Sterling tumbled broadly as the UK opened a new chapter in Brexit negotiation with yesterday’s parliamentary amendment votes. In short, Prime Minister Theresa May needs to go back to EU to renegotiate the Irish backstop into alternative arrangements. But EU has repeated its stance on no renegotiation. For now it’s uncertain whether there could be on standoff on the issue. But so far, losses in the Pound are relatively limited as it stabilized in Asian markets.

At this point, Australian Dollar is the strongest one for today, as lifted by stronger than expected consumer inflation reading. New Zealand Dollar follows as the second. Canadian Dollar is also firm as oil prices rebound due to US sanctions on Venezuela. Swiss Franc, Yen and Dollar are the weakest ones. The greenback will look into today’s FOMC statement and press conference. Traders will also keep an eye on US-China trade talks, as high level meeting between Chinese Vice Premier Liu He and US Trade Representative Robert Lighthizer starts today in Washington.

Technically, EUR/GBP’s rebound tentatively suggests that 0.8620 key support is defended. Break of 1.3012 in GBP/USD will further indicate near term topping in the Pound. With today’s rebound, AUD/USD is now looking at 0.7235 resistance and break will confirm resumption of recent rebound from 0.6722 low.

In other markets, Nikkei is currently down -0.29%. Hong Kong HSI is up 0.24%. China Shanghai SSE is down -0.01%. Singapore Strait Times is down -0.18%. Japan 10-year JGB yield is up 0.0033 at 0.007. Overnight, DOW rose 0.21%. S&P 500 dropped -0.15%. NASDAQ dropped -0.81%. 10-year yield dropped -0.032 to 2.712.

Sterling drops as UK seeks to reopen Brexit negotiation

Sterling dropped broadly after the Parliament voted 317 to 301 for Conservative MP Graham Brady’s Brexit deal amendment. Prime Minister Theresa is now required to go back to EU to renegotiate the deal to replace the Irish backstop with “alternative arrangements”. At the same time, the Parliament rejected Labour MP Yvette Cooper’s proposal to force Article 50 extension to avoid no-deal Brexit. Though, the symbolic amendments opposing no-deal Brexit was passed.

May’s spokesman said that “tonight parliament has sent a clear message that there is a way forward to secure this deal if we are able to secure changes in relation to the backstop.” And, “the EU’s position remains that they want the United Kingdom to leave with a deal. They want the UK to leave with a deal because it’s in their interests as well as those of the UK.”

However, EU repeated its stance that there will be no renegotiation. And, it’s uncertain what exactly alternative arrangements on the Irish border backstop are.

EU Tusk: Brexit withdrawal agreement is not open for renegotiation

On UK’s decision to seek Brexit deal renegotiations, European Council President Donald Tusk said via his spokesman “The Withdrawal Agreement is and remains the best and only way to ensure an orderly withdrawal of the United Kingdom from the European Union”. “The backstop is part of the Withdrawal Agreement, and the Withdrawal Agreement is not open for renegotiation.”

Nevertheless, Tusk said “We welcome and share the UK parliament’s ambition to avoid a no-deal scenario. We continue to urge the UK government to clarify its intentions with respect to its next steps as soon as possible.” And, “If the UK’s intentions for the future partnership were to evolve, the EU would be prepared to reconsider its offer and adjust the content and the level of ambition of the political declaration… Should there be a UK reasoned request for an extension, the EU27 would stand ready to consider it and decide by unanimity.”

European Parliament Guy Verhofstadt echoed and said “we stand by Ireland,”and “there is no majority to re-open or dilute the Withdrawal Agreement in the European Parliament, including the backstop.”

Australia CPI slowed to 1.8%, but beat expectations

Australian Dollar is lifted slightly by stronger than expected consumer inflation reading. Headline CPI rose 0.5% qoq in Q4 versus expectation of 0.4% qoq. Annual rate slowed to 1.8% yoy, down from 1.9% yoy, but beat expectation of 1.7% yoy. RBA trimmed mean CPI rose 0.4% qoq, 1.8% yoy, matched expectations. RBA weighed media CPI rose 0.4% qoq, 1.7% yoy, basically matched expectations.

ABS Chief Economist, Bruce Hockman said: “Annual growth in the CPI remains below 2 per cent in the December quarter 2018, with annual growth in tradables inflation of just 0.6 per cent, while non-tradables inflation rose 2.4 per cent. Over the past four years, annual growth in the CPI has only risen above 2 per cent in two of the past 16 quarters.”

ABS also noted that the most significant price rises this quarter are tobacco (+9.4%), domestic holiday travel and accommodation (+6.2%), fruit (+5.0%) and new dwelling purchase by owner-occupiers (+0.4%). The most significant price falls this quarter are automotive fuel (-2.5%), audio visual and computing equipment (-3.3%), wine (-1.9%), and telecommunications equipment and services (-1.5%).

FOMC forward guidance and balance sheet reduction plan watched

The economic calendar is rather busy today. French GDP, Swiss KOF, Eurozone confidence indicators, Germany CPI and US ADP employment will also be watched. But the major focus will be on FOMC rate decision and press conference.

Fed is widely expected to keep federal funds rate unchanged at 2.25-2.50%. Since December, following extreme market volatility and cautious turn in Fedspeaks, pricing of Fed’s rate path changed drastically. Fed funds futures are now only pricing in around 20% chance of a 25bps hike by the December meeting. Dollar then started weakening broadly. The greenback suffered another round selloff last week after a WSJ report suggesting that the Fed members are considering to end the balance sheet reduction plan earlier than previously expected.

The first focus today will be on forward guidance in the statement. Back in December, FOMC noted that “the Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term.”

