Canada will publish January inflation and Q4 GDP numbers this week, which should provide investors some clues as to the possibility of a near-term rate hike by the Bank of Canada amid a slowing economy. The CPI figures are due on Wednesday and the GDP estimates will be released on Friday, both at 13:30 GMT. The Canadian dollar is vulnerable to upside surprises given that investors have almost priced out the likelihood of any rate hikes this year.

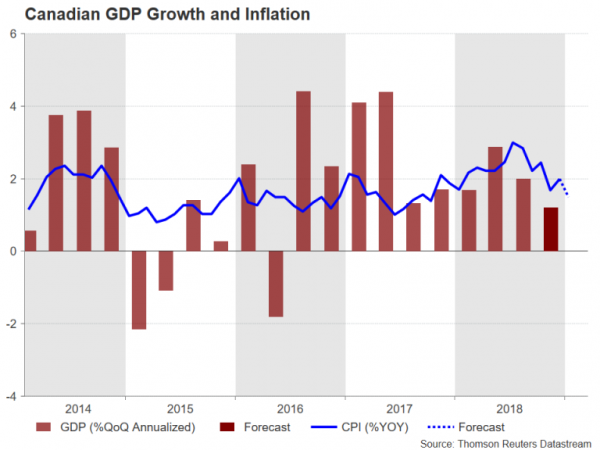

After peaking at a near 7-year high of 3.0% year-on-year in July 2018, headline inflation in Canada has since been trending downwards. While an unexpected jump from 1.7% to 2.0% in December may have briefly boosted rate hike expectations, the strong reading is seen as a one-off and in January, the CPI rate is forecast to turn lower again, falling to 1.5% y/y.

Core inflation, meanwhile, remains steady. The Bank of Canada’s preferred measures of core inflation, the CPI median, CPI trim and CPI median stood at 1.8%, 1.9% and 1.9%, respectively, in December, where they’ve been hovering for much of 2018. Without a clear trend upwards, the Bank of Canada is not likely to be in a hurry to resume its rate hike cycle as the economy goes through a soft patch. The BoC raised rates three times in 2018 but recently signalled that further increases would be dependent on the data improving.

The GDP figures due at the end of the week are anticipated to confirm the moderating growth picture in Canada. Annualized growth during the final three months of 2018 is forecast at 1.2% quarter-on-quarter, slowing from the prior 2.0%. On a month-on-month basis, GDP growth is forecast to have been flat in December.

Canada’s economy has been hit by the downward reversal in oil prices in Q4, which have hurt business investment in the energy sector – the country’s largest export segment. The BoC is also worried about the cooling housing market, while consumer spending has also slowed substantially. The Bank’s governor, Stephen Poloz, recently said that the path for its policy rate towards the neutral range is “highly uncertain”, suggesting there will be no rate hikes until the economy regains some momentum.

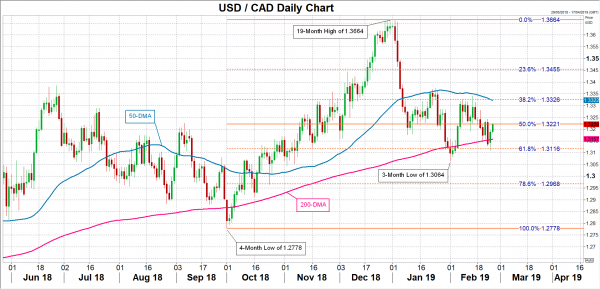

The Canadian dollar has come under pressure over the past day after oil prices slid when US President Trump called on OPEC to lower oil prices. Dollar/loonie jumped back above the 1.32 level only to find resistance near 1.3221 – the 50% Fibonacci retracement of the upleg from 1.2778 to 1.3664. An overall weak set of readings in this week’s data could lift dollar/loonie above the 50% Fibonacci and drive the pair towards the 38.2% Fibonacci at 1.3326, which lies slightly above the 50-day moving average (MA).

However, if there are positive surprises in the numbers, this could take the pair back down towards the 200-day MA, which has been acting as strong support since late January. Not too far below the 200-day MA (currently at 1.3157), is the 61.8% Fibonacci at 1.3116. A break below this level would risk a breach of the 3-month low of 1.3064 set earlier in February.