Brexit and China are the two main themes in the markets today. For now Yen is the strongest one so far followed by Swiss Franc. Risk aversion is triggered by terrible trade data from China which intensified worries over slow down. Both imports and expects contracted in the fastest pace since 2016 in December. It’s rather clearly that the Chinese economy is heavily affected by trade war with the US. Nevertheless, there is no panic selling in the global stock markets. Investor seem to be hopeful on some goods news from Chinese Vice Premier Liu He’s visit to Washington later in the month.

Sterling is the third strongest on increasing chance of no Brexit at all. Ahead of tomorrow’s vote in the parliament, UK Prime Minister Theresa May stepped her rhetorics. She warned that there are some MPs who wish to delay or even stop Brexit. And she urged MPs to vote to deliver what people decided in the referendum back in 2016. EU sent a “reassurance” letter to May today, pledging to work on a post-Brexit agreement by end of 2020 deadline to avoid triggering the backstop “in the most solemn manner”. But it’s unsure how such assurances could change the mind of those who already got a position. That is, those who believed no-deal Brexit is closest to what people want, and those who want no Brexit at all.

Staying in the currency markets, Australian Dollar lead commodity currencies lower on risk aversion. Dollar is mixed as the record US government shutdown drags into the fourth week with no end in sight. In other markets, FTSE is currently down -0.95%, DAX is down -0.52%, CAC is down -0.64%. German 10 year yield is down -0.0211 at 0.219. Earlier today, Hong Kong HSI dropped -1.38%, China Shanghai SSE dropped -0.71%, Singapore Strait Times dropped -0.79%. Japan was on holiday.

Juncker and Tusk: EU commits in solemn manner to avoid triggering Irish backstop

European Commission President Jean-Claude Juncker and European Council President Donald Tusk sent a joint letter to UK Prime Minister Theresa May. That’s for hoping to provide the “assurances” to help May get the agreed Brexit deal through the UK Parliament tomorrow.

In short, Juncker and Tusk pledged to try to reach the agreement regarding post-Brexit EU-UK relationship by the end of next year so as to avoid using the Irish backstop. They also emphasized that a commitment to speedy trade deal made by EU leaders had “legal value” which committed the Union “in the most solemn manner”.

If the target date couldn’t be met, UK will have an option to extend a status-quo transition period, also for avoiding to trigger the backstop. They also pledged that “If the backstop were nevertheless to be triggered, it would only apply temporarily, unless and until it is superseded by a subsequent agreement that ensures that a hard border is avoided.”

May warned some want to delay or even stop Brexit

UK Prime Minister Theresa May warned today “there are some in Westminster who would wish to delay or even stop Brexit and who will use every device available to them to do so.” And, “while no-deal remains a serious risk, having observed the events at Westminster over the last seven days, it’s now my judgment that the more likely outcome is a paralysis in parliament that risks there being no Brexit.”

UK Fox: No-deal Brexit is not suicide, but no Brexit is unrecoverable political disaster

International Trade Minister Liam Fox emphasis today that ‘the government will want to leave with a deal but the government will want to prepare for no deal if it’s impossible to get any agreement through the House of Commons. That would be the default policy.” He added that “I don’t regard no deal as national suicide. I think that no deal would damage our economy but I think it’s survivable. I think no Brexit, politically, is a disaster from which we might not recover.”

Conservative Whip Johnson quits for his objection to May’s Brexit deal

Conservative Whip Gareth Johnson announced to resign from this role of discipline enforcer just ahead of tomorrow’s crucial Brexit deal vote. Johnson said “over the last few weeks, I have tried to reconcile my duties as a Whip to assist the Government to implement the European Withdrawal Agreement, with my own personal objection to the agreement”. He added that “I have concluded that I cannot, in all conscience, support the Government’s position when it is clear this deal would be detrimental to our nation’s interests.”

China Dec trade balance: Massive -35.8% yoy fall in US imports; exports and imports contracted most since 2016

China posted a set of very disappointing trade data today. Exports and imports posted biggest contraction since 2016. More importantly, imports from the US dropped a massive -35.8% yoy in the month. But for the year, trade surplus with the US hit a record high.

In USD terms in December,

- Trade surplus widened to USD 57.1B, above expectation of USD 51.6B.

- However, exports dropped -4.4% yoy to USD 221.3B.

- Imports dropped -7.6% yoy to USD 164.2B.

- Both imports and exports suffered the steepest decline since 2016.

Staying in December,

- With the US, export dropped -3.5% yoy to USD 40.3B, imports dropped a massive -35.8% yoy to USD 10.4B.

