EUR/USD started a major downside move and traded below the 1.1430 support level. USD/CHF is trading nicely above the 0.9980 support and it could trade further higher.

Important Takeaways for EUR/USD and USD/CHF

- The Euro faced an increased selling pressure and declined below the 1.1420 support against the US Dollar.

- There is a major bearish trend line formed with resistance near 1.1415 on the hourly chart of EUR/USD.

- USD/CHF climbed higher and broke the 1.0000 resistance level.

- There is a major bullish trend line formed with support at 0.9980 on the hourly chart.

EUR/USD Technical Analysis

The Euro failed to hold gains above the 1.1500 level and started a downside move against the US Dollar. The EUR/USD pair broke the 1.1450 and 1.1420 support levels to enter a bearish zone.

It seems like the trimmed most of its gains after it formed a high at 1.1513 on FXOpen. It even settled below the 1.1420 support level and the 50 hourly simple moving average. During the drop, there was a break below the 76.4% Fib retracement level of the last wave from the 1.1389 low to 1.1513 high.

Therefore, there are chances of more losses below the 1.1389 low. The next stop for sellers could be near the 1.1360 support and the 1.236 Fib extension level of the last wave from the 1.1389 low to 1.1513 high.

On the upside, there are many resistance near the 1.1415 and 1.1420 levels. The previous support at 1.1420 is likely to act as a strong resistance in the near term.

There is also a major bearish trend line formed with resistance near 1.1415 on the hourly chart of EUR/USD. A break above the channel resistance could push the pair towards 1.1430 and the 50 hourly simple moving average.

To start a fresh upward move, the pair needs to break the 1.1420 and 1.1430 resistance levels. However, the main resistance is near the 1.1435-1.1440 zone in the near term.

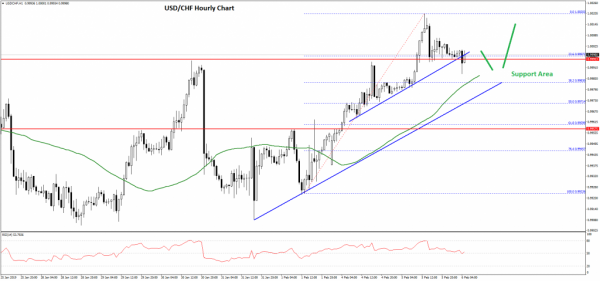

USD/CHF Technical Analysis

The US Dollar formed a solid support near the 0.9910 level and started a strong upward move against the Swiss franc. The USD/CHF pair traded above the 0.9940 and 0.9950 resistance levels to start an uptrend.

Buyers gained momentum and broke the 0.9980 and 1.0000 resistance levels. A high was formed at 1.0020 before the pair started a downside correction. It declined below the 23.6% Fib retracement level of the last wave from the 0.9922 low to 1.0020 high.

However, there is a strong support formed near the 0.9980 level and the 50 hourly simple moving average. Moreover, there is a major bullish trend line formed with support at 0.9980 on the hourly chart.

Therefore, if the pair corrects lower, it is likely to find a strong buying interest near 0.9980 and the 50 hourly simple moving average, below which the next support is at 0.9950.

On the upside, an initial resistance is near the 1.0015 and 1.0020 levels. If there is an upside break above 1.0020, the USD/CHF pair could trade towards the 1.0050 level in the near term.

Overall, the price action is positive and it seems like the US Dollar buyers are in control versus the Euro and the Swiss Franc.