Tuesday February 19: Five things the markets are talking about

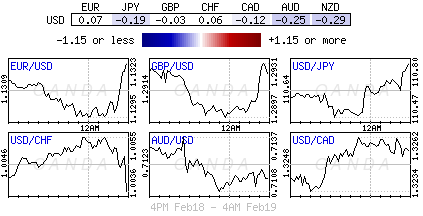

Global equities are trading mixed as Sino-U.S trade talks continue and investors await commentary from the Fed this week – the minutes from the latest meeting are out tomorrow (02:00 pm ET). The big dollar trades a tad higher while U.S Treasuries are steady.

According to the White House the China trade talks are aimed at “achieving needed structural changes in China that affect trade between the United States and China. The two sides will also discuss China’s pledge to purchase a substantial amount of goods and services from the United States.” Trump’s team seem determined to reach a deal that avoids a step up in tariffs on March 1.

Elsewhere, the chances of a disorderly Brexit seem to be rising every day. Seven members quit the U.K’s Labour Party over the weekend over issues including Brexit and antisemitism, while PM Theresa May still hopes that parliament will accept her Brexit withdrawal deal (Feb 27) before the March 29 deadline.

Central Banks and governors are to the fore this week – Aside from the Fed publishing its latest minutes tomorrow, the European Central Bank (ECB) following suit on Thursday (07:30 am ET), while Bank of Canada (BoC) Governor Stephen Poloz will also speak on Thursday (12:35 pm ET) and ECB President Mario Draghi speaks on Friday (10:30 am ET), a day after Reserve Bank of Australia (RBA) Governor Philip Lowe gives his parliamentary testimony (05:30 pm ET).

1. Stocks trade mixed

In Japan, stocks ticked up to new two-month highs overnight on hopes of a breakthrough in Sino-U.S trade talks, though the gains were led by defensive shares as investors remained cautious on the global economic outlook. The Nikkei share average edged up +0.10%, its highest close since mid-December, while the broader Topix added +0.28%.

Down-under, Aussie shares closed modestly higher overnight as losses in the mining and healthcare sectors were offset by significant gains in financial stocks. The S&P/ASX 200 index rose +0.3% at the close of trade. The benchmark had gained +0.4% yesterday. In S. Korea, stocks sagged on weaker export prices. The Kospi stock index closed out down -0.17%.

In China and Hong Kong, stocks ended lower overnight, snapping a two-month and six-week rally respectively, as investors booked profits partly fuelled by optimism that China and the U.S would hammer out a deal to resolve their trade dispute. The CSI300 closed -0.2% lower, while the Hang Seng index ended -0.4% lower and the China Enterprises Index closed -0.3% weaker.

In Europe, regional bourses trade a tad lower across the board, pressured by worse than expected earnings from a number of financials stocks.

U.S stocks are set to open in the ‘red’ (-0.2%).

Indices: Stoxx600 -0.5% at 368.1, FTSE -0.6% at 7178, DAX -0.2% at 11280, CAC-40 -0.4% at 5146, IBEX-35 -0.4% at 9118, FTSE MIB -0.8% at 20159, SMI -0.1% at 9258, S&P 500 Futures -0.2%

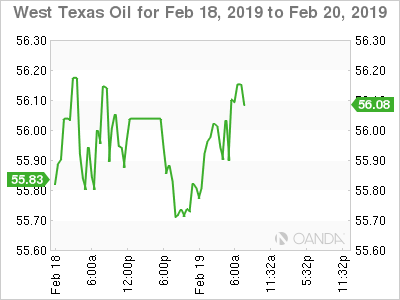

2. Oil trades atop 2019 highs on OPEC cuts, gold unchanged

Oil trades atop of this year’s high print, supported by OPEC+ led supply cuts, although investor concerns about slowing economic growth is currently capping gains.

Brent crude has eased -28c to +$66.22 a barrel, not far from the 2019 high of $66.83 reached yesterday, while U.S crude is up +54c at +$56.13.

The supply curbs led by OPEC have helped crude prices rally more than +20% in 2019. Also helping prices are U.S sanctions against Iran and Venezuela.

Nevertheless, demand-side worries remain the main drag on prices. Investors are concerned that an economic slowdown in China and Britain would “throw up further hurdles this year.”

