital spending rose 5.7% in Q4 versus expectation of 4.5%. Consumer confidence dropped -0.4 to 41.5 in February, slightly missed expectation of 41.6.

China Caixin PMI manufacturing rose to 49.9, easing of the economic downturn

China Caixin PMI manufacturing rose to 49.9 in February, up from 48.3 and beat expectation of 48.7. The key points are “renewed rise in output as total new business picks up, “backlogs continue to rise, but employment trend remains subdued”, and “selling prices increase for first time in four months”.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said “Overall, with the early issuances of local governments’ special-purpose bonds and targeted adjustments to monetary policy, the situation in the manufacturing sector recovered markedly in February due to the effect of increased infrastructure investment. Prices of industrial products also picked up due to improving demand and the rebound in international commodity prices. However, the pressure on manufacturers’ capital turnover became obvious again, which may reflect that the financing environment was not easing as expected, and the effect of credit expansion is not yet significant.”

Suggested reading on China: China’s February PMI Sent Mixed Message. Update on PBOC’s New Tool…

Australia manufacturing PMI rose to 54, but conditions appear to be diverging

Australia AiG Performance of Manufacturing Index rose 1.5 to 54.0 in February. That’s the best monthly result since October 2018 and signals a better month of recovery following and “unreasonably slow summer”. While it’s still the 30th month of expansion, the trend has suggested “slowing growth rates since its recent peak in March 2018”.

Also, AiG noted that “conditions appear to be diverging” across the larger manufacturing sectors and their main locations. Three of the six sectors expanded, one was stable and two contracted. And, “the downturn in housing construction is already affecting some sectors, as is the uncertainty of impending elections”.

New Zealand terms of trade dropped -3%, largest fall since 2015

New Zealand terms of trade index dropped -3.0% qoq in Q4, much worse than expectation of -1.0% qoq. It’s also the largest decline since September 2015 quarter. Also ,falling global prices for milk powder and butter meant overall export prices dropped -1.7%. However, Stats NZ noted that “despite the latest fall, the terms of trade remained near the historic high in the December 2017 quarter.” Also from New Zealand, building permits rose 16.5% mom in January.

USD/JPY Mid-Day Outlook

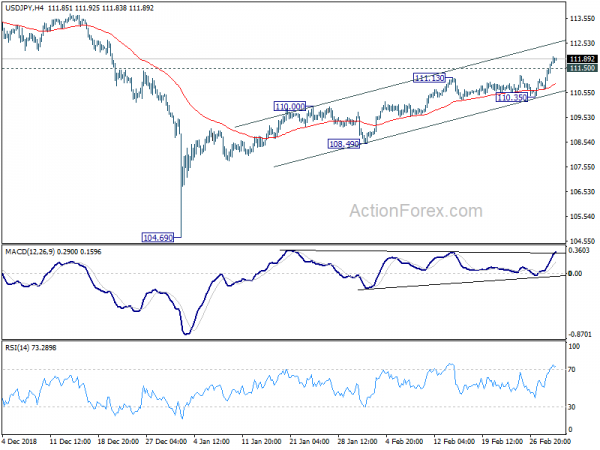

Daily Pivots: (S1) 110.87; (P) 111.18; (R1) 111.70; More…

USD/JPY accelerates further to as high as 111.98 so far today and intraday bias stays on the upside. Current rally from 104.69 should now target 114.54 resistance next. On the downside, below 111.50 minor support will turn intraday bias neutral and bring consolidations. But downside should be contained above 110.35 support to bring another rally.

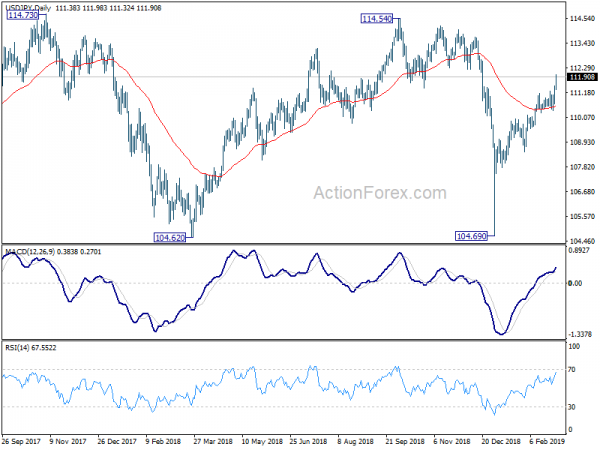

In the bigger picture, current strong rebound from 104.69 argues that decline from 118.65 (2016 high) has completed with three waves down to 104.69, after failing 104.62. More importantly, the rise from 98.97 (2016 low) could be resuming. Focus now turns back to 114.54 resistance, decisive break there will add more credence to this bullish case and target 118.65. This will now be the favored case as long as 55 day EMA (now at 110.59) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Feb | 54 | 52.5 | ||

