Sterling is sold off broadly today as it’s getting unlikely to have a Brexit breakthrough at the Sharm El-Sheikh summit on Sunday. Prime Minister Theresa May is highly unlikely to bring back any revised deal for parliament approval next Wednesday. Dollar follows as the second weakest as markets await result of US-China trade negotiations. Trump is set to meet Chinese Vice Premier Liu He at 2.30 pm Eastern Time. A lack of concrete progress will be a huge blow to market sentiment.

On the other hand, Australian Dollar is the strongest one for today, reversing some of yesterday’s decline. China denied that the news that Dalian ports banned Australian coal imports. But it should be noted that Aussie was also pressured on talks of RBA rate cuts this year. So, it’s too early to cheer the rebound. New Zealand Dollar follows and also reversed earlier losses today. Canadian Dollar shrugs off mixed retail sales data, but follows oil prices higher. Headline retail sales dropped -0.1% mom in December versus expectation of -0.3% mom. Ex-auto sales dropped -0.5% mom versus expectation of -0.3% mom.

In Europe, FTSE is up 0.42%. DAX is up 0.39%. CAC is up 0.28%. German 10-year yield is down -0.0257 at 0.104. Nikkei dropped -0.18%. Hong Kong HSI rose 0.65%. China Shanghai SSE rose 1.91%. Singapore Strait Times dropped -0.24%. Japan 10-year JGB yield dropped -0.0008 to -0.041.

German Ifo dropped to lowest since Dec 2014, economic situation remains weak

German Ifo Business Climate dropped to 98.5 in February, down from 99.3 and missed expectation of 98.9. That’s also the lowest level since December 2014, and the sixth decline in a row. Expectations index dropped to 93.8, down from 94.2 and missed consensus of 94.2. Current Assessment index also dropped to 103.4, down from 104.3 and missed expectation of 103.9.

Clemens Fuest, President of ifo Institute said “these survey results as well as other indicators point to economic growth of 0.2 percent in the first quarter. The economic situation in Germany remains weak.”

Ifo economist Klaus Wohlrabe said “there was hope that the weak period we experienced in the second half of 2018 was only temporary but it looks like it will continue.” Brexit is not off the table yet and US punitive tariffs would hit expect expectations. In particular, the impact of the tariffs is not reflected in the sentiment figures yet.

Also released, German GDP was finalized at 0.0% qoq in Q4. Eurozone CPI was finalized at 1.4% yoy in January, core CPI at 1.1% yoy.

China denies banning Australian coal at Dalian ports

Chinese Ministry of Foreign Affairs spokesman Geng Shuang denied the report that Australian coal imports are banned by Dalian port. He said in a regular press briefing that china’s Australian coal imports continue as normal. Nevertheless, customs administration has stepped up environment and safety checks on foreign cargoes.

Australia’s Minister for Trade, Simon Birmingham also said that “the application of those quotas combined with different testing and the quality assurance and environment is testing centres, may be slowing down the processing of costing data of coal in certain parts of China.” He added that “we have no basis to believe that there is a ban on Australian coal exports into China, or into any part of China.”

Australian Prime Minister Scott Morrison also said “This is not the first time that on occasion local ports make decisions about these matters. “There is no evidence before me or us that would suggest it has the connotations that it has anything to do with anything more broadly than that. This happens from time to time.”

RBA Lowe: What’s of concern is accumulation of downside risks

RBA Governor Philip Lowe said today that the central scenario for 2019 is for growth of around 3%, inflation of around 2%and unemployment of around 5. And “this is not a bad set of numbers”. However, what is more of concern is the “accumulation of downside risks”.

The first major area of risks globally is “political risks” including US-China trade and technology tensions, Brexit, rise of populism and strains in some wester European countries. Second area of international risk is China slowdown. Domestically, RBA board has recently been paying “particularly close attention” to household spending and housing market. Lowe noted that ” underlying trend in consumption is softer than it earlier looked to be”. Decline housing prices could also affect overall spending.

On monetary policy, Lowe reiterated that “the probability that the next move is up and the probability that it is down are more evenly balanced than they were six months ago.”

RBNZ to raise top banks’ capital requirement, might cut interest rate

RBNZ proposed to raise capital requirement for top banks of the country. Capital ratios would be increased to 16% of frisk-weighted assets. Combined the top four banks might need to raise NZD 20B over the next five years to meet the rule. RBNZ Deputy Governor Geoff Bascand said the move would only lead to a “marginal tightening of monetary conditions”.

