Dollar regains some ground in early US session after stronger than expected Q4 GDP report. But at the time of writing, it’s still trailing behind Euro and Swiss Franc. The common currency is boosted up by strong rally in German 10-year yield, which is up 0.028 at 0.178. Swiss Franc, on the other hand, strengthens after Trump-Kim summit in Vietnam collapsed without an agreement, not even a joint statement. Meanwhile, commodity currencies, including Canadian, Australian and New Zealand Dollar are the weakest.

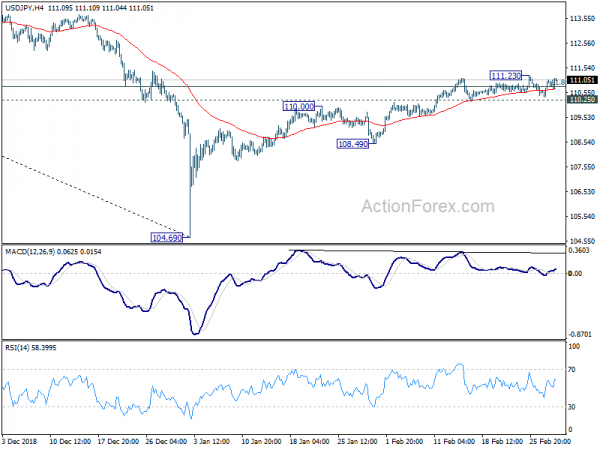

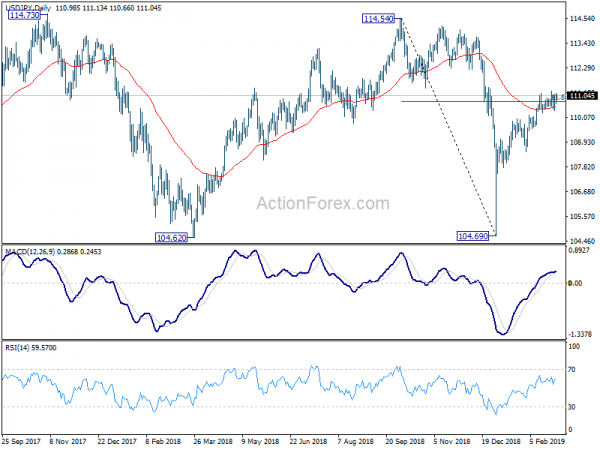

The immediate focus will now be on whether US treasury yield will follow German yield and extends yesterday’s strong rally. In particular, US 10 year yield might set to take on 2.7 handle again, and a firm break there could push Dollar further higher, and even reverse against Euro. Technically, 111.23 resistance in USD/JPY is now an immediate focus. Firm break there will indicate medium term strength for 114.54 key resistance. EUR/JPY has already taken out 126.30 rather decisively. It’s now likely heading to 129.25 resistance next.

In Europe, at the time of writing, FTSE is down -0.46%. DAX is down -0.08%. CAC is up 0.03%. German 10-year yield is up 0.028 at 0.178. Earlier in Asia:, Nikkei dropped -0.79%. Hong Kong HSI dropped -0.43%. China Shanghai SSE dropped -0.44%. Singapore Strait Times dropped -1.15%. Japan 10-year JGB yield dropped -0.0021 to -0.027.

US GDP grew 2.6% annualized in Q4, initial jobless claims rose to 225k

US GDP growth slowed to 2.6% annualized in Q4, down from 3.4% but beat expectation of 2.5%. GDP price index rose 1.8%, beat expectation of 1.7%. The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, private inventory investment, and federal government spending. Those were partly offset by negative contributions from residential fixed investment, and state and local government spending.

Initial jobless claims rose 8k to 225k in the week ending February 23. Four-week moving average of initial claims dropped -7k to 229k. Continuing claims rose 79k to 1.805M in the week ended February 16. Four-week moving average of continuing claims rose 6.75k to 1.762M.

From Canada, current account deficit widened to CAD -15.48B in Q4. IPPI dropped -0.3% mom in January while RMPI rose 3.8% mom.

Trump-Kim summit collapsed, it’s all about the sanctions

Trump in a press conference that he walked away from the summit with North Korean leader Kim Jong-un. But he emphasized that “it was a friendly walk”. The meeting in Vietnam was cut short and ended without an agreement and not even a joint statement.

