Strong risk appetite dominates the financial markets today. Investors are getting more optimistic on US-China trade negotiations, with another round of talks happening in Beijing now. Both sides seem to express more desire to make a deal. Trump hinted that he’s willing to let the March 1 trade truce deadline slip, even though he doesn’t prefer it. Xi will also meet US delegation later this week. Such optimism boosts Asian stocks broadly higher.

In the currency markets, Yen and Dollar are the weakest ones as a result. At the time of writing, Euro is the third weakest, but Swiss Franc is not far away. Australian Dollar strengthens across the board naturally. But it’s overwhelmed by New Zealand Dollar, which was boosted by less dovish than expected RBNZ statement. For now, at least RBNZ doesn’t hint at a rate cut. Market focuses will now turn to UK and US consumer inflation data.

Technically, Dollar has at least topped temporarily against European majors and Aussie. USD/JPY is also losing momentum and could also top close to 110.77 fibonacci level. With current development, some Yen crosses are now eyeing last week’s high as resistance level. NZD/JPY is looking at 75.91 and break will resume the rebound from 69.18 towards 78.86 resistance. CAD/JPY is also looking at 83.98. Break will resume the rebound from 76.61 to 85.17 resistance next.

In Asia, Nikkei closed up 1.34%. Hong Kong HSI is up 1.20%. China Shanghai SSE is up 1.56%, back above 2700 handle. Singapore Strait Times is also up 1.21%. Japan 10-year JGB yield is up 0.0083 at -0.002, still negative. Overnight, DOW rose 1.49%. S&P 500 rose 1.29%. NASDQ rose 1.46%. 10-year yield rose 0.023 to 2.684. 30-year yield rose 0.023 to 3.022, back above 3% handle.

Trump may let trade truce deadline slide for a little while

US Treasury Secretary Steven Mnuchin is now in Beijing with Trade Representative Robert Lighthizer for trade negotiations. The high-level meeting with Chinese Vice Premier Liu He will start tomorrow. Ahead of that, Mnuchin said he hoped to have “productive meetings”, without any elaborations.

Trump, on the other hand, said yesterday that he could let the March 1 trade truce deadline “slide for a little while” if “we’re close to a deal”. But he added that “generally speaking, I’m not inclined to do that.”

Separately, it’s reported that Chinese President Xi Jinping may meet Mnuchin and Lighthizer on Friday.

Another US government shutdown unlikely even though Trump doesn’t like the deal

Trump was briefed overnight about the Congressional deal to avert another government shutdown, with only USD 1.37B for border fencing. He apparently dislike it as he told reporters “I have to study it. I’m not happy about it.” Though, he added that “I don’t think you’re going to see another shutdown.”

He also kept on pressing for the border wall and signaled unilateral actions. He said “The bottom is on the wall: We’re building the wall”. And, “We’re supplementing things, and moving things around, and we’re doing things that are fantastic and taking, really, from far-less-important areas.”

Fed George: Let’s step back and see what happens

Kansas City Fed President Esther George expressed her support for pausing rate hikes yesterday. She said inflation pressures did not appear very strong. At the same time, there were concerns on global slowdown. Thus, “let’s step back and see what happens.”

Cleveland Fed President Loretta Mester said at the coming meetings, Fed “will be finalizing our plans for ending the balance-sheet runoff and completing balance-sheet normalization.” And, Fed will “make these plans and the rationale for them known to the public in a timely way because transparency and accountability are basic tenets of appropriate monetary policymaking.”

Fed Chair Jerome Powell delivered a speech on bank consolidations and rural communities. But he didn’t talk about monetary policy. On the economy, he just said “We don’t feel that the probability of recession is at all elevated.”

NZD jumps on less dovish than expected RBNZ

New Zealand Dollar jumps sharply after RBNZ turned out to be less dovish than expected. OCR was kept at 1.75% as widely expected. And, the central bank restored the language that “the direction of our next OCR move could be up or down” in the statement. However, there was no more dovish tweak.

In short, RBNZ expected interest rate to be unchanged at current level “through 2019 and 2020”. It maintained the view that “As capacity pressures build, consumer price inflation is expected to rise to around the mid-point of our target range at 2 percent.”

And, there were upside and downside risks to the outlook. RBNZ noted “there are upside and downside risks to this outlook. A more pronounced global downturn could weigh on domestic demand, but inflation could rise faster if firms pass on cost increases to prices to a greater extent.”

