The latest inflation data out of Canada will hit the markets on Friday, at 1330 GMT. While these figures are always important for market expectations around future Bank of Canada (BoC) rate hikes, the loonie’s overall direction may depend mostly on how oil prices perform going forward, given the resurgent correlation between these two assets.

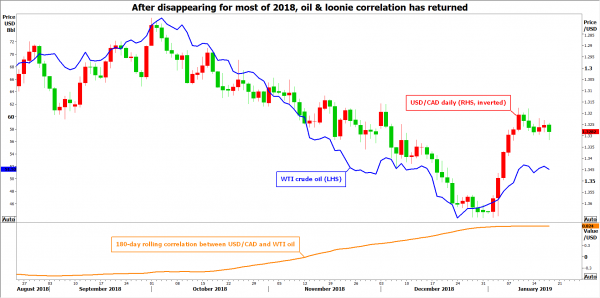

The loonie staged a remarkable rebound to start the new year, clawing back some of the losses it recorded in the final months of 2018, aided by a substantial recovery in oil prices. Recall that Canada is a major oil producer and exporter, so movements in crude tend to have a sizeable effect on the currency. While the correlation between these two assets had faded for most of 2018, it seems to have returned with a vengeance lately, with the loonie mostly taking its cue from movements in crude.

That said, expectations around monetary policy are always important for a currency and hence, traders will briefly turn their sights back to economic data on Friday, when the CPI data for December are released. The headline CPI rate is expected to have remained unchanged at 1.7% in yearly terms. Meanwhile, Underlying measures of inflation – core, trimmed mean, and weighted CPIs – are also due out, though no forecasts are available for any of these.

At its policy meeting last week, the BoC stuck to its forward guidance that further rate hikes will probably be needed over time, despite a weakening global outlook and the overall drop in oil prices, which is expected to hurt investment in Canada. Yet, market pricing suggests a mere 43% probability for just a single quarter-point rate increase by year-end according to Canada’s overnight index swaps, suggesting that investors remain skeptical such an action will indeed take place. Hence, economic data could attract even more attention going forward, as they could “make or break” market expectations around further BoC tightening.

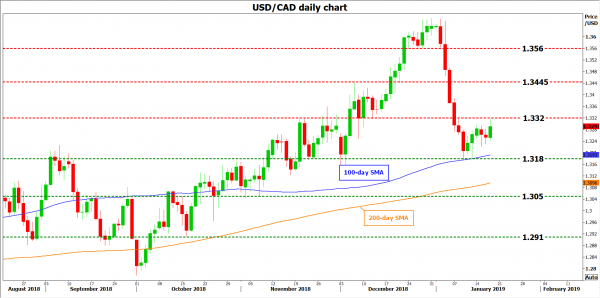

Turning to the market reaction, a stronger-than-expected data set could see the loonie extend its recent gains. Dollar/loonie could drop for a test of the 1.3180 zone, defined by the lows of January 9; the 100-day simple moving average (SMA) at 1.3186 is also part of this area. A downside break could open the way for the 200-day SMA at 1.3089, before the November 7 trough of 1.3050 comes into view.

On the other hand, a disappointment could see the pair break above the 1.3320 zone, marked by the highs of November 20, and potentially aim for a test of 1.3445, the peak of December 6.