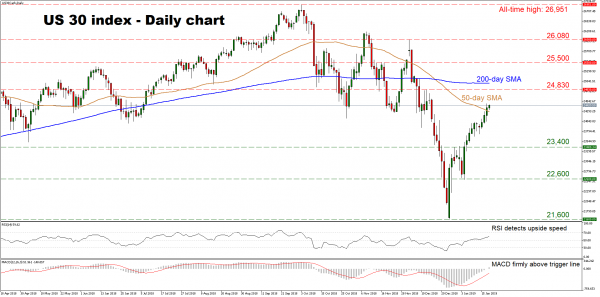

The US 30 index staged a major recovery in recent weeks, after touching an 18-month low on December 26. Price action is now taking place back above the 50-day simple moving average (SMA), which suggests the near-term outlook has shifted back to neutral, from negative previously.

Further advances in the index could encounter immediate resistance near the 24,830 zone, defined by the peaks of December 12. An upside break could open the way for a test of the 200-day SMA at 24,990, with the area around it encapsulating the psychological 25,000 handle. Even higher, attention would shift to 25,500, which capped the rally on November 16.

On the downside, initial support to declines may be found around the 50-day SMA at 24,275, with a bearish break seeing scope for a test of the 23,400 territory, marked by the inside swing high of December 28. Another break below that barrier could see the bears challenging 22,600, the trough of January 4.

Overall, as long as the price remains above the 50-day SMA the short-term outlook is neutral, with a break above the 200-day one required to turn it to cautiously positive.