The overall statement was pretty balanced and did nothing to endorse market speculation of a rate cut by year end.

Suggested readings:

- NZD Jumped although RBNZ Postponed Timing of Rate Hike (At Least Not Expecting a Cut)

- First Impressions: RBNZ Leaves OCR at 1.75%

On the data front

Australia Westpac consumer confidence rose 4.3% in February. Japan domestic CGPI rose 0.6% yoy in January versus expectation of 1.0% yoy. Inflation data will be the major focuses of today. UK will release CPI, PPI and house price index. Eurozone will release industrial production. US will release CPI too. In particular, headline CPI in US is expected to slow sharply from 1.9% yoy to 1.5% yoy in January.

AUD/USD Daily Outlook

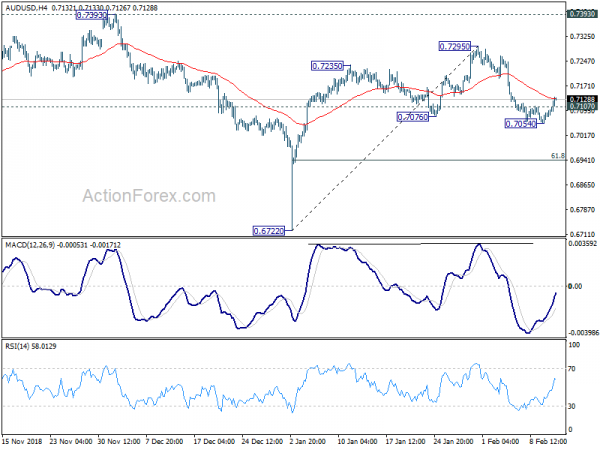

Daily Pivots: (S1) 0.7065; (P) 0.7084; (R1) 0.7115; More…

AUD/USD’s strong recovery and break of 0.7107 minor resistance suggests temporary bottoming at 0.7054. Intraday bias is turned neutral for consolidations. Stronger rise might be seen, but upside should be limited by 0.7295 resistance to bring another fall. We’re holding on to the view that rebound from 0.6722 has completed at 0.7295 already. On the downside, break of 0.7054 will turn bias to the downside for 61.8% retracement of 0.6722 to 0.7295 at 0.6941 next.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Feb | 4.30% | -4.70% | ||

| 23:50 | JPY | Domestic CGPI Y/Y Jan | 0.60% | 1.00% | 1.50% | |

| 1:00 | NZD | RBNZ Official Cash Rate | 1.75% | 1.75% | 1.75% | |

| 9:30 | GBP | CPI M/M Jan | -0.70% | 0.20% | ||

| 9:30 | GBP | CPI Y/Y Jan | 2.00% | 2.10% | ||

| 9:30 | GBP | Core CPI Y/Y Jan | 1.90% | 1.90% | ||

| 9:30 | GBP | RPI M/M Jan | -0.80% | 0.40% | ||

| 9:30 | GBP | RPI Y/Y Jan | 2.60% | 2.70% | ||

| 9:30 | GBP | PPI Input M/M Jan | 0.30% | -1.00% | ||

| 9:30 | GBP | PPI Input Y/Y Jan | 3.80% | 3.70% | ||

| 9:30 | GBP | PPI Output M/M Jan | 0.00% | -0.30% | ||

| 9:30 | GBP | PPI Output Y/Y Jan | 2.20% | 2.50% | ||

| 9:30 | GBP | PPI Output Core M/M Jan | 0.20% | 0.20% | ||

| 9:30 | GBP | PPI Output Core Y/Y Jan | 2.30% | 2.50% | ||

| 9:30 | GBP | House Price Index Y/Y Jan | 2.50% | 2.80% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | -0.40% | -1.70% | ||

| 13:30 | USD | CPI M/M Jan | 0.10% | -0.10% | ||

| 13:30 | USD | CPI Y/Y Jan | 1.50% | 1.90% | ||

| 13:30 | USD | CPI Core M/M Jan | 0.20% | 0.20% | ||

| 13:30 | USD | CPI Core Y/Y Jan | 2.10% | 2.20% | ||

| 15:30 | USD | Crude Oil Inventories | 1.3M | |||

| 19:00 | USD | Monthly Budget Statement Dec | -10.0B | -204.9B |