Although upbeat trade comments by the US President helped the risk-sensitive aussie to grab some buying interest earlier this week, investors maintained some of their wait-and-see attitude as the spotlight shifts back to the calendar and Australia’s capital expenditures reading on Thursday, which could give clues on what to expect from next week’s Q4 GDP growth figures.

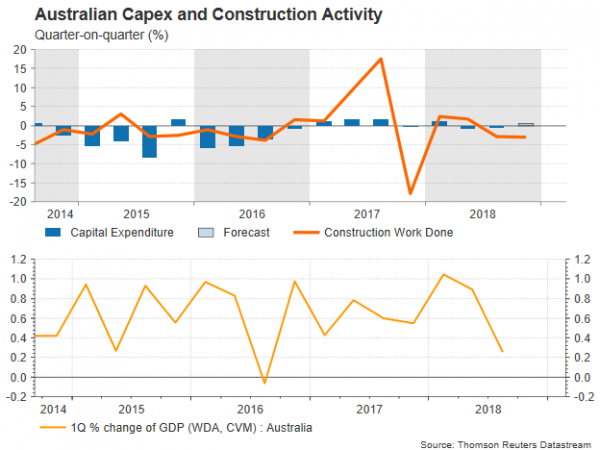

On Thursday at 0030 GMT, the Australian Bureau of Statistics is forecast to show that capital expenditures made by private businesses rose by 0.5% in the three months to December after a decline of an identical magnitude in the third quarter. The data are also following a bigger pullback of 0.9% in the second quarter.

Unlike the highs in early 2018, business conditions deteriorated substantially throughout the year according to the National Australia Bank’s business surveys, with the biggest loss coming in December when the relative index appeared the weakest in four years. The massive Australian household debt-to-disposable income which is twice as high as in the US and surpasses the levels in Canada has led to tighter lending terms and eventually to cooler house prices, discouraging new spending on investments. Consumption was not much helpful to companies either, as wage increases were insufficient to meet the high credit liabilities, leaving little room for other purchases.

Concerns over a struggling business sector returned on Tuesday after the total value of construction completed in the fourth quarter contracted sharply for the second consecutive time, missing significantly projections of a 0.4% increase. The results are now raising speculation that Thursday’s overall capital expenditures (CAPEX) might disappoint as well, potentially subtracting from GDP growth figures for the December quarter next week as infrastructure has been essential for Australia’s economic expansion for many years. Still, the elevated Iron ore and coal prices, which Australia exports the most, accompanied with a falling exchange rate and a greater trade surplus have likely offset some downside from the falling housing prices and subdued consumption at the end of 2018.

But this is not the end of the story as there are other factors aside that firms need to consider for the new year. The trade conflict between the US and China, that have already started to weigh on the Chinese economy, is a key risk for Australian growth as China is a major buyer of aussie products. Hence any further economic deterioration in China would likely spill over to Australia as well. Diplomatic relations with Beijing, will be separately monitored too, given recent reports that a major Chinese port had banned imports of Australian coal even if officials claimed later that the measures were not aimed at the country. Recall that Australia blocked Huawei Technologies from rolling into its 5G networks earlier this month.

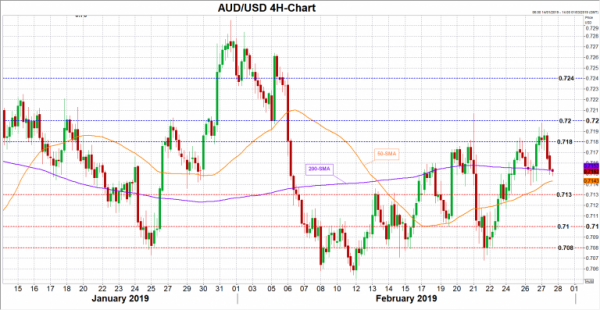

On the monetary front, the Reserve Bank of Australia has acknowledged the uncertainties arising in the domestic and global economy in the latest policy meeting, revising down its growth forecasts for 2019 and 2020. It also left the window for a rate cut open, with overnight indexed swaps giving a 60% probability for such a move by October. On Thursday, chances for a policy easing could increase again if the Q4 CAPEX reading appears surprisingly GDP-negative. In such as a case, the aussie could bear the consequences, with AUDUSD falling first to the 0.7140-0.7130 support area and then to the 0.7100-0.7080 zone.

Should the data beat forecasts, the pair could rebound to test resistance between 0.7180 and 0.7200. Higher, the rally could pause near 0.7240.

It is also worth noting that Thursday’s private sector credit numbers for January and Friday’s AIG manufacturing index for February could disrupt the market as well, while China’s Caixin/Markit manufacturing PMI due on Thursday could also trigger a response by investors.