U.S. Highlights

- The barrage of negative U.S. data continued this week, with weakness in December durable goods orders and a decline in existing home sales in January.

- Still, markets were hopeful that progress would be made in the China-U.S. trade talks, which could help remove a cloud of uncertainty that has weighed on investment.

- The data affirms that the Fed made the right choice to shift off of gradual rate increases, and wait patiently to see if the U.S. economy remains resilient in the face of global weakness. We expect these signs to become clearer in the spring.

Canadian Highlights

- Oil prices and a broader U.S. dollar sell off helped lift the loonie a touch this week.

- Retail sales volumes rebounded in December, but the fourth quarter as a whole was flat, consistent with our view of subdued consumer spending at the end of the year.

- In a speech this week, Bank of Canada Governor Stephen Poloz discussed the limitations of monetary policy, and reaffirmed the data dependent path for getting interest rates back to neutral.

U.S. – Awaiting Signs of Spring

Spring training got underway this week, a reminder that better weather is just around the corner. But, it will likely be some time before we see signs of spring in the U.S. economy. Various indicators pointed to soft momentum at the end of 2018 and early in 2019. Last week it was retail sales and industrial production. This week, the bad news came from durable goods orders and existing home sales.

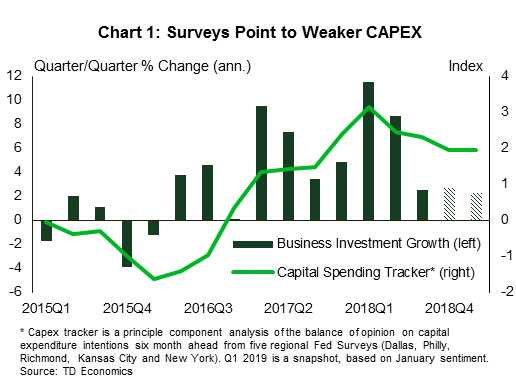

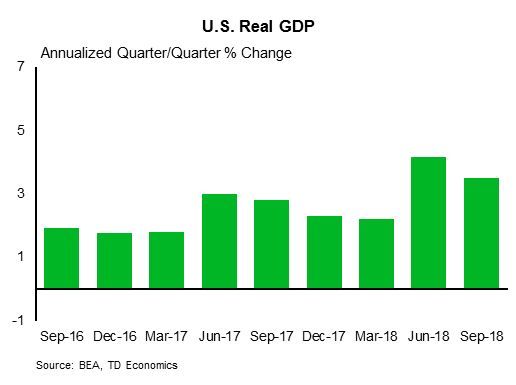

Overall durable goods orders rose 1.2% in December, but the underlying business-investment gauge – nondefense capital goods orders ex-aircraft – declined 0.7%, the fourth decline since August. Capex spending had already slowed in the third quarter of 2018 after a period of strength (Chart 1), and the durables data suggests a similarly modest pace in Q4. That lines up with our capital expenditure tracker, (based on Fed sentiment surveys) and points to more modest growth into early 2019 as well.

Uncertainty related to trade policy and slower growth abroad likely contributed to more modest business spending in the latter half of 2018. Markets were optimistic about ongoing China-U.S. talks this week, but there is no concrete news yet. The President also indicated that March 1st is not a magic date, providing hope that an escalation in tariffs isn’t imminent. It could also mean that talks drag on, keeping the cloud of uncertainty hanging over investment.

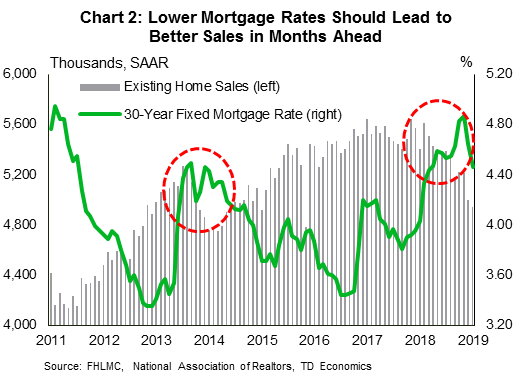

The U.S. housing market also started 2019 on a weaker footing. Existing home sales fell 1.2% in January, hitting the lowest level since November 2015. It is likely sales were somewhat depressed by uncertainty due to the government shutdown, but the trend was already soft.

Deteriorating affordability has cut into housing demand over the past year, but mortgage rates have dropped about 60 basis points since late 2018, which should show up in improved sales in the months to come (Chart 2). Homebuilder confidence also improved in February, supporting a more positive housing narrative ahead.

