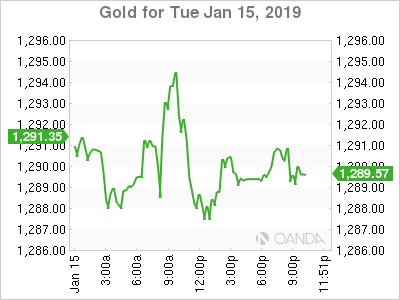

Gold fell 0.16 percent on Tuesday. The Brexit drama failed to spark investor’s appetite in the yellow metal as the failure of Prime Minister’s May’s proposal was foretold. The vote ending being as one sided as predicted and will move the uncertainty to next week. On Monday she has to present a new proposal but given the short time line there might not be enough time for anything new. Labour’s no vote confidence is not expected to have the backing of the MPs needed which could trigger higher demand in the yellow metal as investors seek refuge from the uncertainty surrounding the UK divorce from the EU.

Fed members have several statements clearly outlining that a pause in the central bank’s monetary policy tightening. The gold will feel less downward pressure, but disappointing inflation data offers no support at this stage.

The fiscal stimulus announcement out of China sparked gains in risker assets given the Brexit vote outcome provided no surprises. Trade talks between US and China, Brexit headlines and the extended US government shutdown will keep gold in the minds of investors that will seek the metal for safe haven if risk appetite dries up.