Trump said “it was all about the sanctions”. He added “basically they wanted the sanctions lifted in their entirety, and we couldn’t do that”. On the other hand, Trump said Kim offered to dismantle North Korea’s main nuclear facility at Yongbyon, but “it wasn’t enough” to the US.

Trump also added that he could’ve signed an agreement today but it wasn’t the right time. He emphasized he’d “rather do it right”.

French GDP grew 0.3% in Q4, positive contribution from foreign trade

French GDP grew 0.3% qoq in Q4, matched expectations. Over the year, growth slowed to 1.5% in 2018, down from 2.3% in 2017. Looking at the details, final domestic demand excluding inventory changes decelerated: it contributed 0.2 points to GDP growth, after 0.5 points in the previous quarter. Foreign trade balance contributed positively to GDP growth again: +0.3 points, after +0.2 points in Q3. Conversely, changes in inventories contributed negatively to GDP growth again (−0.2 points after −0.4 points).

From Germany, import price index dropped -0.2% mom in January versus expectation of 0.2% mom. CPI accelerated to 1.6% yoy in February, up from 1.4% yoy and beat expectation of 1.5% yoy.

Swiss GDP grew 0.2% qoq, confirmed slowdown

Swiss GDP grew 0.2% qoq in Q4, rebounded from Q3’s -0.3% qoq contraction, but missed expectation of 0.4% qoq. SECO noted that “as in other European countries, this confirms a slowdown of the economy compared to the first half of the year.”

Looking at the details, manufacturing grew 1.5%, benefited from the strong international demand for Swiss products: exports of goods**(+5.6%) grew substantially. Development in the service industry varied and remained below the historical average, curbed by declining exports of services (−2.6 %) and a final domestic demand which remains sluggish (−0.0%). Consumption expenditures of private households (+0.3%) saw a moderate rise.

Swiss KOF dropped to 92.4, deteriorating sentiment extended from manufacturing to others

KOF economic Barometer dropped to 92.4 in February, down from 96.2 and missed expectation of 96.0. KOF noted that recent downward tendency ” continued unabated”, and the Swiss economy can expect to experience a “weak phase” in the coming months. And, the marked decline is predominantly due to negative impulses from the manufacturing industry; but the deteriorating sentiment has meanwhile also extended to the other components of this barometer.

BoJ Suzuki: Absolutely no need to ramp up monetary easing

BoJ board member Hitoshi Suzuki said today that there is “absolutely no need” to ramp up monetary easing. He added, “if the momentum for hitting the price target is lost, the BOJ will consider taking appropriate action. But many board members, including myself, believe the momentum is sustained.”

Nevertheless, Suzuki noted it’s the current massive stimulus program is still needed. He said “there’s a risk inflation won’t accelerate much for a prolonged period, as companies remain cautious of raising wages and households are sensitive to price rises.

Released from Japan, industrial production dropped -3.7% mom in January versus expectation of -2.5% yoy. Retail sales rose 0.6% yoy in January, below expectation of 1.5% yoy. Housing starts rose 1.1% yoy in January. versus expectation of 10.3% yoy.

China PMI manufacturing dropped to 49.2, new export orders hit decade low

The official China PMI manufacturing dropped to 49.2 in February, down from 49.5 and missed expectation of 49.5. That’s the third straight month of sub-50 reading. Looking at the details new export orders index dropped -1.7 to 45.2, its lowest level in 10 years, suggesting trade war with the US continues to have an impact on exports. Production dropped -1.4 to 49.5. Employment dropped -0.3 to 47.5. PMI services dropped to 54.3, down from 54.7, missed expectation of 54.5.

However, analyst Zhang Liqun tried to talk down the deterioration in the statement. He noted that the decline in PMI was mainly due to Lunar New Year factor. He pointed to the significant decline in the production, the purchase volume, and the raw material inventory as indications.

ANZ business confidence dropped to -30.9, RBNZ to cut in November

New Zealand ANZ Business Confidence dropped to -30.9 in February, down from -24.1. Activity Outlook dropped to 10.5, down fro 13.6. ANZ noted that recent improvement in business activity stalled. Export intentions fell to the weakest since March 2009. Pricing intentions remain range-bound.