Finally, on the data front, the delayed fourth quarter GDP report is released next week. We expect growth moderated to 2.2% in Q4, after running above 3 ½% through the middle of the year. With the government shutdown and the continued phenomenon of residual seasonality, the first quarter of 2019 is likely to be even weaker at 1.6%.

For now, this lackluster data affirms that the Fed made the right choice to shift off of gradual rate increases, and wait patiently to see if the U.S. economy remains resilient in the face of global weakness. The minutes from the January FOMC meeting showed members debating whether further rate hikes will be necessary, but not contemplating cuts. Members continued to view sustained expansion strong labor market conditions, and inflation near 2% as the most likely path ahead. We too expect economic momentum to improve in the spring, and remain modestly above trend through the remainder of 2019. As long as there are no curve balls, the Fed is likely to raise rates once more in the latter half of the year.

Canada – A Reminder on the Limits of Monetary Policy

Oil prices firmed this week and, when taken together with a broader U.S. dollar sell off, helped lift the loonie a touch. Overall, the few tidbits of economic data received this week did not change our view on the outlook for the Canadian economy.

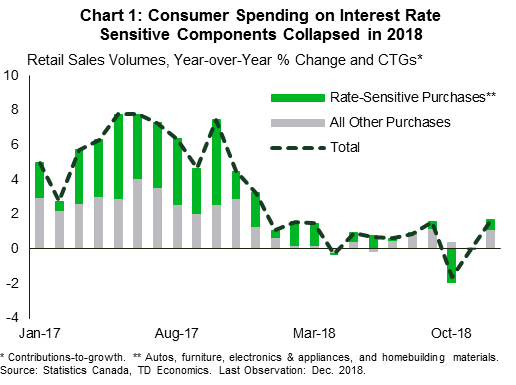

As expected, consumers have been feeling the pinch of higher interest rates. Retail sales volumes were flat for much of 2018, with the most interest rate-sensitive components of household spending taking a hit (Chart 1). Retail sales volumes rebounded in December, but growth in the fourth quarter of 2018 was non-existent, consistent with our view of subdued consumer spending at the end of the year.

Government budget season began this week, with British Columbia kicking things off (see commentary). In its second full budget, the NDP government took care not to upend existing plans. Notable spending initiatives include a new childcare benefit program, $900 million allocated to the CleanBC plan, and a plan to eliminate interest on student loans. An incremental $24 million was allocated to the Homes for BC plan, aimed at eliminating homelessness.

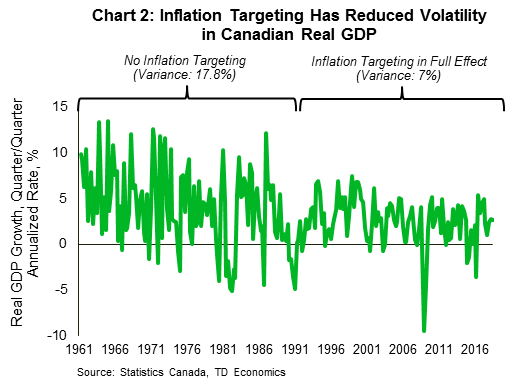

Capping off the week was a speech by Bank of Canada Governor Stephen Poloz. In addition to reaffirming that his goal remains further rate increases, but that the timing is data dependent, the speech stayed true to its title: “Toward 2021: the Power and Limitations of Policy”. Governor Poloz remarked about the success and limitations of the central bank’s inflation targeting regime. While low and stable inflation has provided numerous benefits to Canada’s economy, such as lower nominal interest rates and more stable income growth, there are limits to this framework. Inflation targeting is essentially a one-trick pony, achieving price stability at the expense of other possible mandates such as full employment or a stable exchange rate. Moreover, the limitation of one instrument does little to combat excesses, such as the bingeing of households and firms on debt due to low interest rates. Lastly, the forward looking nature of monetary policy requires setting interest rates in order to achieve objectives a year or more away, making it an exercise in risk management.

Overall, this speech helped provide an update on the Bank’s thinking as it heads toward the renewal of the inflation-control target set for 2021. Those expecting an expansion in its mandate are likely to be disappointed. The message this week seems to be that the Bank wants to stick to its current focused mandate, highlighting the macroeconomic stability that inflation targeting delivers (Chart 2). Governor Poloz also appears content to leave financial and housing market regulation to other government agencies, given the limited power of monetary policy to address financial imbalances.

