Global markets are in mild risk averse mode on concerns over US-China trade talk. That came after Trump said he will not meet Chinese President Xi this month to complete the trade agreement. Yen and Swiss Franc are trading as the stronger ones, as lifted by falling treasury yields too. But upside momentum of both is a bit weak.

On the other hand, dovish RBA sent Australian Dollar lower again. Canadian Dollar follows as the second weakest as oil price weakens. But the fate of the Loonie hinges on job data to be released later today. Sterling turned mixed as yesterday’s post BoE rebound fades. Dollar is also mixed for now but it’s the strongest one for the week.

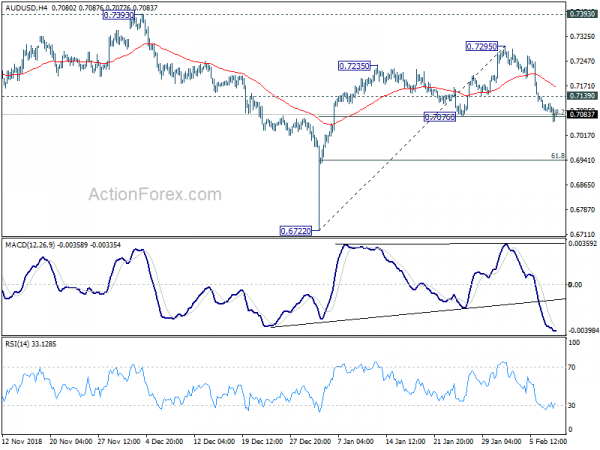

Technically, AUD/USD’s break of 0.7076 support further affirms the case of bearish reversal and opens up decline back to 0.6722 low. Dollar is losing some momentum. But more upside remains in favor against Euro and Swiss Franc. USD/CAD is also on track for 1.3375 resistance to confirm near term bullish reversal. Euro is a currency to watch this week as EUR/JPY is pressing 124.35 support while EUR/GBP is pressing 0.8726 support. Break of both these levels could prompt more broad based decline in the common currency.

In other markets, Nikkei closed down -2.01%. Hong Kong HSI is back from holiday and is down -0.08%. China is still on holiday. Singapore Strait Times is down -0.10%. Japan 10-year JGB yield is down -0.029 at -0.0204. Overnight, DOW dropped -0.87%. S&P 500 dropped -0.94%. NASDAQ dropped -1.18%. 10-year yield dropped -0.050 to 2.652, back below 2.7% handle. 30-year yield dropped -0.045 to 2.993, lost 3.0% handle.

Trump said he will not meet Chinese President Xi this month to seal trade deal

Stocks are apparently a bit troubled by the development in US-China trade negotiations. When asked whether he will meet Chinese President Xi Jinping this month to seal the trade deal, Trump bluntly said “No”, shaking his head. He went further and said “Not yet. Maybe. Probably too soon. Probably too soon” for a meeting next month.

The current trade-war ceasefire will end on Mar 1 and for now, US maintains the plan to impose tariffs on USD 200B in Chinese goods from 10% to 25% after that. While Trump’s comment triggered concerns of further escalation in trade war, it’s seen not as the most likely scenario.

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will travel to Beijing to resume trade talks next week. Trump’s comment could be just a negotiation tactic. And, more importantly, Trump has scheduled to meet North Korean leader Kim Jong-un in Vietnam on February 27-28. It’s easy for him to travel from Vietnam to China after that. And last but not least, the cease-fire deadline can be extended if there is enough progress in the negotiations.

Fed Bullard: Interest rate now a little bit restrictive

St. Louis Fed President James Bullard just described current interest rate as “a little bit restrictive” after that rate hike in December. And, to him, Fed is now “putting downward pressure rather than upward pressure on inflation”. And that could drag core inflation further below Fed’s 2% target. Thus, he expects Fed to miss inflation target again in 2019.

Further, Bullard warned that “I do think it has damaged us to have continually missed on the low side.” Thus, Fed has too “tread carefully” this in regarding interest rate decisions.

According to Fed’s own December projections, the longer run federal funds rate sat at 2.5-30% (central tendency) and 2.5-3.5% (range). Current federal funds rate is at 2.25-2.50%, which is still below the long running range.

ECB Coeure: Eurozone not in lasting and serious slowdown, just broader and longer

ECB Executive Board member Benoit Coeure said Eurozone is facing a broader and longer slowdown, but not a lasting and serious one. And he’s confidence that ECB has existing and new tools to fight a slowdown.

Coeure told Barron’s in an interview that “We don’t think that we have enough elements to conclude that we’re facing a lasting and serious slowdown of the euro zone economy.” He added that “what we’re seeing now is that the slowdown may be broader and longer-lasting than originally forecast.”

RBA projects slower rise in inflation and fall in unemployment

Australian Dollar suffers another round of selloff today after RBA revealed rather dovish economic forecasts in the Statement on Monetary Policy. In the summary part, Governor Philip Lowe’s “balanced” turn was echoed.

The first scenario is “further progress in reducing unemployment and bringing inflation into the target range can reasonably be expected.” In this case, higher interest rate “would become appropriate at some point”. However, in other scenarios, “If there were then to be a sustained increase in unemployment and a lack of progress in returning inflation to target, it might instead be appropriate to lower the cash rate.”

RBA now judges ” the probabilities of these two sets of scenarios have shifted to be more evenly balanced than previously.”

In the new economic projections:

- 2019 year-end growth was revised to 3%, down from 3.25%.

- 2020 year-end growth was revised to 2.75%, down from 3%.

- June 2020 unemployment rate was revised to 5%, up from 4.75%.

- That is, unemployment rate will fall at a slower pace.

- 2019 year-end CPI was revised to 1.75%, down from 2.25%.

- 2020 year-end CPI was unchanged at 2.25%.

- That is, CPI will rise at a slower pace.

On the data front

Japan household spending rose 0.1% yoy in December, below expectation of 0.8% yoy. Labor cash earnings rose 1.8% yoy, matched expectations. Current account surplus widened to JPY 1.56T.

Swiss unemployment and German trade balance will be featured in European session. But main focus will be on Canadian job data to be released later today.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7088; (P) 0.7103; (R1) 0.7118; More…

AUD/USD’s fall from 0.7295 is still in progress and intraday bias stays on the downside. Break of 0.7076 cluster support (38.2% retracement of 0.6722 to 0.7295 at 0.7076) affirms the case that rebound from 0.6722 has completed at 0.7295. Further decline should be seen to 61.8% retracement at 0.6941 next. On the upside, above 0.7139 minor resistance will turn intraday bias neutral first. But risk will remain on the downside as long as 0.7295 resistance holds.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Household Spending Y/Y Dec | 0.10% | 0.80% | -0.60% | |

| 23:50 | JPY | Current Account (JPY) Dec P | 1.56T | 1.52T | 1.44T | |

| 0:00 | JPY | Labor Cash Earnings Y/Y Dec | 1.80% | 1.80% | 2.00% | 1.70% |

| 0:30 | AUD | RBA Statement on Monetary Policy | ||||

| 6:45 | CHF | Unemployment Rate Jan | 2.40% | 2.40% | 2.40% | |

| 7:00 | EUR | German Trade Balance Dec | 19.4B | 18.1B | 19.0B | 18.9B |

| 13:15 | CAD | Housing Starts Jan | 206K | 213K | ||

| 13:30 | CAD | Net Change in Employment Jan | 9.3K | |||

| 13:30 | CAD | Unemployment Rate Jan | 5.60% |