Both investors and traders remain cautious on taking on large new positions before the outcome of Sino-U.S trade talks this week.

Note: OPEC last week lowered its forecast for growth in world oil demand this year to +1.24M bpd – however, there are some analysts who believe that number “could be weaker still.”

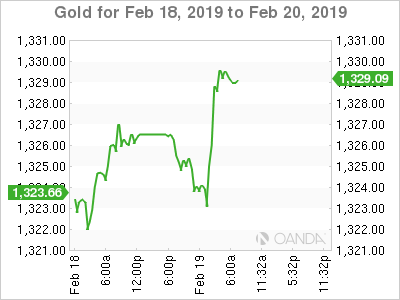

Ahead of the U.S open, Gold prices hover atop of their 10-month highs as optimism around U.S-China trade discussions reduced the ‘big’ dollar’s appeal. Spot gold is little changed at +$1,326.48 per ounce – the ‘yellow’ metal touched +$1,327.64 an ounce in Monday’s session, its highest since late April. U.S gold futures have rallied +0.5% to +$1,329 an ounce.

3. Italian yields jump after industrial orders disappoint

Italian government bond yields have backed up +5 to +6 bps across the curve this morning after data showed industrial orders in the euro zone’s third-largest economy dropped -5.3% in December over the same month in 2017.

The disappointing data has put an end to an earlier rally in prices that was sparked by expectations for a new round of cheap multi-year loans for Italian banks by the ECB.

Italy’s 10-year BTP yield was last up +6 bps on the day at +1.74%, pushing the gap over German 10-year Bund yields to +273 bps – 10 bps wider on the day.

Elsewhere, the yield on 10-year Treasuries has decreased -1 bps to +2.66%. In Germany, the 10-year Bund yield has dipped -2 bps to +0.09%, the lowest in more than a week, while in the U.K, the 10-year Gilt yield has dipped -1 bps to +1.151%.

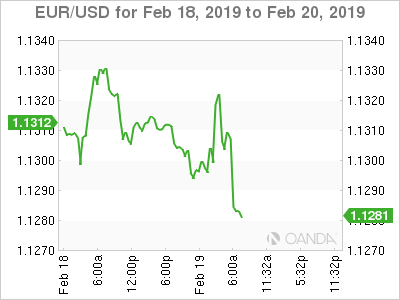

4. Dollar slips, looks for support

EUR/USD (€1.1281) is a tad weaker and holding just below the psychological €1.13 level despite mixed German ZEW data for Feb. – German Feb ZEW survey was mixed, but a slight improvement in ‘expectations survey’ suggests that negative factors (Brexit deal and weak growth from China) had already been expected.

GBP/USD (£1.2910) holding atop of the £1.29 handle as UK-EU officials continue to meet to find a fix to the Irish backstop issue. Expect the market to become rather volatile and nervous if next week’s vote delivered another defeat for PM May’s Brexit strategy.

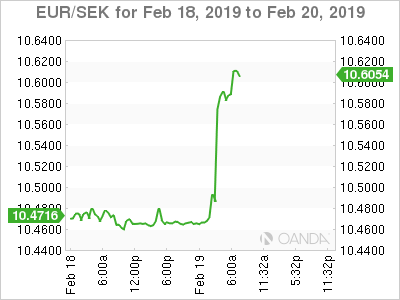

The SEK has plunged, taking EUR/SEK to a five-month high of €10.5801 earlier this morning after Swedish inflation data for January came in below market expectations, up +1.9% y/y – this compares to a +2% increase in the previous month, which is the Riksbank’s target and was well below the consensus for +2.3%.

5. German economic expectations brighten

German data this morning from the ZEW economic research institute showed that economic expectations improved slightly in February, albeit from an extremely low level previously, but also despite a much “gloomier assessment of the current economic situation.”

The institute’s measure of economic expectations increased to -13.4 points from -15.0 points in January.

Note: The latest reading is below the historical average of 22.4 points, but narrowly beats economists’ forecasts of -14.0 points.

“There are currently no signs that Germany’s flagging economy will stage a swift recovery,” ZEW President Achim Wambach said.

Note: Europe’s largest economy narrowly avoided recession toward the end of 2018 and many have cut their growth outlooks. The consensus now forecast Germany’s economic growth at just +0.5% this year. If so, it would be the weakest expansion rate since 2013.