Asian stocks slid after Chinese data showed a slowdown in inflation. In January, Chinese consumer prices rose by an annualized rate of 1.7%, which was lower than the expected 1.9%. The stocks also dropped after it was revealed that US and China negotiators had made little progress in the negotiations with the United States. The reason for the lack of progress is that China has been unwilling to offer major concessions about its business practices like forced technology transfer and intellectual property theft. In China, the Shanghai and Hang Seng declined by 0.65% and 1.65%. In Japan, the Nikkei dropped by 1.26%. Today, investors will focus on the statement from the negotiators who are meeting in Beijing.

Focus will remain on the United Kingdom today as the country releases the retail sales numbers. The core retail sales numbers are expected to show that in January, the headline retail sales numbers rose by 3.4%, which was higher than December’s 3%. On a MoM basis, the retail sales rose by 0.2%, which was higher than December’s contraction of 0.9%. The core retail sales rose by an annualized rate of 3.0%, which was better than the expected 2.6%. Investors will also focus on news about Brexit. Yesterday, Theresa May’s approach to Brexit suffered when MPs voted against her strategy.

Investors will also focus on important data from Europe and United States. In Europe, Spain will release its inflation numbers for January. The numbers are expected to show that consumer prices remained unchanged at 1% in the month. The harmonized inflation adjusted consumer prices are expected to have remained unchanged at 1%. In Italy, the trade surplus for December is expected to have been 3.47 billion euros. This will be lower than November’s surplus of 4.7 billion euros. In the United States, the core retail sales for December are expected to have increased by 0.1% while the headline number is expected to remain unchanged at 0.2%.

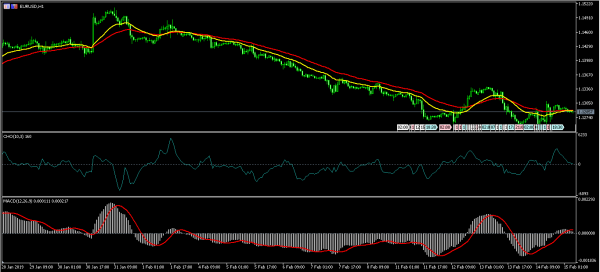

EUR/USD

The EUR/USD pair moved slightly lower in overnight trading and reached a low of 1.1285. This was slightly higher than yesterday’s low of 1.1250. On the hourly chart, the pair is trading along the 42-day and 21-day EMA. The Chaikin oscillator has fallen to the neutral level while the signal line of the MACD has just moved above the neutral line. At this point, the pair could move in either direction depending on the data.

GBP/USD

The GBP/USD pair declined sharply after Theresa May’s defeat in parliament. The pair is now trading at 1.2770, which is close to the lowest level since 16 January. On the four-hour chart, the pair is below the 42-day and 21-day EMAs while the RSI has declined close to the oversold level of 70. The price is also along the lower line of the Bollinger Bands. Today, the pair could continue the downward trend as traders follow the Brexit story.

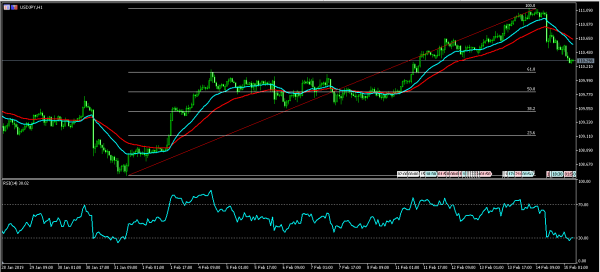

USD/JPY

The USD/JPY pair moved lower in overnight trading. The pair reached a low of 110.30. The pair has been on an upward rally since the beginning of the year. On the daily chart, the hourly chart, the 42-day and 21-day EMAs have crossed over, which is an indication that the pair could continue the downward trend. The RSI has moved sharply lower to below 30. The price is also close to the 61.8% Fibonacci Retracement level. The pair will likely resume the upward trend today if it hits the 61.8% retracement level.