ANZ also noted that “Clearly the economy is stretched at the moment, but it does appear that momentum has waned markedly over the last six months.” And it expects RBNZ to become “less certain that core inflation will continue rising towards the midpoint of the target band”. ANZ forecasts a cut in OCR in November.

Also from down under, Australia private capital expenditure rose 2.0% in Q4 versus expectation of 1.0%. Private sector credit rose 0.2% mom in January versus expectation of 0.3% mom.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 110.53; (P) 110.81; (R1) 111.26; More…

USD/JPY rebounds notably in early US session but it’s staying in range of 110.25/111.23, intraday bias remains neutral first. On the upside, decisive break of 111.23 will firstly confirm resumption of whole rebound from 104.69. Secondly, that will indicate strong support from 55 day EMA, and likely firm break of 61.8% retracement of 114.54 to 104.69 at 110.77 too. In that case, further rise should be seen back to 114.54 key resistance next. On the downside, though, break of 110.25 minor support will suggest rejection by 110.77. And in that case, the rebound from 104.69 has likely completed. Intraday bias will be turned back to the downside for 108.49 support for confirmation.

In the bigger picture, while the rebound from 104.69 was stronger than expected, it’s struggle to get rid of 55 day EMA completely. Outlook is turned mixed first. On the downside, break of 108.49 support will revive that case that such rebound was a correction. And, larger down trend is still in progress for another low below 104.62. But sustained trading above 55 day EMA will turn focus to 114.54. Decisive break there will confirmation completion of the decline from 118.65 (2016 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jan P | -3.70% | -2.50% | -0.10% | |

| 23:50 | JPY | Retail Trade Y/Y Jan | 0.60% | 1.50% | 1.30% | |

| 00:00 | NZD | ANZ Business Confidence Feb | -30.9 | -24.1 | ||

| 00:01 | GBP | GfK Consumer Confidence Feb | -13 | -15 | -14 | |

| 00:30 | AUD | Private Capital Expenditure Q4 | 2.00% | 1.00% | -0.50% | 0.00% |

| 00:30 | AUD | Private Sector Credit M/M Jan | 0.20% | 0.30% | 0.20% | |

| 01:00 | CNY | Manufacturing PMI Feb | 49.2 | 49.5 | 49.5 | |

| 01:00 | CNY | Non-manufacturing PMI Feb | 54.3 | 54.5 | 54.7 | |

| 05:00 | JPY | Housing Starts Y/Y Jan | 1.10% | 10.30% | 2.10% | |

| 06:45 | CHF | GDP Q/Q Q4 | 0.20% | 0.40% | -0.20% | -0.30% |

| 07:00 | EUR | German Import Price Index M/M Jan | -0.20% | 0.20% | -1.30% | |

| 07:45 | EUR | French GDP Q/Q Q4 P | 0.30% | 0.30% | 0.30% | |

| 08:00 | CHF | KOF Leading Indicator Feb | 92.4 | 96 | 95 | 96.2 |

| 13:00 | EUR | German CPI M/M Feb P | 0.50% | 0.50% | -0.80% | |

| 13:00 | EUR | German CPI Y/Y Feb P | 1.60% | 1.50% | 1.40% | |

| 13:30 | CAD | Current Account Balance Q4 | -15.48B | -$14.01b | -$10.34b | -10.11B |

| 13:30 | CAD | Industrial Product Price M/M Jan | -0.30% | 0.30% | -0.70% | -0.80% |

| 13:30 | CAD | Raw Materials Price Index M/M Jan | 3.80% | 4.10% | 3.80% | |

| 13:30 | USD | Initial Jobless Claims (FEB 23) | 225K | 221K | 216K | 217K |

| 13:30 | USD | GDP Annualized Q/Q Q4 A | 2.60% | 2.50% | 3.40% | |

| 13:30 | USD | GDP Price Index Q4 A | 1.80% | 1.70% | 1.80% | |

| 14:45 | USD | Chicago PMI Feb | 57.8 | 56.7 | ||

| 15:30 | USD | Natural Gas Storage | -172B | -177B |