| 21:45 | NZD | Building Permits M/M Jan | 16.50% | 5.10% | 5.40% | |

| 21:45 | NZD | Terms of Trade Index Q/Q Q4 | -3.00% | -1.00% | -0.30% | -0.10% |

| 23:30 | JPY | Jobless Rate Jan | 2.50% | 2.40% | 2.40% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Feb | 1.10% | 1.00% | 1.10% | |

| 23:50 | JPY | Capital Spending Q4 | 5.70% | 4.50% | 4.50% | |

| 00:30 | JPY | PMI Manufacturing Feb F | 48.9 | 48.5 | 48.5 | |

| 01:45 | CNY | Caixin PMI Manufacturing Feb | 49.9 | 48.7 | 48.3 | |

| 05:00 | JPY | Consumer Confidence Feb | 41.5 | 41.6 | 41.9 | |

| 07:00 | EUR | German Retail Sales M/M Jan | 3.30% | 1.90% | -4.30% | |

| 07:30 | CHF | Retail Sales Real Y/Y Jan | -0.40% | 0.40% | -0.30% | -0.20% |

| 08:30 | CHF | PMI Manufacturing Feb | 55.4 | 53.6 | 54.3 | |

| 08:45 | EUR | Italy Manufacturing PMI Feb | 47.7 | 47 | 47.8 | |

| 08:50 | EUR | France Manufacturing PMI Feb F | 51.5 | 51.4 | 51.4 | |

| 08:55 | EUR | Germany Manufacturing PMI Feb F | 47.6 | 47.6 | 47.6 | |

| 08:55 | EUR | German Unemployment Change Feb | -21K | -5K | -2K | |

| 08:55 | EUR | German Unemployment Claims Rate Feb | 5.00% | 5.00% | 5.00% | |

| 09:00 | EUR | Eurozone Manufacturing PMI Feb F | 49.3 | 49.2 | 49.2 | |

| 09:30 | GBP | Mortgage Approvals Jan | 67K | 63K | 64K | |

| 09:30 | GBP | Money Supply M4 M/M Jan | 0.20% | 0.30% | 0.40% | |

| 09:30 | GBP | PMI Manufacturing Feb | 52 | 52 | 52.8 | |

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 7.80% | 7.90% | 7.90% | 7.80% |

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Feb | 1.50% | 1.50% | 1.40% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb A | 1.00% | 1.10% | 1.10% | |

| 13:30 | CAD | GDP M/M Dec | -0.10% | 0.00% | -0.10% | |

| 13:30 | USD | Personal Income Dec | 1.00% | 0.30% | 0.20% | |

| 13:30 | USD | Personal Spending Dec | -0.50% | 0.10% | 0.40% | 0.60% |

| 13:30 | USD | PCE Deflator M/M Dec | 0.10% | 0.00% | 0.10% | 0.00% |

| 13:30 | USD | PCE Deflator Y/Y Dec | 1.70% | 1.70% | 1.80% | |

| 13:30 | USD | PCE Core M/M Dec | 0.20% | 0.20% | 0.10% | 0.20% |

| 13:30 | USD | PCE Core Y/Y Dec | 1.90% | 1.90% | 1.90% | |

| 14:30 | CAD | Manufacturing PMI Feb | 53 | |||

| 14:45 | USD | Manufacturing PMI Feb F | 53.7 | 53.7 | ||

| 15:00 | USD | ISM Manufacturing Feb | 56 | 56.6 | ||

| 15:00 | USD | ISM Prices Paid Feb | 52 | 49.6 | ||

| 15:00 | USD | ISM Employment Feb | 55.5 | |||

| 15:00 | USD | U. of Mich. Sentiment Feb F | 95.8 | 95.5 |