But he added that the central could consider to loosen up monetary further is needed. Bascand said “when we set the OCR (Official Cash Rate), we set it with for a 18 month to 2 year look ahead. So let’s say we are making a decision in the third quarter of this year…we just have to feed that into our regular monetary policy decision making”. And, “if we were worried, and thinking we were undershooting inflation, undershooting maximum sustainable employment, then we would obviously look for an OCR change…that is the implication.”

GBP/USD Mid-Day Outlook

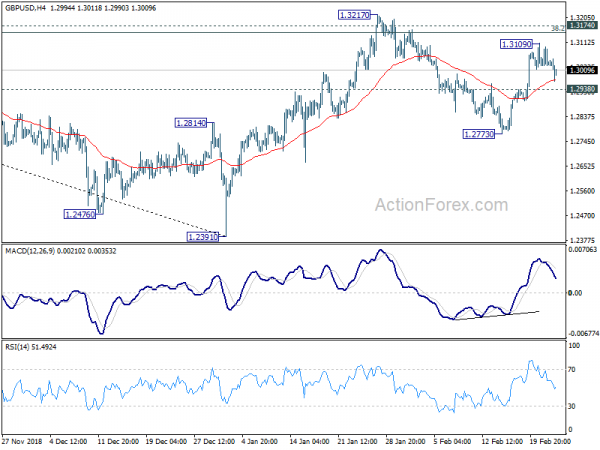

Daily Pivots: (S1) 1.3009; (P) 1.3052; (R1) 1.3078; More….

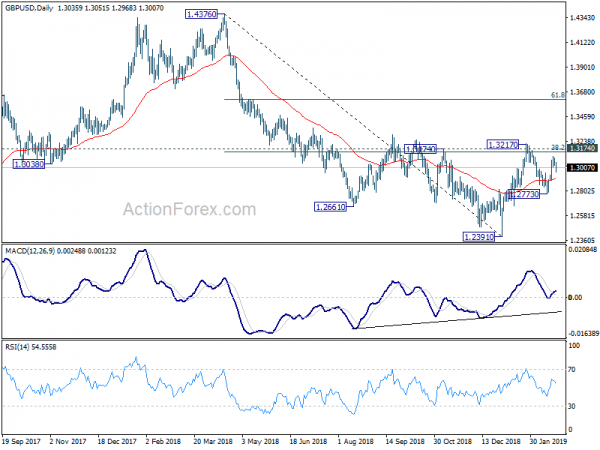

GBP/USD drops notably today but stays above 1.2938 minor support. Intraday bias remains neutral first. On the upside, above 1.3109 will target 1.3174/3217 resistance zone. Decisive break there will complete a head and shoulder bottom pattern (ls: 1.2661, h: 1.2391, rs: 1.2773). That would indicate bullish reversal for 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. On the downside, break of 1.2935 minor support will turn bias back to the downside for 1.2773 instead.

In the bigger picture, focus is back on 1.3174 resistance with current rebound. Break will indicate completion of decline from 1.4376. Rise from 1.2391 would then be seen as the third leg of the corrective pattern from 1.1946 (2016 low). In that case, further rise could be seen through 1.4376 resistance. Nevertheless, rejection by 1.3174 again will extend the decline from 1.4376 through 1.2391 to 1.1946 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Jan | 0.80% | 0.80% | 0.70% | |

| 07:00 | EUR | German GDP Q/Q Q4 F | 0.00% | 0.00% | 0.00% | |

| 09:00 | EUR | German IFO Business Climate Feb | 98.5 | 98.9 | 99.1 | 99.3 |

| 09:00 | EUR | German IFO Expectations Feb | 93.8 | 94.2 | 94.2 | |

| 09:00 | EUR | German IFO Current Assessment Feb | 103.4 | 103.9 | 104.3 | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan F | 1.10% | 1.10% | 1.10% | 0.90% |

| 10:00 | EUR | Eurozone CPI M/M Jan | -1.00% | -1.10% | 0.00% | |

| 10:00 | EUR | Eurozone CPI Y/Y Jan F | 1.40% | 1.40% | 1.60% | 1.50% |

| 13:30 | CAD | Retail Sales M/M Dec | -0.10% | -0.30% | -0.90% | |

| 13:30 | CAD | Retail Sales Ex Auto M/M Dec | -0.50% | -0.30% | -0.60% | -0.70% |