Strong risk appetite remains the main theme for today on trade optimism. Though, Dollar is trying to steal the show in early US session with stronger than expected inflation data. For now, Yen remains the weakest one for today. Euro follows as weighed down by poor industrial production data, then Swiss Franc. On the other hand, New Zealand was boosted by less dovish than expected RBNZ MPS today. At least, RBNZ suggests that it’s not on track for a rate cut. Meanwhile, Aussie is supported by strong risk appetite based on trade-deal optimism.

Trump indicated yesterday that he’s willing to let the March 1 trade truce deadline with China slide a little. White House spokeswoman Sarah Huckabee Sanders was quoted by Fox news saying that Trump is weighing possibilities regarding China trade deadline. Though, the trade deal will only be finalized at Trump-Xi meeting. In Beijing, Treasury Secretary Steven Mnuchin said talks in Beijing are “so far, so good”.

US headline CPI slowed to 1.6% yoy in January, down from 1.9% yoy but beat expectation of 1.5% yoy. CPI core was unchanged at 2.2% yoy, beat expectation of 2.1% yoy. Core CPI has been at or above 2.2% for eight out of the past nine-months.

In Europe, currently, FTSE is up 0.70%. DAX is up 0.44%. CAC is up 0.50%. German 10-year yield is up 0.144 at 0.0105. Earlier in Asia, Nikkei rose 1.34%. Hong Kong HSI rose 1.15%. China Shanghai SSE rose 1.84%, reclaimed 2700 handle. Singapore Strait Times rose 1.36%. Japan 10-year JGB yield rose 0.0051 to -0.005, staying negative.

UK CPI slowed to 2-year low

UK CPI slowed to 1.8% yoy in January, down from 2.1% yoy and missed expectation of 2.0% yoy. That’s also the lowest level since January 2017. Core CPI was unchanged at 1.9% yoy, matched expectations. ONS noted that the largest downward contribution to the change in the 12-month rate came from electricity, gas and other fuels. Meanwhile, these downward effects were partially offset by air fares.

Also from UK, RPI slowed to 2.5% yoy, down from 2.7% yoy, below expectation of 2.5% yoy. PPI input slowed to 2.9% yoy, down from 3.2% yoy and missed expectation of 3.8% yoy. PPI output slowed to 2.1% yoy, down from 2.4% yoy and missed expectation of 2.2% yoy. PPI output core was unchanged at 2.4% yoy, above expectation of 2.3% yoy. House price index slowed to 2.5% yoy, down from 2.7% yoy, matched expectations.

UK Barclay: Not in anyone’s interest to extend Article 50

In the UK, ITV news reported that its correspondent overhead lead Brexit negotiator Olly Robbins said the parliament is facing a choice of Prime Minister Theresa May’s deal or a long article 50 extension. And, the issue is whether Brussels is clear on the terms of extension.

On the other hand, Brexit Minister Steve Barclay is quick to clarify that “the prime minister has been very clear that we are committed to leaving on the 29th of March… It’s not in anyone’s interest to have an extension without any clarity.”

And, the Financial Times reported that PM Theresa May told business leaders that extending Article 50 process beyond March 29 serves no purpose.

Eurozone industrial production dropped -0.9% mom in Dec

Eurozone industrial production contracted -0.9% mom in December, much worse than expectation of -0.4% mom. Over the year, IP dropped -4.2% yoy. Looking at the industrial groupings, production of both capital goods and non-durable consumer goods fell by -1.5% and energy by -0.4%, while production of intermediate goods remained unchanged and durable consumer goods rose by 0.7%. For EU 28, industrial productions dropped -0.5% mom, -2.7% yoy.

NZD jumps on less dovish than expected RBNZ

New Zealand Dollar jumps sharply after RBNZ turned out to be less dovish than expected. OCR was kept at 1.75% as widely expected. And, the central bank restored the language that “the direction of our next OCR move could be up or down” in the statement. However, there was no more dovish tweak.

In short, RBNZ expected interest rate to be unchanged at current level “through 2019 and 2020”. It maintained the view that “As capacity pressures build, consumer price inflation is expected to rise to around the mid-point of our target range at 2 percent.”

And, there were upside and downside risks to the outlook. RBNZ noted “there are upside and downside risks to this outlook. A more pronounced global downturn could weigh on domestic demand, but inflation could rise faster if firms pass on cost increases to prices to a greater extent.”

The overall statement was pretty balanced and did nothing to endorse market speculation of a rate cut by year end.

Suggested readings:

- NZD Jumped although RBNZ Postponed Timing of Rate Hike (At Least Not Expecting a Cut)

- First Impressions: RBNZ Leaves OCR at 1.75%

Also released in Asian session, Australia Westpac consumer confidence rose 4.3% in February. Japan domestic CGPI rose 0.6% yoy in January versus expectation of 1.0% yoy.

