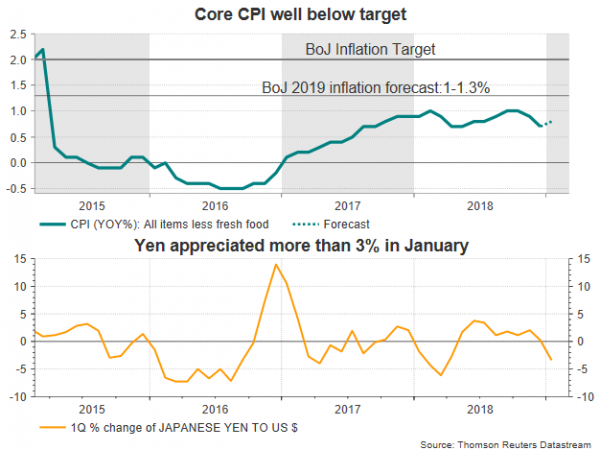

Inflation pressures in Japan decelerated in the last quarter of 2018, forcing the central bank to lower its inflation expectations for 2019. In January, the core Consumer Price Index (CPI) is anticipated to show a mild rise, but with global risks threatening to boost the safe-haven yen in coming months, questions are now arising about whether the measure could continue to recover in coming months.

On Thursday at 2330 GMT, the core CPI for the month of January is forecast to tick up by 0.1 percentage points to 0.8% y/y, undershooting once again the Bank of Japan’s 2.0% inflation goal. Although the BoJ governor, Haruhiko Kuroda, kept the foot on the easing pedal for more than five years now, the price growth is still more than halfway lower from the target, holding the Bank well behind its US and EU counterparts in unwinding crisis-era policies.

A simmering trade war between the US and China, the still-unresolved Brexit and political uncertainties in the Eurozone are considered as threats that could cause another global economic slowdown in the near future. The BoJ however, has a very narrow window to provide additional economic support in case conditions inside and outside the country deteriorate as interest rates are already in negative territory and money liquidity is abundant given the central bank’s large-scale asset purchases. On top of this, a bulk of funds is anticipated to shift towards safer investments such as the Japanese yen, which tends to gain when risk aversion increases. Consequently, a currency appreciation would make Japanese products more expensive to overseas buyers and imports cheaper to domestic consumers, putting pressure on firms to keep prices low and therefore inflation down in order to remain competitive. Note that Japan’s trade deficit topped 4 ½ -year highs in January as businesses saw demand from the slowing-China tumbling by 8.4%. While the Lunar New Year holiday could be partly responsible for the plunge, exports have also fallen significantly in other regions, evidence that broader economic weakness has probably started to bite in trade-dependent Japan.

With other central banks adopting a more accommodative stance in the face of upcoming economic headwinds, the BoJ is in a big dilemma about its future strategy. On Tuesday and in response to an opposition lawmaker, Kuroda said that lower interest rates and more asset buying could be potential stimulus tools to trim the yen’s appreciation. Yet with criticism rising over BoJ’s inability to drive inflation to the target and financial institutions complaining that low interest rates are squeezing their profits, Kuroda may not use these tactics unless the cost of such a step is worthy to mitigate sharper negative shocks.

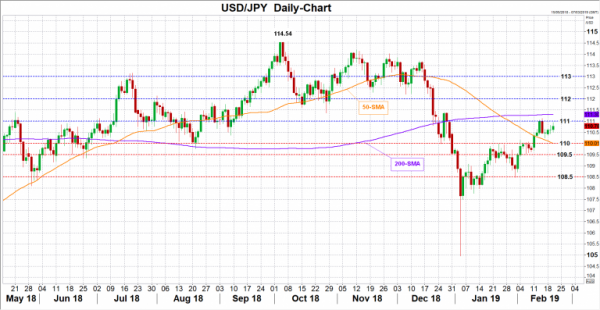

In market reaction, a weaker-than-expected CPI would increase the odds for a more cautious BoJ policy meeting on March 14, helping USDJPY to reach the 111 level and even break above the 200-day moving average currently at 111.30. If the market manages to pierce the 112 mark too, the next pause could be within the 112-113 area.

On the other hand, a CPI below 1.0% may not excite traders. Nevertheless, in the absence of any other important news, the yen could attract some buying, sending USDJPY probably down to 110, where the 50-day MA is currently standing. Moving lower, another challenge may appear between 109.50 and 108.50.