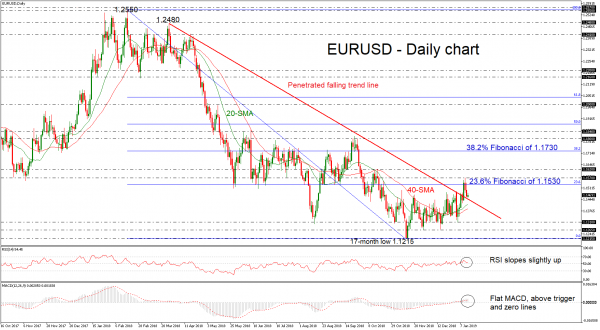

EURUSD lost momentum over the previous couple of sessions finding strong resistance on the 1.1570 hurdle. Despite the upside penetration of the long-term descending trend line the price failed to extend gains well above this level.

In the daily timeframe, the RSI indicator rebounded on the neutral threshold of 50 and is sloping marginally higher, while the MACD oscillator is flattening above the trigger and zero lines. It is worth mentioning that momentum is too weak to provide a sustained move higher.

If the price action remains above the diagonal line, there is scope to test again the 23.6 % Fibonacci retracement level of the downleg from 1.2550 to 1.1215, around 1.1530. This is considered to be a significant resistance area which has been rejected a few times in the past. Rising above it would see prices re-testing the 1.1570 barrier and then the 1.1620 obstacle.

On the other side, in case of further downside pressure, then the focus would turn to the 20- and 40-simple moving averages (SMAs) at 1.1415 and 1.1390 respectively. A drop below these levels would extend losses towards the 1.1310 support and then until 1.1265, identified by the troughs on November 28 and December 14.

Overall, looking at the medium-term, there are significant obstacles before posting a sharp bullish rally, driving the price back down again.