EUR/USD Mid-Day Outlook

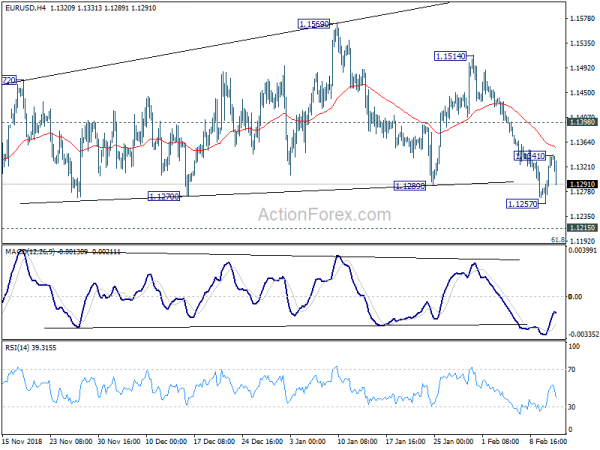

Daily Pivots: (S1) 1.1277; (P) 1.1308; (R1) 1.1359; More…..

EUR/USD recovers to 1.1341 earlier today but drops sharply in early US session. Intraday bias remains neutral as consolidation from 1.1257 temporary low might extend. Though, upside should be limited below 1.1398 minor resistance to bring fall resumption. We’re holding on to the view that corrective pattern from 1.1215 has completed already. On the downside, below 1.1257 should see further decline through 1.1215 low to 1.1186 fibonacci level. However, break of 1.1398 will dampen this bearish view and bring stronger rebound back to 1.1514/69 resistance zone.

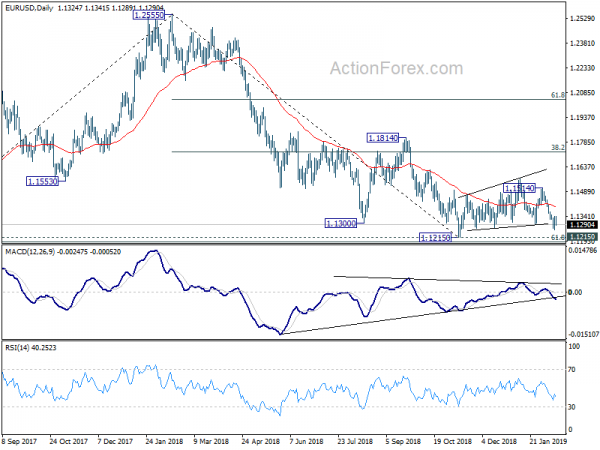

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Feb | 4.30% | -4.70% | ||

| 23:50 | JPY | Domestic CGPI Y/Y Jan | 0.60% | 1.00% | 1.50% | |

| 01:00 | NZD | RBNZ Official Cash Rate | 1.75% | 1.75% | 1.75% | |

| 09:30 | GBP | CPI M/M Jan | -0.80% | -0.70% | 0.20% | |

| 09:30 | GBP | CPI Y/Y Jan | 1.80% | 2.00% | 2.10% | |

| 09:30 | GBP | Core CPI Y/Y Jan | 1.90% | 1.90% | 1.90% | |

| 09:30 | GBP | RPI M/M Jan | -0.90% | -0.80% | 0.40% | |

| 09:30 | GBP | RPI Y/Y Jan | 2.50% | 2.60% | 2.70% | |

| 09:30 | GBP | PPI Input M/M Jan | -0.10% | 0.30% | -1.00% | -1.60% |

| 09:30 | GBP | PPI Input Y/Y Jan | 2.90% | 3.80% | 3.70% | 3.20% |

| 09:30 | GBP | PPI Output M/M Jan | 0.00% | 0.00% | -0.30% | |

| 09:30 | GBP | PPI Output Y/Y Jan | 2.10% | 2.20% | 2.50% | 2.40% |

| 09:30 | GBP | PPI Output Core M/M Jan | 0.40% | 0.20% | 0.20% | 0.10% |

| 09:30 | GBP | PPI Output Core Y/Y Jan | 2.40% | 2.30% | 2.50% | 2.40% |

| 09:30 | GBP | House Price Index Y/Y Jan | 2.50% | 2.50% | 2.80% | 2.70% |

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | -0.90% | -0.40% | -1.70% | |

| 13:30 | USD | CPI M/M Jan | 0.00% | 0.10% | -0.10% | 0.00% |

| 13:30 | USD | CPI Y/Y Jan | 1.60% | 1.50% | 1.90% | |

| 13:30 | USD | CPI Core M/M Jan | 0.20% | 0.20% | 0.20% | |

| 13:30 | USD | CPI Core Y/Y Jan | 2.20% | 2.10% | 2.20% | |

| 15:30 | USD | Crude Oil Inventories | 2.1M | 1.3M | ||

| 19:00 | USD | Monthly Budget Statement Dec | -10.0B | -204.9B |