US: Upcoming Key Economic Releases

U.S. Real GDP – Q4 Initial

Release Date: February 28, 2019

Previous: 3.4%

TD Forecast: 2.2%

Consensus: 2.5%

Following weak December retail sales and core capital goods data, we look for Q4 GDP growth to slow to 2.2%, down from Q3’s solid burst of 3.4%. While consumption expenditures should be respectable (upper 2% range), housing and business inventories are likely to subtract from growth. The more measured expansion rate reflects the economy’s normalization as fiscal stimulus wanes and past interest rate hikes bite. As a final note, due to the shutdown, this report will be a combination of the advance and second releases; there will only be one subsequent revision.

Canada: Upcoming Key Economic Releases

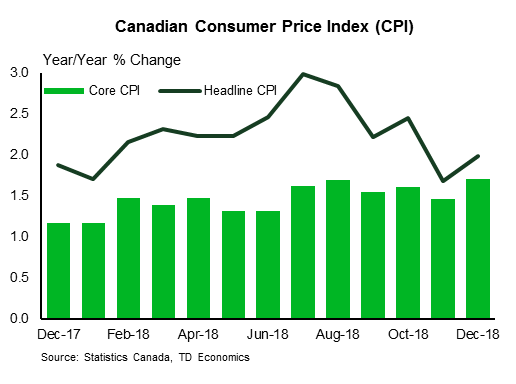

Canadian Consumer Price Index – January

Release Date: February 27, 2019

Previous: -0.1% m/m, 2.0% y/y

TD Forecast: 0.2% m/m, 1.5% y/y

Consensus: 0.2% m/m, 1.5% y/y

We expect inflation to slip back to 1.5% in January, largely driven by the partial reversal in airfares. This is a key source of uncertainty, which on balance skew risks to the downside. Since the methodological changes in March 2018, airfares have recorded significant m/m swings and bounced 22% m/m in December. While it is tempting to assume a large correction, we note that seasonal patterns in January point to a further increase while past performance indicates that large swings don’t always fully reverse in the next month. On the other hand, January airline deals point to a partial correction, especially with the new, more expansive methodology which may make the index more sensitive to discounts. Taken together we expect airfares to decline m/m, bucking the seasonal trend. We also eye marginal upside risks in energy, owing to carbon pricing rules and higher Ontario hydro costs. Note however the bulk of the carbon tax impact will be in April, when a fuel charge is implemented on four provinces, comprising roughly half of CPI. Finally, we flag that the January release will incorporate methodological changes to the rent index.

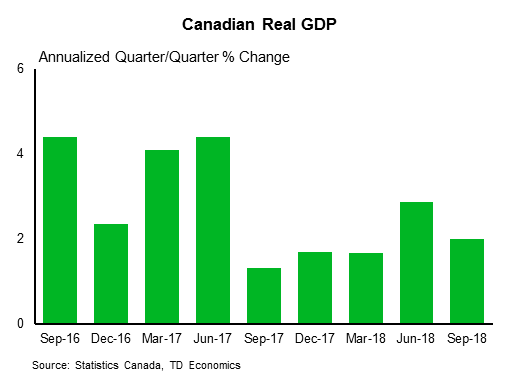

Canadian Real GDP – Q4 & December

Release Date: March 1, 2019

Previous: 2.0% q/q, -0.1% m/m

TD Forecast: 0.9% q/q, 0.0% m/m

Consensus: N/A

We expect a soft close to 2018, with slowing economic momentum and the impact of energy sector developments the main culprits holding economic growth to just 0.9% (q/q, annualized). Consumer spending is expected to remain soft at just 1.3% with spending on durable goods forecast to contract for a second quarter. Similarly, residential investment is expected to subtract from growth again on the back of falling resale activity, muted construction, and a soft reading for renovation. This leaves non-residential investment to do the heavy lifting where an expected pop-back in equipment spending following the prior quarter’s unusual drop should lead the way (early indicators suggest little contribution from non-residential structures). The wildcard is net trade. Due to the U.S. government shutdown, we don’t yet know how December shaped up, but based on the data in hand we anticipate a modest positive contribution, largely due to flat import growth. Weak commodity prices are expected to have kept nominal GDP effectively unchanged in the fourth quarter.

Industry-level GDP is also forecast to remain unchanged in December as a contraction in the goods-producing sector offsets a modest increase in services. Manufacturing output will weigh on the goods sector due to weaker petroleum output while residential construction and utilities should also act as a headwind to growth. This will leave services as the primary driver, underpinned by stronger retail and wholesale trade. A flat print for industry-level GDP in December provides a muted handoff to Q1, where crude oil curtailments will weigh heavily on January.