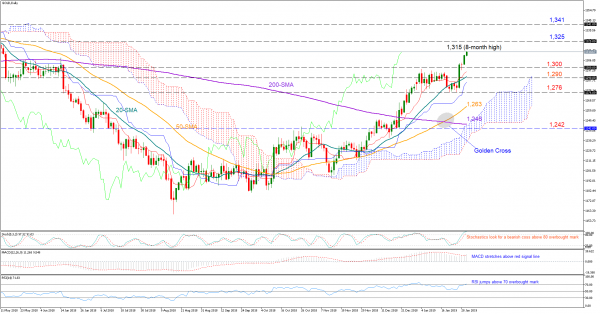

Gold’s rally got some extra fuel early on Wednesday, with the price jumping to an 8 ½ -month high of 1,315.

In the technical picture, the MACD seems to be resuming upside momentum above its red signal line, a positive sign that the bulls may continue to drive the market even if downside corrections cannot be ruled out in the very short-term as both the Stochastics and the RSI are fluctuating in overbought area. Trend signals are also encouraging, with the price deviating above the 20-day simple moving average (MA) which is positively sloped above the longer-term 50- and 200-day MAs.

Additional gains may find immediate resistance around 1,325, while slightly higher the 1,341 barrier could act as resistance as it did in the first months of 2018. Even higher, the focus could shift to 1,356 before the 1,365.89 peak comes into view.

In case bears take control over the situation, a crucial support is expected to appear between 1,300-1,290, where the 20-day MA is also located. A return below that zone could add more pressure, with the price potentially stopping next near the 1,276 mark and then around the 50-day MA which currently stands at 1,263. Should the bears beat the latter, a bigger sell-off would likely start below the 200-day MA at 1,246.

In the medium-term picture, the market is strongly bullish thanks to the rebound on the 1,242 level on December 20. The clear golden cross between 50- and the 200-day MAs supports prospects for an extension of the impressive uptrend.