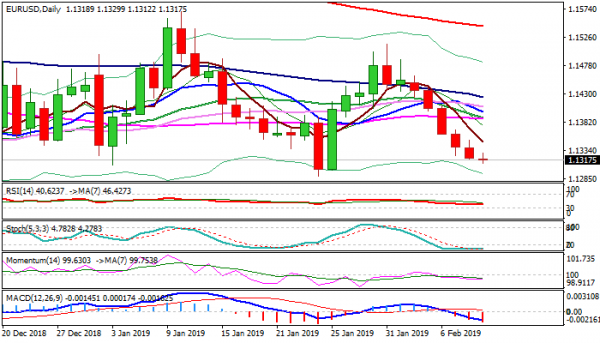

The Euro maintains bearish bias at the beginning of the week and holding below broken 200WMA (1.1334) as last Friday’s close below here generated bearish signal, as the moving average limited downside attempts in more than one year and marks very important support.

The pair holds in red for the sixth straight day, pressured by strong rally of US dollar and bearish daily technical studies and eyes key near-term support at 1.1289 (2019 low posted on 24 Jan), as full retracement of 1.1289/1.1514 rally would open way for further weakness.

Deeply oversold slow stochastic warns of hesitation on approach to 1.1289 support and possible bounce.

Corrective action could be seen as positioning before bears resume with falling 5SMA offering initial resistance at 1.1348, with converged 55/20SMA’s (1.1387/89) expected to cap extended upticks and keep bears in play.

Res: 1.1330, 1.1348, 1.1389, 1.1407

Sup: 1.1312, 1.1289, 1.1267, 1.1215