But since then, Fed officials sung a chorus, saying that Fed can afford some patience before another rate move. And Fed chair Jerome Powell even indicated that Fed is flexible to move in either direction if necessary. Any change in the forward guidance that hints at a pause could give Dollar more pressure.

And secondly, Powell will need to indicate if there is any change in Fed’s balance sheet reduction plan.

Here are some previews on FOMC:

- Fed Meeting: All Eyes on Powell’s Balance Sheet Remarks

- What Jerome Powell Will Say?

- Will Fed Signal Slowdown in Balance Sheet Reduction?

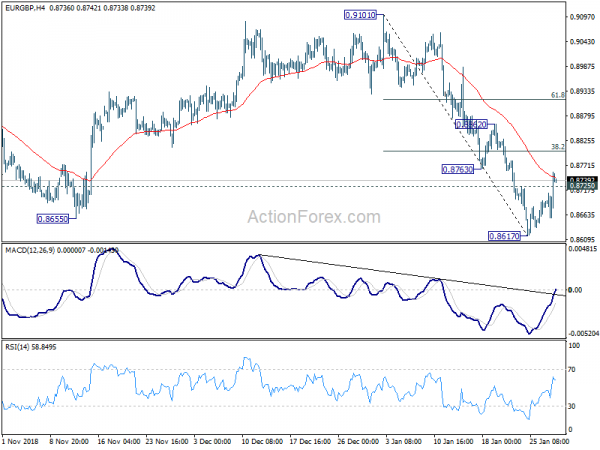

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8685; (P) 0.8722; (R1) 0.8788; More…

EUR/GBP’s strong rebound and break of 0.8725 minor resistance suggests short term bottoming, after defending 0.8620 key support. Intraday bias is turned back to the upside for 38.2% retracement of 0.9101 to 0.8617 at 0.8802. Break will target 61.8% retracement at 0.8916. On the downside, decisive break of 0.8620 will resume larger decline from 0.9305 and target 100% projection of 0.9305 to 0.8620 from 0.9101 at 0.8416.

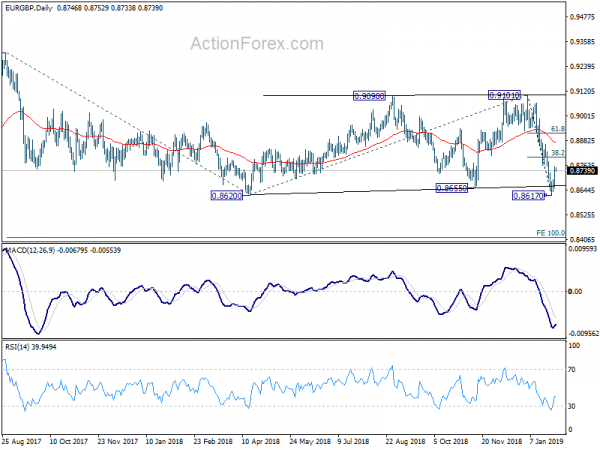

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). The medium term range is set between 0.8620 and 0.9101. Downside breakout of 0.8620 will pave the way back to 0.8312 support . Break of 0.9101 will bring retest of 0.9304/5 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Dec | 1.30% | 0.90% | 1.40% | |

| 0:01 | GBP | BRC Shop Price Index Y/Y Jan | 0.40% | 0.30% | ||

| 0:30 | AUD | CPI Q/Q Q4 | 0.50% | 0.40% | 0.40% | |

| 0:30 | AUD | CPI Y/Y Q4 | 1.80% | 1.70% | 1.90% | |

| 0:30 | AUD | CPI RBA Trimmed Mean Q/Q Q4 | 0.40% | 0.40% | 0.40% | |

| 0:30 | AUD | CPI RBA Trimmed Mean Y/Y Q4 | 1.80% | 1.80% | 1.80% | |

| 0:30 | AUD | CPI RBA Weighted Median Q/Q Q4 | 0.40% | 0.50% | 0.30% | |

| 0:30 | AUD | CPI RBA Weighted Median Y/Y Q4 | 1.70% | 1.70% | 1.70% | 1.80% |

| 5:00 | JPY | Consumer Confidence Index Jan | 41.9 | 42.5 | 42.7 | |

| 6:30 | EUR | French GDP Q/Q Q4 | 0.30% | 0.30% | ||

| 7:00 | EUR | German GfK Consumer Confidence Feb | 10.3 | 10.4 | ||

| 8:00 | CHF | KOF Leading Indicator Jan | 98.1 | 96.3 | ||

| 9:30 | GBP | Mortgage Approvals Dec | 63K | 64K | ||

| 9:30 | GBP | Money Supply M4 M/M Dec | 0.20% | 0.00% | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Jan | 0.73 | 0.82 | ||

| 10:00 | EUR | Eurozone Economic Confidence Jan | 106.7 | 107.3 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Jan | 0.6 | 1.1 | ||

| 10:00 | EUR | Eurozone Services Confidence Jan | 11.2 | 12 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -7.9 | -7.9 | ||

| 13:00 | EUR | German CPI M/M Jan P | -0.80% | 0.10% | ||

| 13:00 | EUR | German CPI Y/Y Jan P | 1.60% | 1.70% | ||

| 13:15 | USD | ADP Employment Change Jan | 170K | 271K | ||

| 13:30 | USD | GDP Annualized Q/Q Q4 | 3.40% | |||

| 13:30 | USD | GDP Price Index Q4 | 1.80% | |||

| 15:00 | USD | Pending Home Sales M/M Dec | 1.10% | -0.70% | ||

| 15:30 | USD | Crude Oil Inventories | 8.0M | |||

| 19:00 | USD | FOMC Rate Decision (Upper Bound) | 2.50% | 2.50% | ||

| 19:00 | USD | FOMC Rate Decision (Lower Bound) | 2.25% | 2.25% |