- With EU, exports dropped -0.3% yoy to USD 37.6B, imports dropped -2.7% yoy to USD 22.5B.

- With Australia, exports dropped -5.2% yoy to USD 4.0B, imports dropped -3.4% yoy to USD 7.3B.

For the year as a whole,

- With the US, exports rose 11.3% yoy to USD 478.3B, imports rose just 0.7% yoy to USD 155.1B.

- Trade surplus with the US jumped 17.2% yoy to USD 323.2B, highest on record.

- With EU, exports 9.8% yoy to USD 408.6B, imports rose 11.7% yoy to USD 273.4B.

- Trade surplus with EU rose 6.2% yoy to USD 135.1B.

- With Australia, exports rose 14.2% yoy to USD 47.3B, imports rose 11.2% to 105.45B.

- Trade deficit with Australia rose 8.9% yoy to USD 58.1B.

Elsewhere

Australia TD securities inflation rose 0.4% mom in December. Eurozone industrial production dropped -1.7% mom in November, way below expectation of 0.3% mom rise.

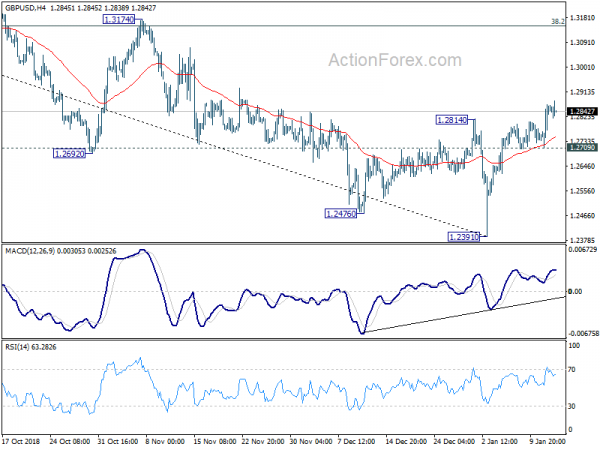

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2743; (P) 1.2805; (R1) 1.2900; More….

Intraday bias in GBP/USD remains on the upside and rise from 1.2391 is in progress. Such rebound is seen as correcting whole down trend from 1.4376. Further rally would be seen to 1.3174 resistance, which is close to 38.2% retracement of 1.4376 to 1.2391 at 1.3149. We’d expect strong resistance from there to limit upside, at least on first attempt. On the downside, break of 1.2709 minor support will argue that such rebound is completed and turn bias back to the downside for retesting 1.2391 low.

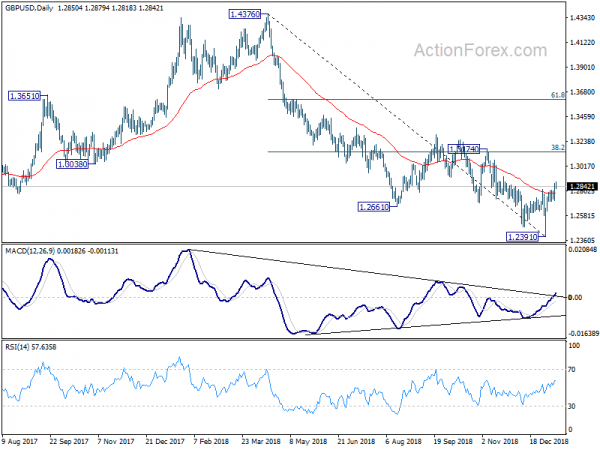

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend from 2.1161 (2007 high). And this will now remain the preferred case as long as 1.3174 structural resistance holds. GBP/USD should target a test on 1.1946 first. Decisive break there will confirm our bearish view. However, sustained break of 1.3174 will invalidate this case and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | TD Securities Inflation M/M Dec | 0.40% | 0.00% | ||

| 2:00 | CNY | Trade Balance (USD) Dec | 57.1B | 51.6B | 44.7B | |

| 2:00 | CNY | Exports Y/Y (USD) Dec | -4.40% | 3.00% | 5.40% | |

| 2:00 | CNY | Imports Y/Y (USD) Dec | -7.60% | 3.00% | ||

| 2:00 | CNY | Trade Balance (CNY) Dec | 395B | 345B | 306B | |

| 2:00 | CNY | Exports Y/Y (CNY) Dec | 0.20% | 10.20% | ||

| 2:00 | CNY | Imports Y/Y (CNY) Dec | -3.10% | 7.80% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Nov | -1.70% | 0.30% | 0.20% | 0.10% |